There’s no shortage of massive wind turbines dotting my home state of Kansas’ landscape.

Kansas’ turbines could power 1.6 million homes.

Wind power is contributing in a big way to electricity production in the U.S.:

The U.S. Energy Information Administration reports the country generated the most wind power in history in 2021!

And I expect it to get even better from here.

Part of the Inflation Reduction Act the House of Representatives passed on Friday will supercharge wind and solar power adoption, as the government funds utilities and speeds up renewable energy projects.

Today’s Power Stock has one of the largest portfolios of wind and solar power-generation projects in the U.S.: Clearway Energy Inc. (NYSE: CWEN).

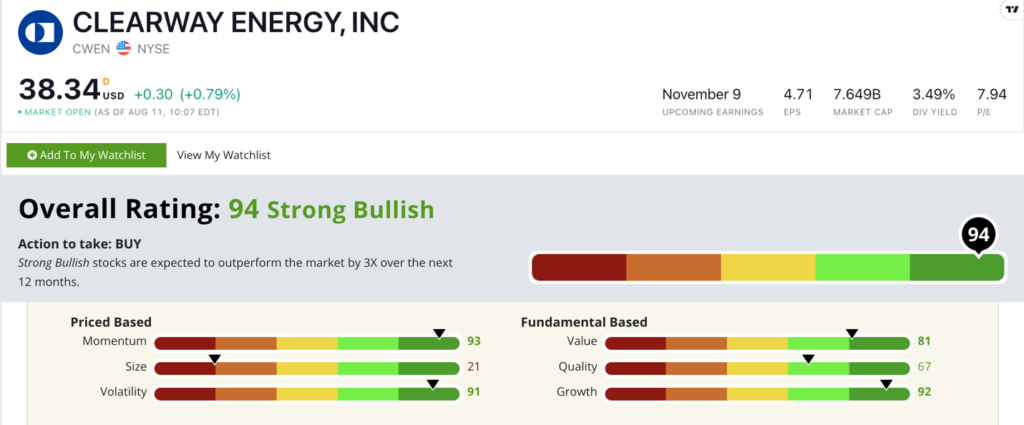

CWEN Stock Power Ratings in August 2022.

Clearway owns 5,238 megawatts (MW) of wind and solar plants in the U.S.

Wind plants across nine states account for 3,285 MW of that power. That’s enough to power 2.4 million homes.

The company also owns natural gas plants that generate almost 2,500 MW of power in California and Connecticut.

Clearway Energy stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CWEN Stock: Fantastic Growth + Strong Momentum

The second quarter of 2022 was a blockbuster for CWEN.

Two items stood out to me:

- The renewables arm of its business generated $83 million in net income — a 207.4% increase over the same quarter a year ago!

- Clearway signed an agreement to acquire another 413 MW of wind power from Capistrano Wind Partners LLC.

That’s why CWEN scores a 92 on our growth metric.

In addition to being a strong growth stock, CWEN is also a solid value.

Its price-to-earnings ratio is 8. The energy utility industry’s average is an inflated 22.

CWEN is a bargain compared to its peers.

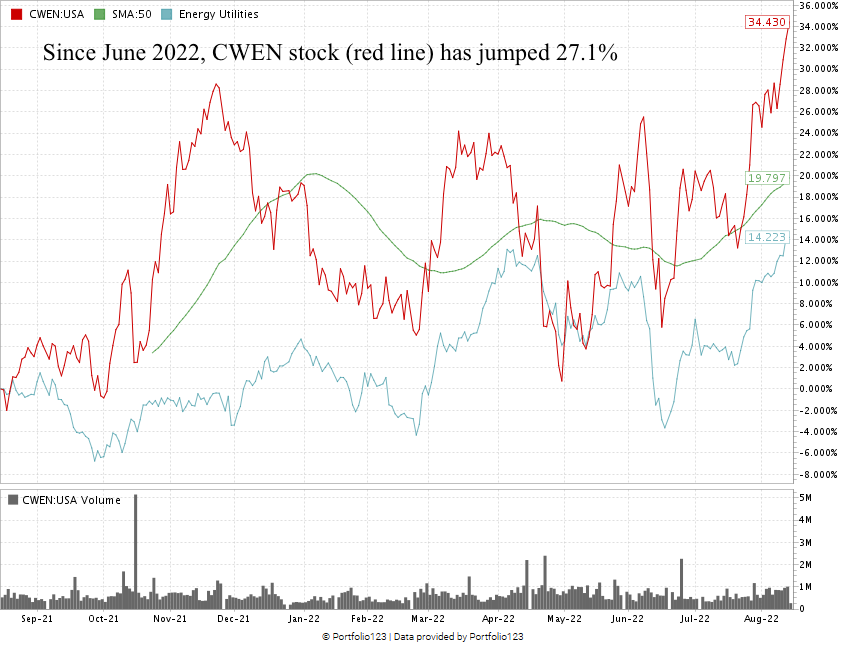

Clearway’s momentum is also impressive. It rates a 93 on our momentum factor.

Over the last 12 months, CWEN stock is up 34.3%. The average gain for energy utility stocks, on the other hand, is just 14.2%.

It’s gained more than 27% since June, and I’m convinced that’s just the start.

Clearway Energy Inc. stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The renewable energy mega trend was already in place.

Congress’ latest action will increase the number of wind and solar energy projects around the country.

I think you can see why Clearway Energy Inc. is a “Strong Bullish” stock to add to your portfolio.

"Infinite Energy" Stock Opportunities

CWEN is a strong play within renewables, but Chief Investment Strategist Adam O’Dell is targeting the next generation of energy storage in the Green Zone Fortunes model portfolio.

His No. 1 stock for this trend is up over 100% since March, and he’s confident this stock has more room to run higher.

To find out how you can gain access to his highest-conviction stock recommendations, click here to watch his “Infinite Energy” presentation now.

Stay Tuned: Top-Rated Chicken Industry Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a “Strong Bullish” chicken product producer.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.