My wife and I love to take weekend trips to Walt Disney World in Orlando.

Every time we drive by one of the parks, one massive thing stands out … and it’s not Epcot.

It’s the mouse-ear-shaped farm of 500,000 solar panels that helps power the park.

And thanks to action in Congress, the entire renewable energy sector is getting a huge boost in the U.S.

The Inflation Reduction Act includes enormous tax subsidies and incentives to speed up the clean energy transition.

This chart shows the amount of electricity solar will generate through 2050.

Last year, the U.S. generated 103.4 billion kilowatt-hours (kWh). By 2050, that will jump 795.8%!

Today’s Power Stock is a $235 million solar panel company: Genie Energy Ltd. (NYSE: GNE).

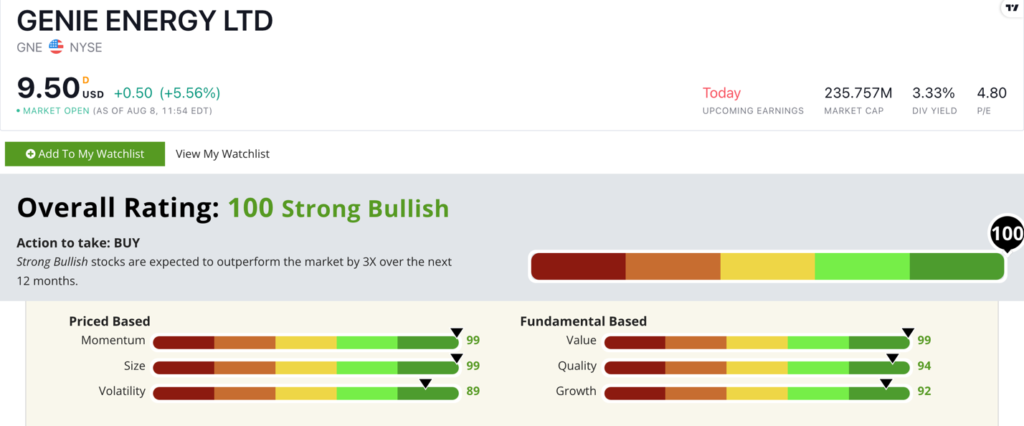

GNE Stock Power Ratings in August 2022.

GNE supplies energy and natural gas to residential and small business customers in the U.S. and abroad.

The company also manufactures, distributes and installs solar panels all over the world.

Genie Energy stock scores a “Strong Bullish” perfect 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

GNE Stock: “Strong Bullish” on All Metrics

GNE just reported its latest quarterly earnings.

Highlights include:

- Gross profit increased 218.2% to $67.5 million.

- Gross margin jumped to 89.9% from 27.8%!

- Genie’s renewable arm brought in $3.8 million in quarterly revenue — a 61.2% increase from the same quarter a year ago.

According to our Stock Power Ratings system, GNE is in the green on all of our metrics!

It scores a 99 on value, momentum and size.

On value, GNE’s price-to-earnings ratio is 4 times lower than the energy utilities industry.

Its price-to-sales ratio is 0.6 — well under the industry average of 2.7.

This tells us Genie Energy stock is a bargain compared to its peers.

GNE’s market cap (number of shares times share price) of $235.8 million makes it a microcap stock. Our historical analysis shows that smaller stocks outperform their larger counterparts.

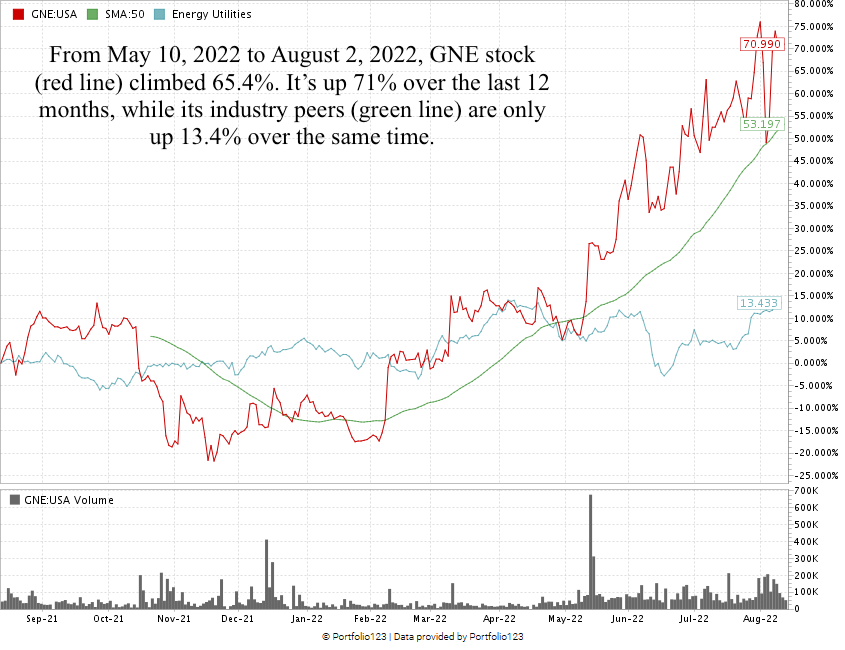

After GNE stock dropped in May, it started a massive comeback.

From May 10 to August 2, it rallied 65.4% to hit a 52-week high. After a minor drop, which you can see in the stock chart above, a strong quarterly report is pushing GNE up again.

Genie Energy Ltd. stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The Senate’s new climate bill will supercharge the clean energy industry … now and for years to come.

GNE is working on clean energy on a global scale through its solar offerings, and it’s a strong contender for your portfolio.

Want More Renewable Stock Recommendations?

Chief Investment Strategist Adam O’Dell and I have agreed for years that renewable energy is one of the biggest multidecade mega trends of our time.

Adam identified four stocks as part of his “Infinite Energy” presentation that are up as much as 86% and 67% in the five months since he unveiled them.

He’s also releasing a brand-new “better battery” stock later this week.

To get access to our highest-conviction green energy recommendations, as well as stocks that belong to several other mega trends, click here now to find out more about “Infinite Energy.”

Stay Tuned: Wind and Solar Leader

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on one of the largest renewable energy owners in the U.S.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.