Another shutdown looms.

No one in Washington wants it. They swear on a stack of bibles they won’t let it happen.

But bipartisan talks broke down yesterday, and the chances are now only about 50-50 they can pull off a last-minute deal.

My opinion: Sooner or later, this problem will be resolved.

They will again kick the can down the road.

The left and the right will go back to business as usual — throwing bricks at each about other hot-button issues.

LEFT: Bipartisan negotiations to keep the government open seemed to be going well until the Dems demanded a cap on ICE arrests. So, now talks have broken down and no one knows what’s going to happen next.

What won’t be resolved is a problem that’s much bigger than any shutdown:

The biggest pile-up of debt in the history of mankind.

I know. You’ve heard about this many times before. And every time, it seems, we manage to somehow get by. The government saves the day. Stocks recover. People forgive, forget and move on (or so it seems.)

But let me tell you why this time is different.

In the next big debt crisis, the Fed will NOT come to the rescue.

The Fed has already stuck its neck out far more than anyone ever believed possible.

And this is a conclusion from a very reliable source …

In the midst of the 2008 debt crisis, I sat down with former Fed Chairman Paul Volcker at a conference in Washington, D.C.

We talked briefly about a mutual friend. Then I asked him what he thought about the Lehman Brothers collapse and the Federal Reserve’s massive money printing to save it.

LEFT: Paul Volcker has no ax to grind. He told it like it was when he was Fed Chairman. He tells it like it is today. In the next debt crisis, it won’t be able to crank up the money printing presses like it did in 2008 with impunity.

As always, Mr. Volcker didn’t want to directly criticize Chairman Ben Bernanke, his successor at the Fed. So, he responded this way:

“Mr. Weiss, when I was chairman, if someone told me that the government would someday do what it’s doing today, I would have never believed them.”

And that day marked just the beginning of the Fed’s unprecedented money-printing operations that continued for nearly a decade.

Today, most people look in the rear-view mirror and ask, “If the Fed’s done it before, why can’t they do it again?”

Mr. Volcker would probably tell you it just doesn’t work that way. The fact is, the Fed has gone so far out on a limb, it has no more wiggle room. It has already fired its biggest guns.

Unless it wants to see a collapse in the U.S. dollar and massive inflation, it cannot crank up the printing presses again. If anything, the pressure continues to build on the Fed to start pulling money out of the economy.

That’s precisely what the Fed started doing in January of last year.

And even if it pauses now for a few months, it doesn’t change a darn thing. Meanwhile …

U.S. debts today are far worse.

Government debts are $22 trillion.

Households are in hock to the tune of $15.5 trillion in mortgages, credit card, student loan debts and more.

U.S. corporations have piled up a record $15 trillion in short- and long-term loans.

All told, we’re in hock to the tune of $51.3 trillion, according to the Fed.

That’s two and a half times the entire output of the U.S. economy, precisely at a time when GDP is the biggest in history.

And if you think that’s a horrendous burden, wait till you see the other kinds of obligations sloshing around in the U.S. economy …

- The government has obligations of at least $105 trillion to pay for Social Security, Medicare and veterans’ benefits.

- Major U.S. banks have obligations of $207 trillion in derivatives — high-risk bets they place on interest rates, stocks and foreign exchange.

Put it all together, and you’re looking at total debts and obligations of $363 trillion.

That’s not just two or three times GDP. It’s SEVENTEEN times GDP.

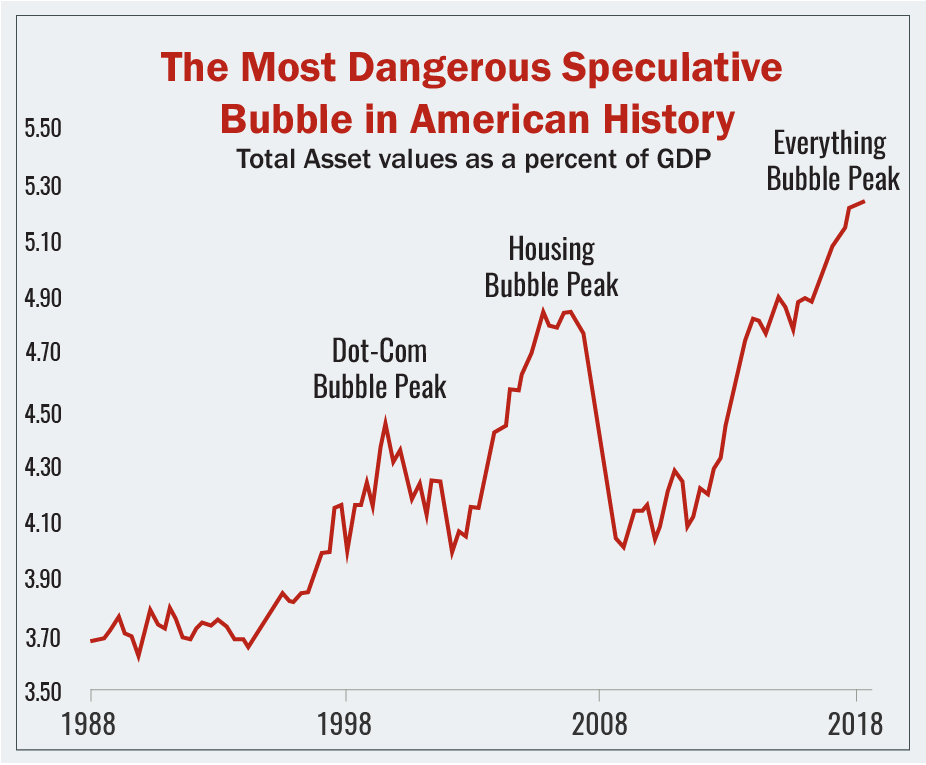

The Most Dangerous Speculative Bubble in American History

Back in 2000, when the dot-com bubble burst, the Fed did everything it could to stop the crash, but the Nasdaq plunged by more than 70 percent, and investors lost $5 trillion!

The housing bubble of the mid-2000s was even bigger. And so was the bust that soon followed. Again, the Fed tried to stop the bleeding, but this time investors lost $16 trillion!

Today, the bubble is the biggest of all – not just in tech stocks and real estate, but in every kind of asset imaginable.

Here’s what to do …

First, don’t be fooled by Wall Street hype. If they say the Fed can save the day, they’re either blind with one eye or talking with a forked tongue.

Second, don’t get sucked into the latest stock market rally. It’s just a knee-jerk reaction to the same old propaganda about the almighty Fed’s “limitless power” to save the day again.

Source: Mike Larson, editor of Safe Money

Third, get our shocking forecasts and strategy recommendations for 2019 and beyond.

But don’t delay. Tomorrow it will go off line for good.

Good luck and God bless!

Martin