In times of global instability, defense stocks are typically good bets for investors.

However, when the U.S. is flirting with a default on its debt, it’s the opposite.

That’s because defense contractors working on projects for the military need government funding.

If Congress fails to reach an agreement to raise the $31.4 trillion debt ceiling, the risk of these defense companies not getting paid on their government contracts is massive.

(In case you missed it: I provided a primer on the debt ceiling last week. You can read that essay here.)

On Friday, Chad showed you how he used our Green Zone Power Ratings system to look up two defense stocks on his shortlist amid this debt ceiling debacle.

I’m going to run with that idea and dive deep into one stock that would get crushed by a debt default.

Defense Relies on the Government

As I pointed out in my essay last week, the U.S. government is dangerously close to reaching the limit of debt it can issue to pay its bills.

If that happens … and some suggest it could be as soon as June 1 … the Treasury Department will have to be selective with who it chooses to pay.

And certain sectors will suffer more than others.

The defense sector is extremely reliant on government funds to operate:

[CHART]

As you can see from the chart above, U.S. defense spending will increase 225% from 2000 to 2028.

Aside from salaries for soldiers and federal employees, a bulk of that money goes to defense contractors providing goods and services for our troops.

If the government can’t pay its bills, our troops will still get paid, but those contractors won’t.

It will be devastating to a lot of American companies … like the one I’m highlighting today.

Debt Default Would Hammer TGI Stock

Triumph Group Inc. (NYSE: TGI) is an American company specializing in components such as fuel systems, hydraulics and gears for commercial and military aircraft.

It employs more than 4,800 across 28 locations in eight countries. And TGI works with major defense contractors like Lockheed Martin (NYSE: LMT) and Boeing (NYSE: BA).

But Triumph’s stock is in a bad spot…

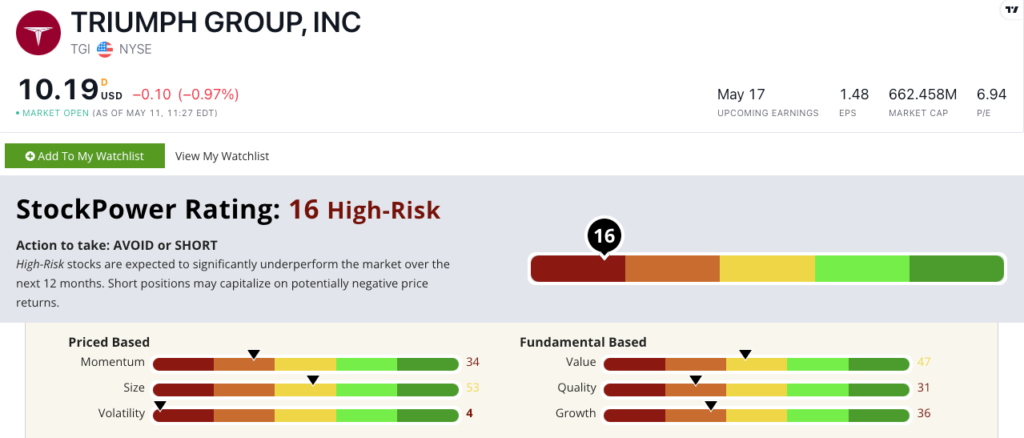

TGI rates a “High-Risk” 16 on our proprietary Green Zone Power Ratings system. It means we expect the stock to significantly underperform the broader market over the next 12 months.

It scores no higher than “Neutral” on any of our six metrics.

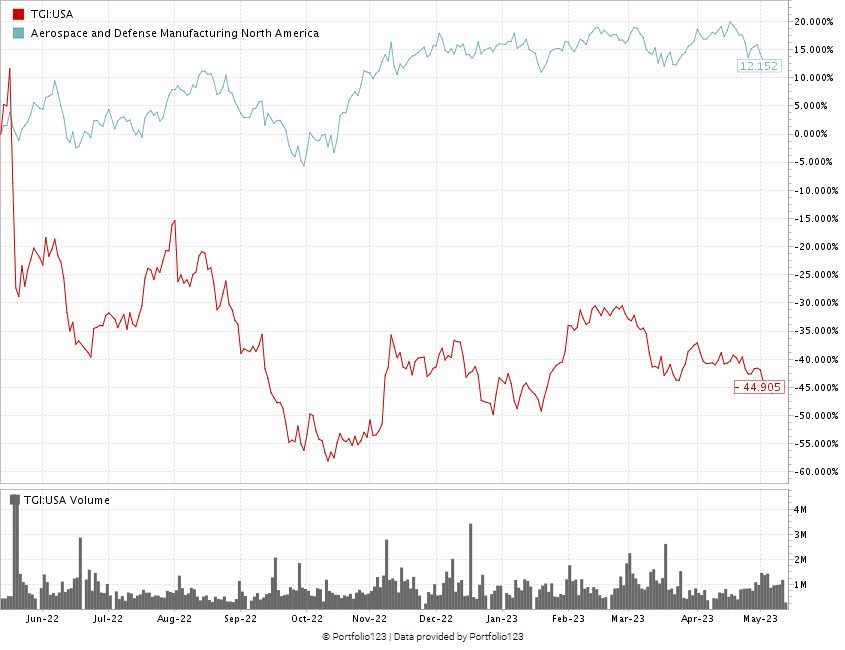

While its aerospace and defense counterparts have seen decent stock price gains over the last 12 months, TGI has struggled:

Created in May 2023.

Over the last year, TGI stock has dropped 45%. Its peers are averaging a 12.2% gain over the same time.

The stock rallied in early 2022 … gaining almost 63% during the start of Russia’s military offensive into Ukraine.

But TGI pared all those gains back and continues trending lower. That shows why it rates a 34 on momentum and a 4 on volatility in our system.

Adam recently talked about using the volatility factor to avoid the worst of the worst in the stock market. And TGI shows you exactly why.

Bottom line: If the U.S. government can’t find a compromise to raise the debt ceiling in the coming weeks, stocks that rely on government funds face an uncertain future.

And our Green Zone Power Ratings system tells us TGI is already in a tough spot before that happens.

As the government barrels toward X-day — the day when the debt ceiling is reached and the U.S. can no longer pay its bills — companies like TGI are staring at the prospect of losing millions in government revenue.

Those two points make TGI a stock you want to avoid in your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets