If there’s one thing the U.S. government loves to flash its cash with, it’s defense.

The U.S. spent $877 billion on defense in fiscal-year 2022. That’s more than the next 10 countries combined!

Now with a looming debt crisis, the government may be forced to tighten the purse strings to make ends meet. That means certain defense contractors could come under fire.

Even if Congress and the White House agree to raise the $31.4 trillion debt ceiling, that only kicks the can down the road. Matt mentioned yesterday that the ceiling has been suspended more than 100 times since World War II.

That means we’ll be talking about the debt ceiling again in the future.

With that in mind, I wanted to explore the defense sector and see what our proprietary Green Zone Power Ratings system says about some of its biggest names…

2 Defense Stocks Exhibit Levels of Risk

Just like last week, I wanted to start with a big name — a company that is first to pop into your mind when someone says “defense contractor.”

And it doesn’t get much bigger than Lockheed Martin Corp. (NYSE: LMT).

In 2022, Statista reported LMT’s net sales to the U.S. government totaled $48.5 billion. That accounts for 73% of its total sales for the year.

That’s a lot of money tied up with an entity facing budget cuts and reduced spending on areas like defense or health care.

Of course, I don’t think Lockheed is at a huge risk amid the debt ceiling debacle. If the U.S. cuts spending on defense to cover its deficit, it will likely look at smaller contractors before upsetting one of its largest customers.

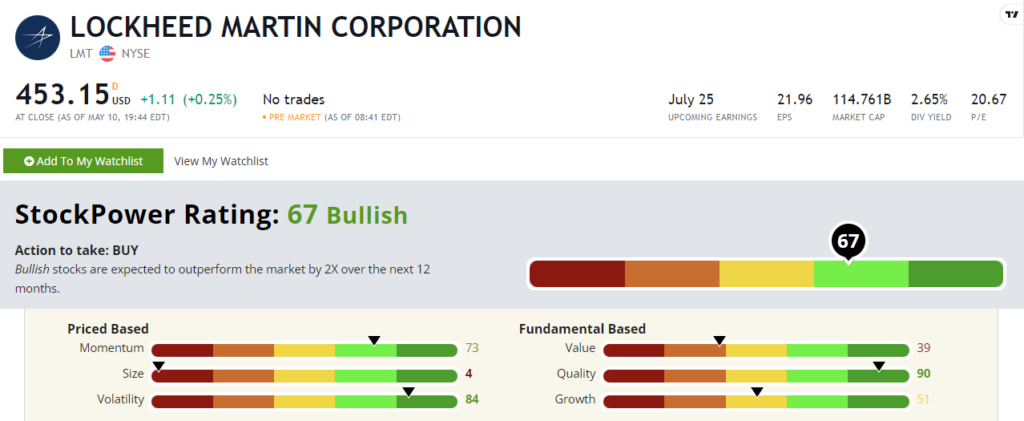

And LMT stock looks solid according to our Green Zone Power Ratings system.

LMT scores a “Bullish” 67 out of 100. Bullish stocks have historically beaten the broader market by 2X.

I want to home in on this defense stock’s fantastic quality score of 90 out of 100. Part of that is buoyed by its massive and reliable client, the U.S. government.

The company has a strong return on investment of almost 27%. Its aerospace and defense peers average a return of -5%.

Lockheed’s net and operating margins are also blowing away its peers.

Looking closer at its balance sheet, Lockheed grew its total assets from $50.8 billion in 2021 to $52.8 billion in 2022. Its return on those assets is 11% — beating the industry average of -10.3%.

And that shows why this stock could outperform from here.

Now for a defense stock that isn’t looking so hot…

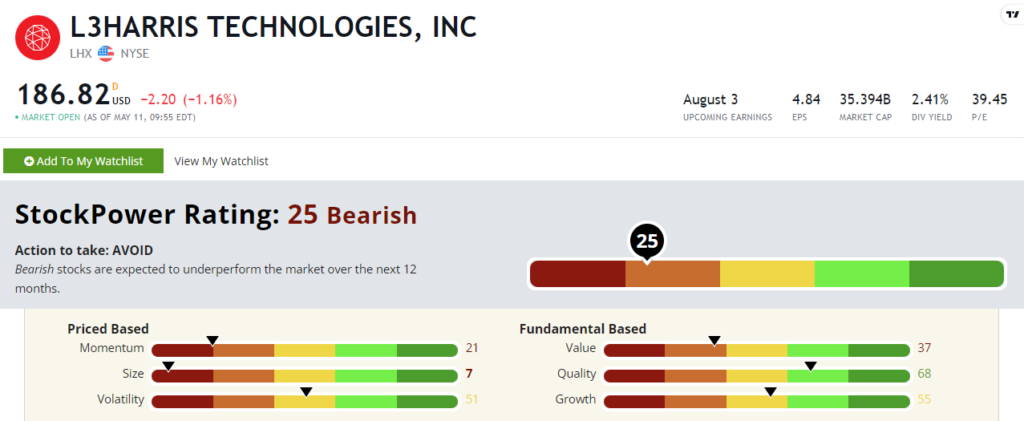

L3Harris Technologies Inc. (NYSE: LHX) rates a “Bearish” 25 out of 100, which means it’s set to underperform the broader market over the next 12 months.

LHX has a problem with momentum, reflected in its 21 score on that factor. Over the last year, it’s lost 22% of its share value.

I did a little digging in an attempt to figure out why. Simply Wall St. reports that 83% of LHX’s shares are held by institutions, with 14 shareholders owning 51% of the company.

That means the Big Money holds a lot of sway on LHX’s board. If they sour even more on recent performance, we could see a steep and fast drop in its share price.

And with the threat of defense spending cuts due to the debt ceiling, that’s a lot of red flags to consider for LHX stock. This is one to avoid.

Use the Green Zone Power Ratings System Today

Adam O’Dell developed the Green Zone Power Ratings system so anyone can get a quick snapshot of what to expect from any number of companies, including other defense stocks.

And you can start using it now! Just go to www.MoneyandMarkets.com and search for other defense stocks on your watchlist — or any other ticker that strikes your fancy.

Note: I mentioned institutional investors holding the lion’s share of LHX stocks above, but there’s a subset of small-cap stocks that these Big Money firms wish they could get into.

Adam has spent months researching these stocks trading under $5… He’s landed on a select few that he believes will rocket higher once they cross that $5 threshold and Wall Street jumps in.

Once that happens, he sees the potential for these stocks to gain 500% over the next year.

But the window to get into these top recommendations is closing tonight at midnight Eastern time. Click here for information on how to gain access before you miss the boat.

That’s all for me this week. Tune in Monday morning to hear from Matt Clark on another defense stock to avoid as this debt debacle unfolds…

Until next time,

Chad Stone

Managing Editor, Money & Markets