Perhaps no other sector has borne the brunt of the COVID pandemic more than airlines.

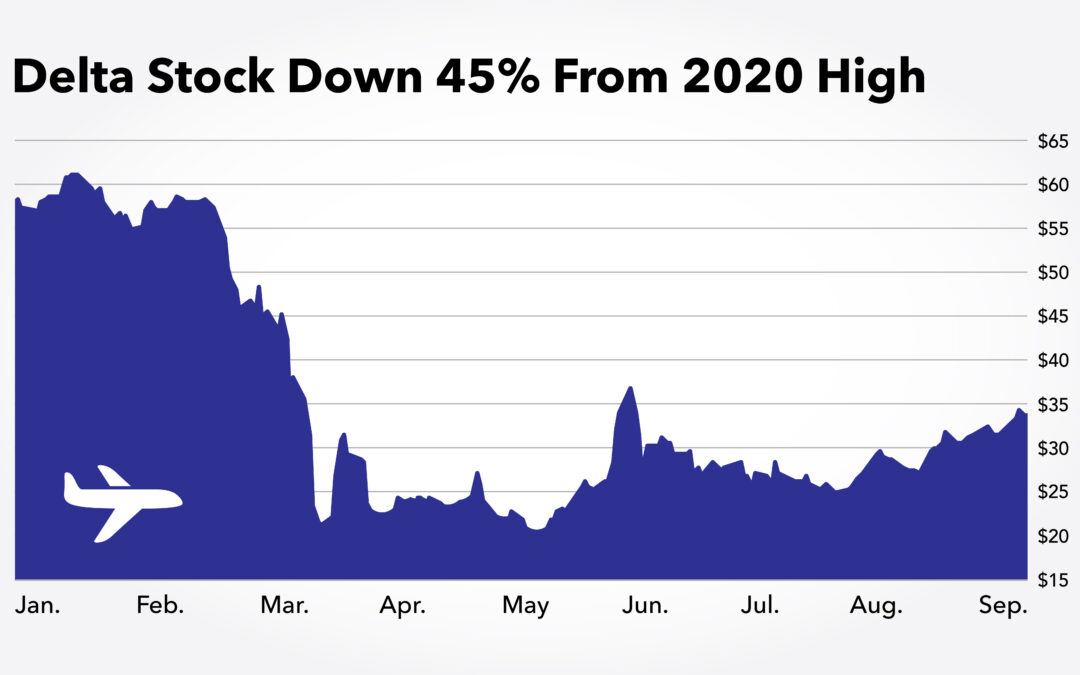

The stock prices of most of the major carriers are still down by about half this year… and this is after a strong rally in the past five months. Both business and pleasure travel have plunged. It’s been a rough road.

Today, we’ll look at Delta Air Lines Inc. (NYSE: DAL). Though it’s been battered as badly as the rest of its peers, Delta seems to be turning a corner of sorts for a few reasons:

- It recently announced it would furlough fewer pilots, which is good for labor morale.

- It managed to cut costs by permanently reducing its headcount. About 20% of its workforce took early retirement this year. And close to half of its workforce agreed to short-term or long-term unpaid leaves of absences.

An underappreciated aspect of headcount reductions is that they affect more senior personnel. When life returns to normal, Delta can re-staff with younger and cheaper labor, thus putting itself in position for higher profitability down the line.

Still, the company burns through about $27 million per day even with this reduced cost structure. And the unspoken understanding is that Delta, along with all of its peers, will need additional government support for several months — or even years.

Delta could be a nice turnaround play … or it could be a nasty value trap.

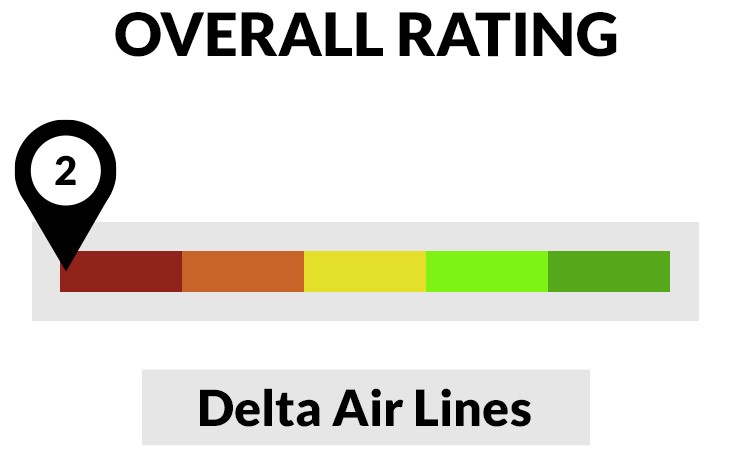

To find out, let’s take a look at Delta’s stock rating using our Green Zone Ratings system.

Delta Stock Rating

At first glance … yikes.

Delta stock’s Green Zone Rating is ugly.

Delta sports an overall rating of just 2. So, 98% of the stocks in our universe rate higher. That’s ugly. Let’s drill down to see what is driving that score.

Growth — Delta’s highest rating comes in Growth, where it rates a 30. If that seems implausibly high, consider that our metric incorporates sales and income growth over various time frames. Delta loses serious points for its sales and profit collapse this year. But its respectable growth over the past several years keeps the rating from plummeting lower.

Value — You might think that airline stocks are “cheap” after the pounding they took. Alas, no. Delta rates a 20 on Value, meaning that 80% of the stocks in our universe are a better bargain. Stock prices have to be cheap relative to something, such as earnings or sales. Well, earnings and sales collapsed even faster than the stock price, hence the low rating.

Volatility — Volatile stocks tend to be inferior investments over time. So, a low score here means the stock is more volatile rather than less, and Delta rates a 14 on Volatility. This is not a steady stock.

Quality — Would you like to become a millionaire? Then take Virgin Airlines founder Richard Branson’s advice:

Start with a billion dollars and launch a new airline.

Branson isn’t the only billionaire with strong words about the airline industry. The ever quotable Warren Buffett had this to say about it:

The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.

It’s fair to say that airlines are the exact opposite of a high-quality company. Their return stream is lumpy even under the best conditions. They’re capital-intensive and bogged down with debt. Delta rates a 14 on Quality.

Momentum — It gets worse. Stocks that are trending higher tend to attract new buyers, which in turn pushes the stocks even higher. Momentum creates a virtuous cycle. But Delta rates just a 5 on Momentum.

Size — For all its problems, Delta is still a massive company, with a market cap of $21 billion. That gives it a Size rating of 3. And smaller companies tend to outperform larger ones over time.

Bottom line: You could argue that Delta is stronger than some of its peers. For example, American Airlines (NYSE: AAL) rates even lower, at 1.

But no matter how you slice it, Delta’s stock rating shows it is a smoldering dumpster fire of a company, and we’re best to avoid it.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.