Your retirement could be in serious jeopardy with a recession looming if not already here amid the novel coronavirus pandemic, but there are dividend stocks to buy to help make sure your golden years are golden.

The future is uncertain.

Those are words you hate to hear if you are retired or getting ready to.

In looking at ways to bolster that retirement, investments could be the way to go. But, as an investor, you have to be smart — especially in these uncertain economic times.

That’s why we looked at thousands of dividend-paying stocks to come up with a few that can best help you fund your retirement.

These four dividend stocks to buy have either strong dividends or ones that won’t be impacted nearly as much in a market crash.

4 Dividend Stocks to Buy to Help Fund Retirement

1. Universal Health Realty Trust

Market Capitalization: $1.3 billion

5-Year Return: 93.8%

5-Year Earnings Growth: 31.43%

Annual Dividend Yield: 2.81%

60-Month Beta: 0.91

The first on our list of dividend stocks to buy is a real estate investment trust, or REIT. These are companies that own, operate or finance income-producing properties related to a specific sector.

Universal Health Realty Trust (NYSE: UHT) invests in health care and human service-related properties. These include acute care hospitals, surgery centers and medical office buildings.

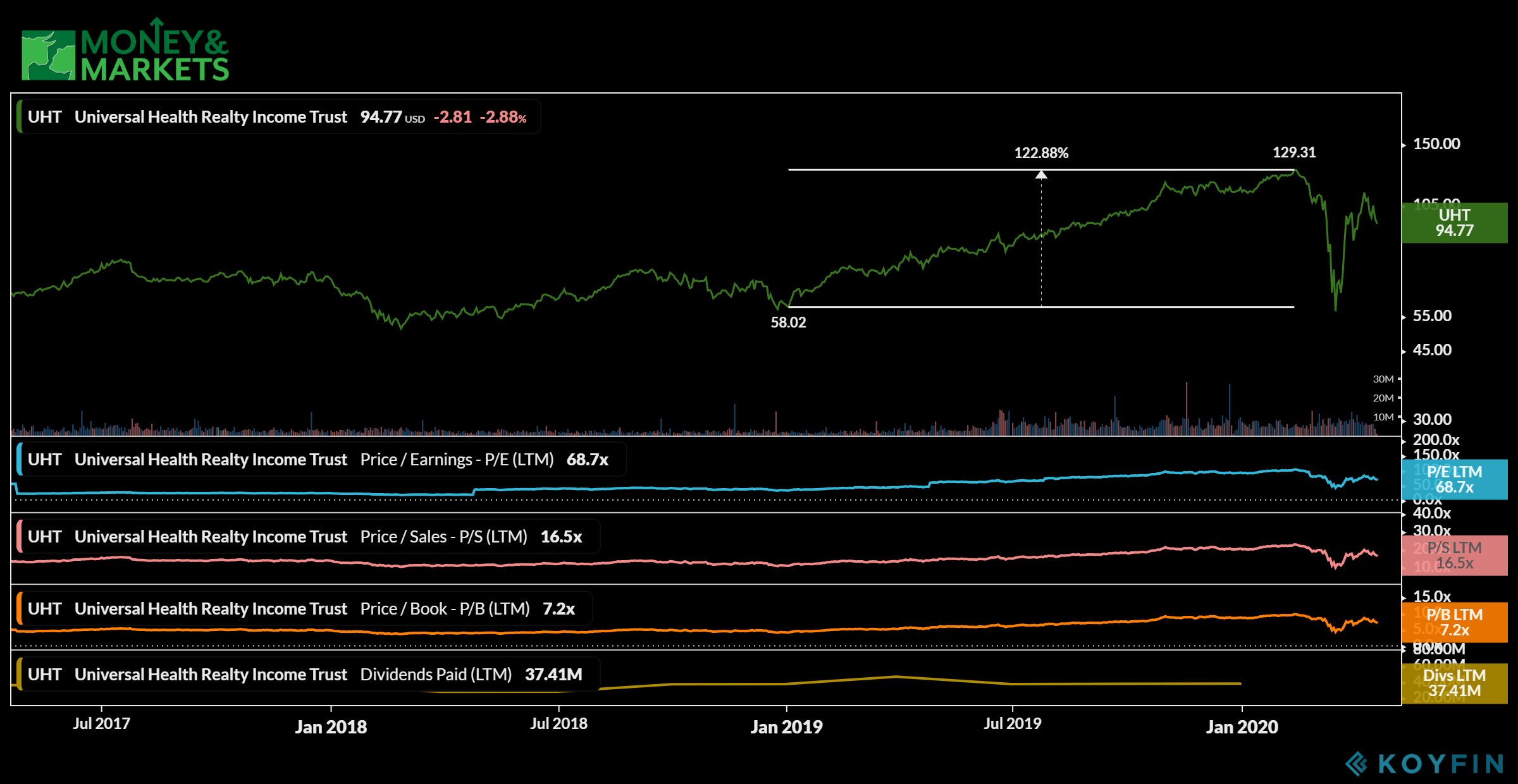

In 2019, Universal Realty had a great year. Its share price bounced more than 122% as demand for more and more medical office space grew.

Of course, like all other equities, it suffered a big drop in March 2020 thanks to the coronavirus. However, shares have recovered nicely to come close to their 52-week highs.

But, stock price aside, REITs are great investments because 90% of the profits have to be paid out as dividends to shareholders.

In March 2020, Universal Health paid a dividend of $0.68 per share and that dividend hasn’t wavered much in the last two years.

It’s a good, solid quarterly dividend producer that can help bolster your savings. That’s why Universal Health Realty is one of the four dividend stocks to buy to help fund your retirement.

2. Realty Income Corp.

Market Capitalization: $17.4 billion

5-Year Return: 8.23%

5-Year Earnings Growth: 33.98%

Annual Dividend Yield: 5.5%

60-Month Beta: 0.64

Another REIT on the list is Realty Income Corp. (NYSE: O).

This company invests in freestanding, single-tenant commercial properties in the U.S., Puerto Rico and the United Kingdom.

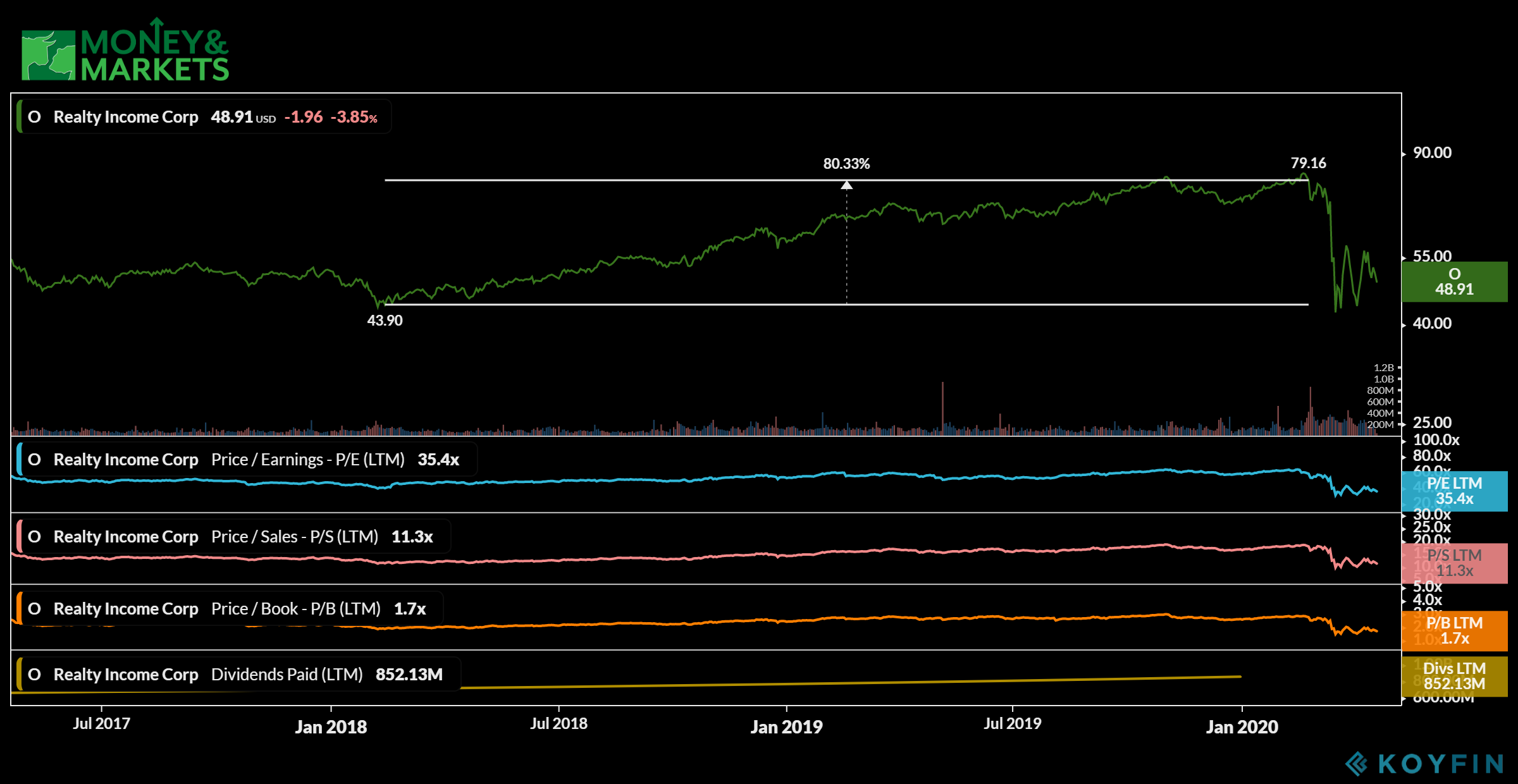

Like Universal Health, Realty Income Corp. had a strong 2019. In fact, in two years, the share price of the company jumped more than 80%.

It fell, like others, but that has made it extremely cheap to get into.

All of that aside, the strongest part of Realty Income is its dividend. Unlike many REITs, Realty Income pays its dividends every month. It’s paid a dividend for nearly 600 straight months. They’ve also raised their dividend 70 times since they started paying it.

Currently, the dividend is $0.23 per share, but again, they pay every month thanks to a portfolio of more than 3,500 properties.

You really can’t get much better than a REIT that’s affordable and pays a monthly dividend. That’s why Realty Income Corp. is one of the four dividend stocks to buy to help fund your retirement.

3. National Retail Properties

Market Capitalization: $5.1 billion

5-Year Return: -22.2%

5-Year Earnings Growth: 25.8%

Annual Dividend Yield: 6.8%

60-Month Beta: 0.74

The next dividend stock to buy on the list is like Realty Income Corp., which benefits from single-tenant, net-leased properties.

National Retail Properties (NYSE: NNN) has a large portfolio of properties that serve everything from convenience stores to family entertainment.

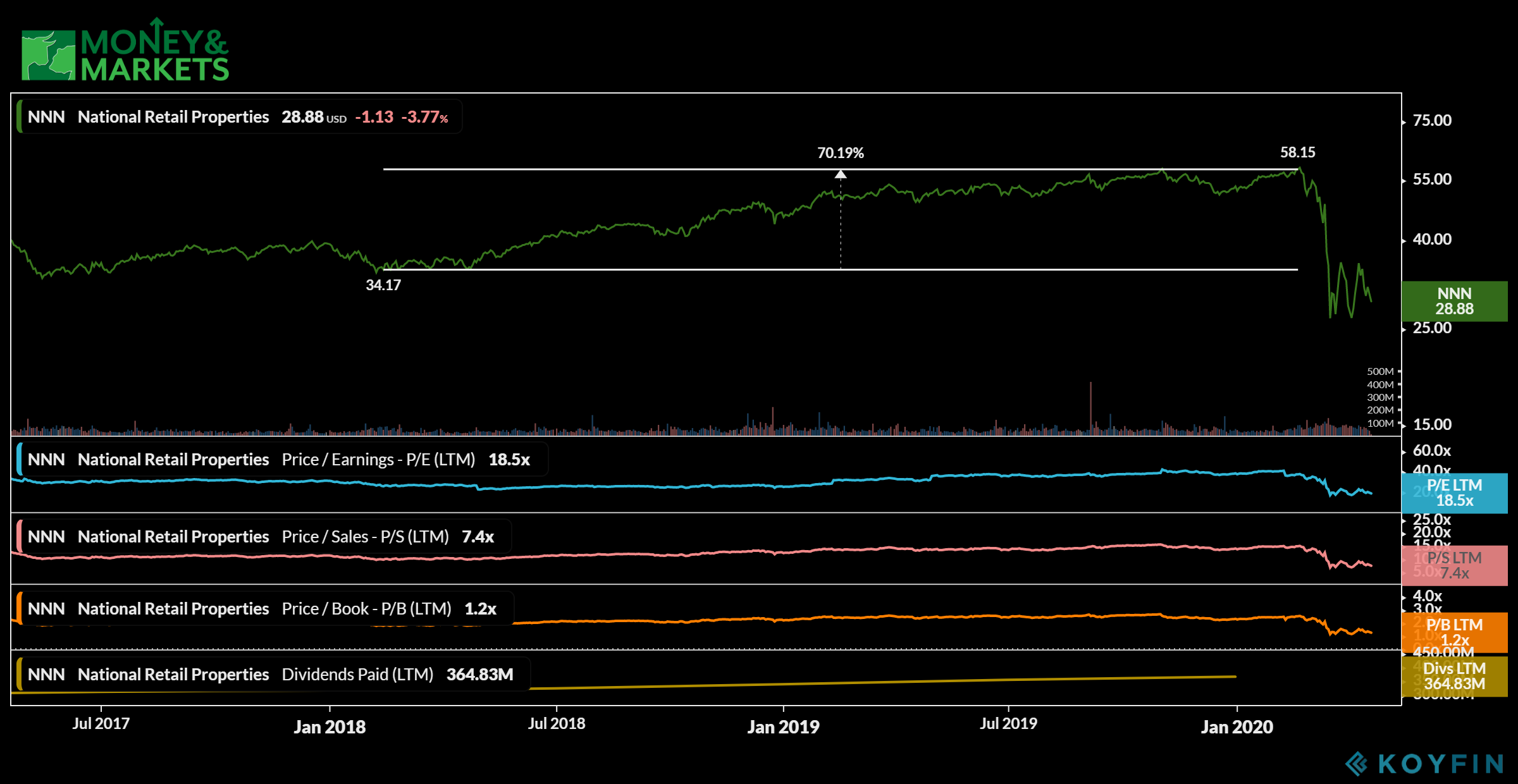

In February 2020, it reached a new 52-week high of $58 per share but shed more than half of that in the coronavirus crash. That makes it more affordable than the previous two stocks we’ve mentioned.

But the strength of National Retail is its clientele. Around 5% of its portfolio is property operated by 7-Eleven convenience stores. It also has Flynn Restaurant Group (Taco Bell and Arby’s) and Camping World as clients.

That gives it close to 2,500 properties in 47 states, which is one of the reasons why the company has raised its dividend for 30 straight years.

It has an annual dividend yield of 6.86% and its last dividend payment to shareholders was $0.51 per share, which is one of the best in the market.

The fact that it has raised that dividend, even during the Great Recession, is pretty impressive.

That’s the reason why National Retail Properties is one of the four dividend stocks to buy to help fund your retirement.

4. Urstadt Biddle Properties Inc.

Market Capitalization: $470 million

5-Year Return: -43.9%

5-Year Earnings Growth: -51.26%

Annual Dividend Yield: 9.54%

60-Month Beta: 0.96

The smallest of our companies is Urstadt Biddle Properties Inc. (NYSE: UBA).

It’s a REIT that focuses on small properties — mainly community shopping centers located in the northeast. But don’t let the size fool you.

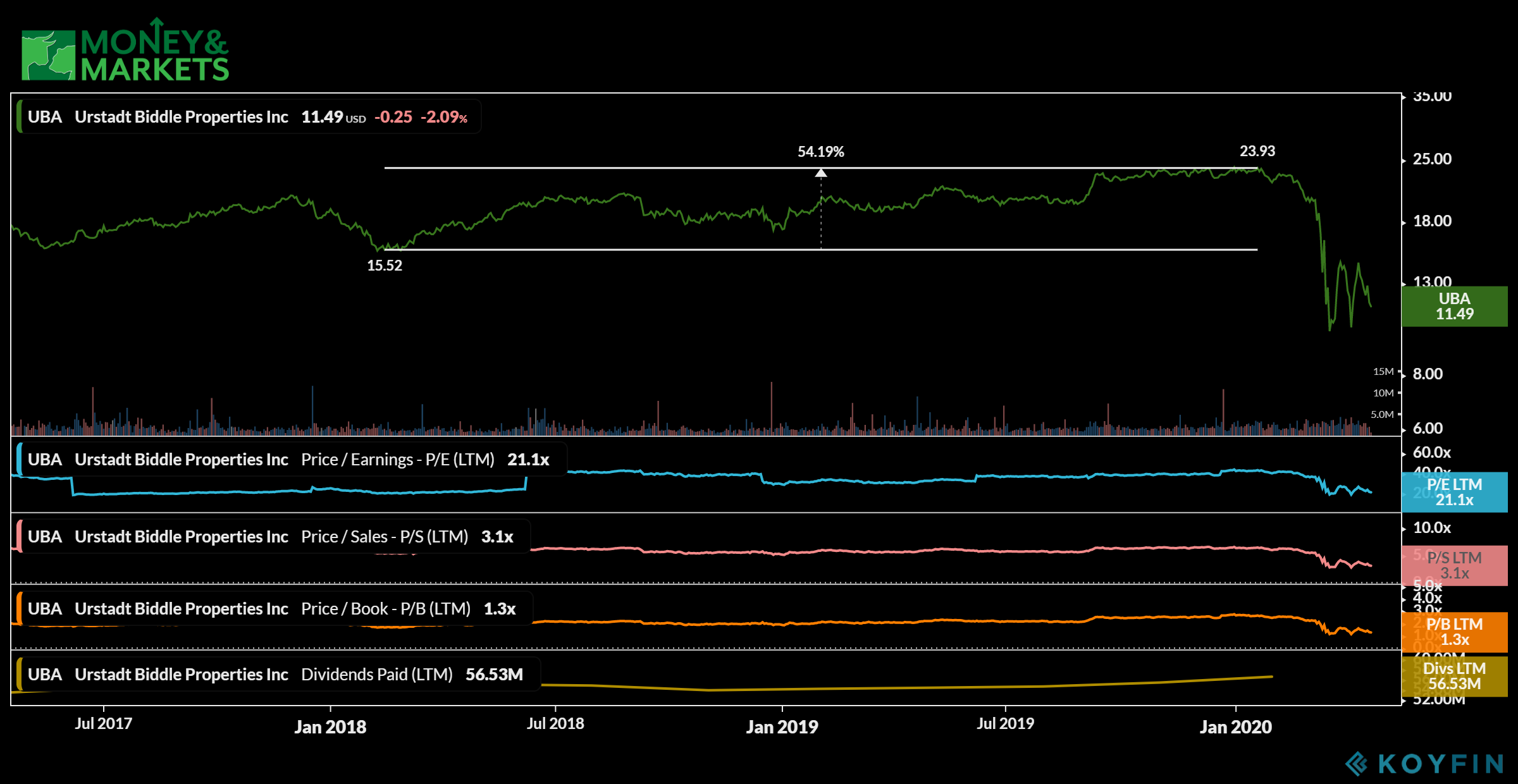

Shares of Urstadt Biddle jumped more than 50% in two years from 2018 to 2020 but did fall off in the recent market crash. That makes it the cheapest stock on the list, trading at around $12 per share.

All of its 5.3 million square feet is in Connecticut, New Hampshire, New Jersey and New York.

While its return and earnings growth are negative, that’s not what we are looking at when it comes to finding dividend stocks to help fund retirement.

For that, we look at dividends. And UBS has one of the strongest. It last paid out a dividend of $0.28 per share — an increase from 2019. UBS has increased that dividend in each of the last 25 years and hasn’t missed a dividend payment in 50 years.

Because it is located in high-income areas, its tenants enjoy solid business.

But paying a dividend without interruption for 50 years and increasing that dividend every year is why Urstadt Biddle Properties Inc. is one of the four dividend stocks to buy to help fund retirement.

So here you have a collection of REITs that offer strong backing and solid dividends, which is what you should be looking for to help fund your retirement.

You won’t get rich with these stocks, but you certainly can help offset any potential downswings in the market by investing.

That’s why these are the four dividend stocks to buy to help fund your retirement.