Health care in the U.S. is a mess.

We have the best doctors in the world and the best medical technology by a country mile. The best and brightest minds from across the globe come here to practice.

But the administration is enough to give you a migraine.

And to call investing in the sector difficult is an understatement.

We can best explain new drug or device research as throwing a big plate of spaghetti on the wall and seeing what sticks. And this says nothing of political risk and the potential for a future “Medicare for all” to completely upend the sector’s economics.

American society is aging. Demand for medical care will rise from here as the baby boomers advance through their golden years. But for all the reasons listed above, profiting from that trend may prove difficult.

Unless you’re a landlord.

I have no idea what the American medical system will look like 10 years from now.

It might look like it does today — or we may have socialized medicine by then.

But however this shakes out, I’m confident that our aging population will still need care.

And I’m confident that we’ll need facilities to accommodate them.

Dividend of the Week: DOC Stock

This brings me to my Dividend Stock of the Week: Physicians Realty Trust (NYSE: DOC) is a real estate investment trust (REIT) that specializes in medical office buildings.

DOC pays a competitive dividend, just shy of 5%. That isn’t too shabby in a world where the 10-year Treasury still yields less than 1%!

Now, as a caveat: REITs don’t always stack up well using our Green Zone Ratings model because the quirky accounting tends to throw it off. (More on that below.)

We’ll take a look at DOC using our six-factor model.

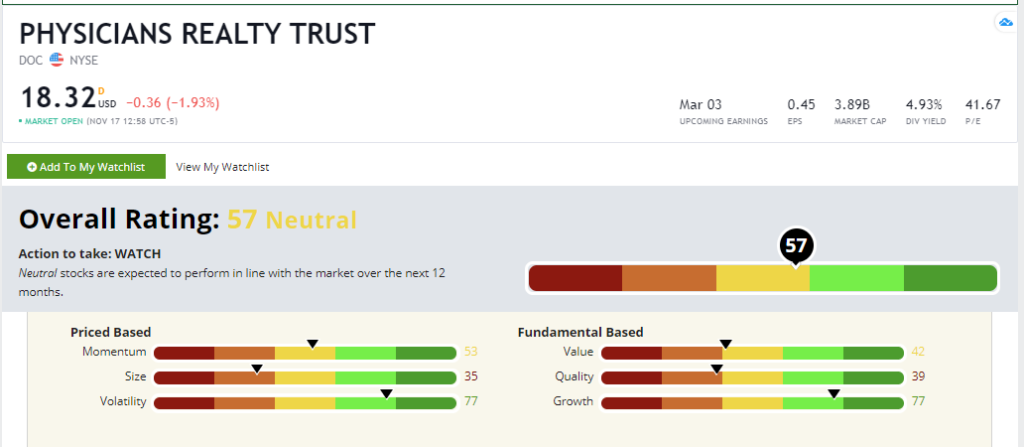

Physicians Realty Trust’s Green Zone Rating on November 17, 2020.

At first glance, it looks mediocre, sporting a composite rating of 57.

In our historical analysis, a rating in this range is a recipe for returns more or less in line with the S&P 500.

But let’s dig a little deeper to see some of DOC’s underlying strengths…

DOC: 6-Factor Green Zone Stock Rating

Volatility — DOC rates highly in Volatility, scoring a 77. Low-volatility stocks tend to outperform high-volatility stocks over time, and a high rating here implies low volatility. By our system, DOC is less volatile than all but 23% of the stocks in our universe.

Growth — REITs aren’t known as aggressive growth vehicles. Investors tend to view them as stodgy, old income plays. But DOC rates well in Growth, at 77. Demand for DOC’s medical office properties has been strong for years, and I don’t expect that to change any time soon.

Momentum — DOC scores a decent 53 on Momentum. In a market that has favored “virus-proof” tech names, this medical office REIT still rates in the top half of all stocks. That’s promising. Ultimately, we don’t “need” our income stocks to move higher, as we buy them primarily for income rather than capital gains. But we’ll certainly take the rising share price!

Value — DOC rates relatively low on Value, at 42. But this is an area where our model tends to punish REITs due to their quirky accounting. You see, REITs generally have low reported earnings because of high non-cash expenses (like depreciation) that distort the picture. So, while DOC might not be “cheap,” per se, it’s not as expensive as a rating of 42 might otherwise suggest.

Quality — Its Quality score is a similar story: DOC rates a 39. Our Quality rating depends primarily on profitability and debt management. Well, REITs have low reported GAAP earnings due to their quirky accounting and tend to have high debt levels because their properties are mortgaged. So, I suggest taking this particular metric with a grain of salt in this case.

Size — And finally, we get to Size. DOC is relatively large, with a market cap of around $4 billion. That pushes its size rating to 35. As a general rule, smaller companies tend to outperform over time.

Takeaway

On balance, DOC looks interesting.

With an overall score of 57, it’s not far from our “Bullish” zone, which starts at 60.

Considering that our model “punishes” DOC on Value and Quality due to its quirky REIT accounting, I’m comfortable giving it the benefit of the doubt here and milking its 5% dividend.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.