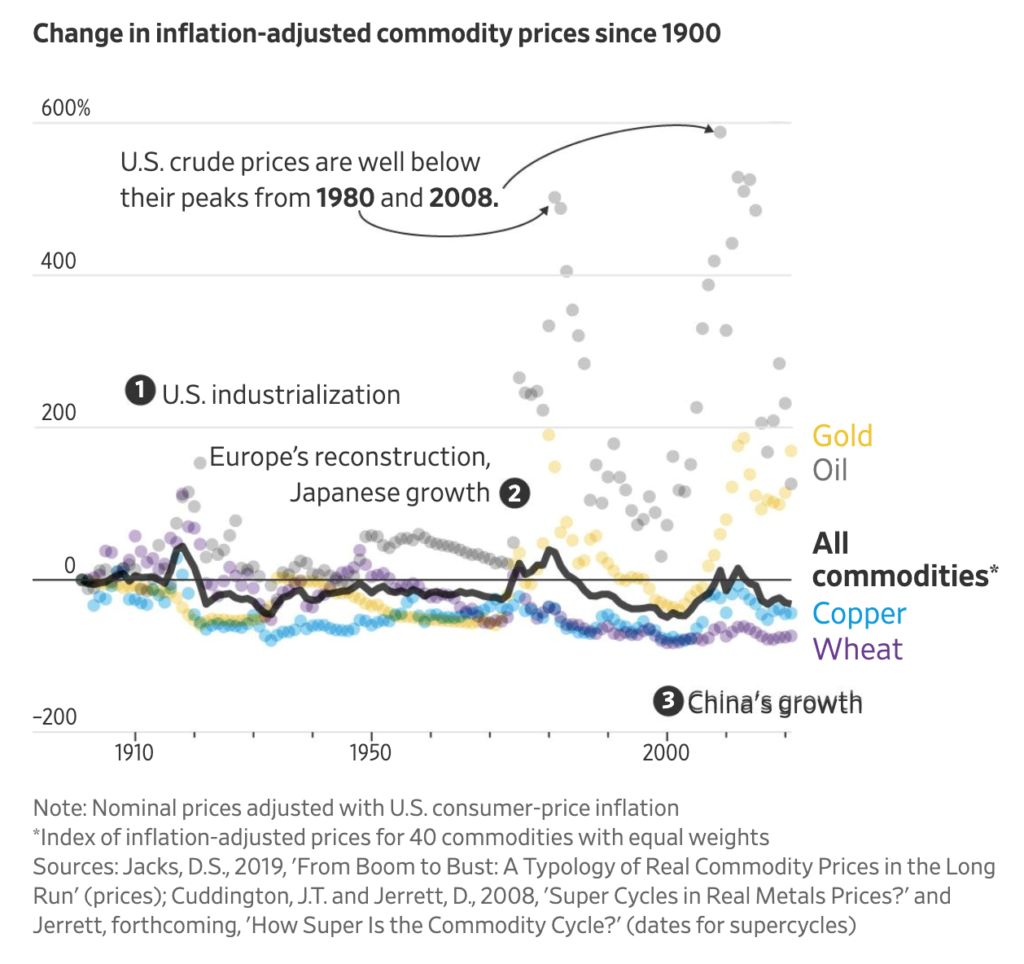

Commodity prices have surged in the past year. This led to some analysts expecting a new bull market in commodities. History shows commodities as an asset class might not have ever experienced a true bull market.

In inflation-adjusted terms, the price of a broad commodities index is below the level it was in 1900.

Commodity Prices Since 1900

Source: Ritholtz.com.

Supply and Demand Should Guide Investors’ Commodity Investments

It makes sense that commodity prices, in general, remain steady with inflation. That’s because rational markets react to price moves in commodities.

If the price of wheat rises, farmers should plant more wheat next season. The increased supply should lower the price. When the price drops, farmers plant less. Then, based on less supply, the price should rise.

That cycle also applies to copper and other metals, although the changes take several years instead of a single planting season.

The fact that commodity markets can adapt to changes in supply and demand keeps prices relatively flat, adjusted for inflation. That can be seen in the chart above. Solid lines show that prices for copper, wheat and a broad commodities index are all lower than they were in 1900.

However, oil and gold rose over that time. This makes perfect sense.

Demand for oil was negligible in 1900. Over the next few years, inventors would develop techniques that transformed oil into energy — changing the world. Higher prices reflect those changes in demand.

Oil could enjoy increased demand for decades. The drive for green energy will drive that demand since oil is needed to make and deliver those technologies.

There is no new technology that explains why gold prices are higher than they were 120 years ago. The reason for the price increase lies in investor demand. For the past century, in fact for more than 20 centuries, investors have valued gold as an inflation hedge — making gold attractive now.

But not all commodities are suitable for long-term investments. Investors should focus on short-term strategies based on factors related to supply and demand when investing in commodities other than gold or oil.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.