The Fed has started buying corporate bonds, which is worrying some analysts, but is fighting the Federal Reserve the best decision right now?

Fed Chair Jerome Powell announced last week the central bank will start moving away from buying corporate debt through exchange-traded funds, and will instead move to buy individual company bonds.

“It’s a better tool for supporting liquidity and market functioning,” Powell said during his semiannual testimony before the House Financial Services Committee on June 17.

Some are highly critical of the Fed’s move into Treasurys, with Wall Street veteran Richard Bernstein saying the bond market equates to “third grade soccer” now in a recent appearance on CNBC’s “Trading Nation.”

“There are no winners or losers,” said Bernstein, CEO of Richard Bernstein Advisors. “Everybody gets a participation medal, and one has to wonder by taking out the risk-return consideration from a huge market — what that means for misallocation of capital, where a bubble is going to form and things like that.”

But Banyan Hill Publishing’s Ian King doesn’t see it like that, and he thinks there’s a huge misconception about what the Fed’s quantitative easing (QE) efforts really entail.

“There are a lot of memes going around about ‘money printers that go brrrrr’ and it’s easy to think that the Fed prints currency,” said King, Editor of Automatic Fortunes. “This is not the case.”

It all comes back to the function of the Fed and banking in general.

“In a fractional reserve system of banking, and money is simply credit,” King said. “And the controllers of credit are the banks — they determine who is creditworthy and who is not. The QE intervention by the Fed removes bonds off the bank balance sheet and replaces them with reserves, which can be turned into credit.”

While the Fed has signaled it will do whatever it takes to keep markets functioning, Powell reiterated that the central bank will “put the tools away” when it sees the improvement it’s looking for.

And what that means is investors who want to thrive in this environment need to adopt the mantra: “Don’t fight the Fed” — at least in the short-term.

Don’t Fight the Fed

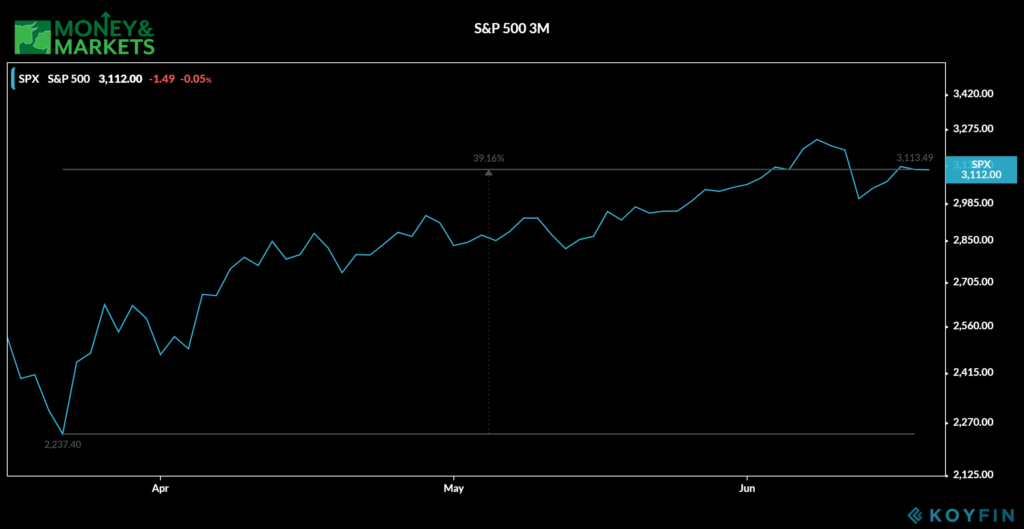

Uncertainties about the economic recovery from the coronavirus lockdown have created a rocky trading environment this week, but the Fed’s unprecedented support has fueled a 39% S&P 500 rally off its March 23 low.

King sees a lot of upside for the stock market in the short-term, and thinks the only thing that could dampen spirits is if the economy has to be shutdown again due to another wave of COVID-19 infections.

Many states have reported a spike in new cases of the novel coronavirus after reopening efforts have ramped up in the last few weeks, but politicians are wary of closing the economy again.

“If this were to happen AND the government doesn’t combat the economic slump with the same fiscal stimulus, I think both the economy and the stock market would be in a world of pain,” King wrote via email. “However, it doesn’t appear that state governors are willing to shut down the economy again. In Florida, Gov. Ron DeSantis totally rejected the idea of another shutdown entirely.”

King sees another bullish signal for stocks as well.

“Additionally, there is now $4.7 trillion in money market funds (up from $3.5 trillion last month) looking for a home,” he wrote. “This is a bullish tailwind for stocks.”

If you want to hear more of King’s thoughts on the current market, be sure to check out his recent “Participation Trophy” Stock Market video on YouTube. Subscribe to the Smart Profits Daily channel to get insights from King and other members of the Smart Profits Daily team.