If you watched Seinfeld, you might recall that time George Constanza double-dipped. He dipped a chip, took a bite and then dipped again. There are dangers to the double-dip, and George’s antics led to chaos.

The economy is poised to double-dip. And the results could be chaotic for millions of Americans counting on a recovery.

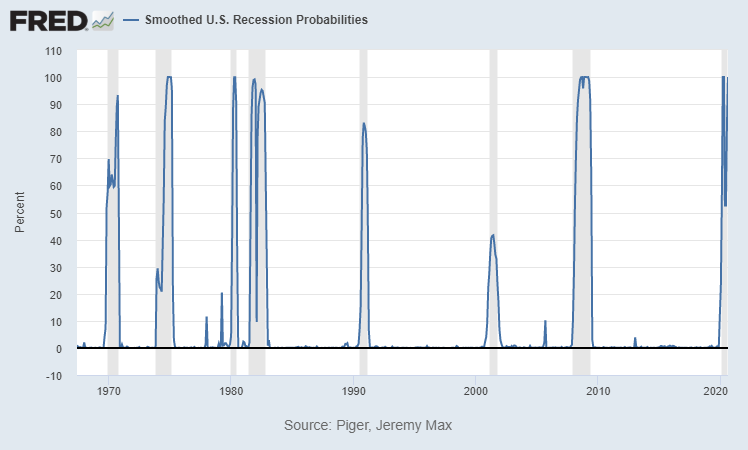

A reliable Federal Reserve model indicates a double-dip recession is likely. As shown in the chart below, the recent deep decline has just one precedent: the early 1980s.

Fed Data Points to Double-Dip Recession

Source: Federal Reserve.

This model compiles many sets of data:

- Employment.

- Industrial production.

- Personal income.

- Manufacturing and trade sales.

It’s designed to identify economic recessions. Since it was first published in 1998, the model has been highly accurate.

Identifying recessions in real time is a problem for economists. The previous recession, for example, ended in June 2009. The National Bureau of Economic Research didn’t confirm that until September 2010.

Lags of a year or more are common, but this model helps policymakers respond to conditions in real time.

This model has never generated a false signal. That means it’s likely the stimulus program dampened the contraction. But without more stimulus, a second economic decline is likely.

What a Double-Dip Recession Means for Investors

Let’s review the double-dip recession of the early ‘80s.

That contraction began in January 1980 and lasted just six months. About a year later, in July 1981, a deeper recession began. The second dip lasted 16 months.

A similar pattern may unfold this time. Policymakers failed to address economic problems with the first stimulus package. They simply boosted short-term growth.

And there are many economic problems that remain unsolved:

- Overcapacity in the retail sector.

- Office space vacancies.

- Reduced use of public transportation.

Those problems are now causing a second recession, assuming the first one ended.

Conservative investors should remain defensive as the double-dip recession threatens the bull market in stocks.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.