Traders follow technical indicators for signals in the market. Some signals are leading indicators, meaning they precede other important signals.

For precious metals traders, signals in mining companies are often leading indicators of reversals in the metal.

Miners tend to lead because they offer leveraged exposure to the market.

Here’s an example:

- Assume it costs a miner about $20 per ounce to produce silver.

- They mine 1 million ounces a year.

- If silver is at $24 an ounce, the company should generate a profit of about $4 an ounce, or $4 million.

This is a simple example, so assume the company has no other costs and no additional revenue.

If the price of silver increases by 20% to $28.80 an ounce, and production costs stay the same, the miner’s profits increase to $8.80 per ounce. That’s $8.8 million in profits for the company, an increase of 120%.

Even smaller gains in the price of silver have a large impact on earnings. A 1% increase in silver prices results in a 6% jump in the earnings of this hypothetical mining company.

Remember, leverage increases gains on the upside but can cause significant losses on the downside.

A 1% decline in the price of silver could result in a 6% drop in earnings for this silver miner.

This leverage makes silver miners an excellent way to invest in silver.

Silver Miners Show Positive Trend

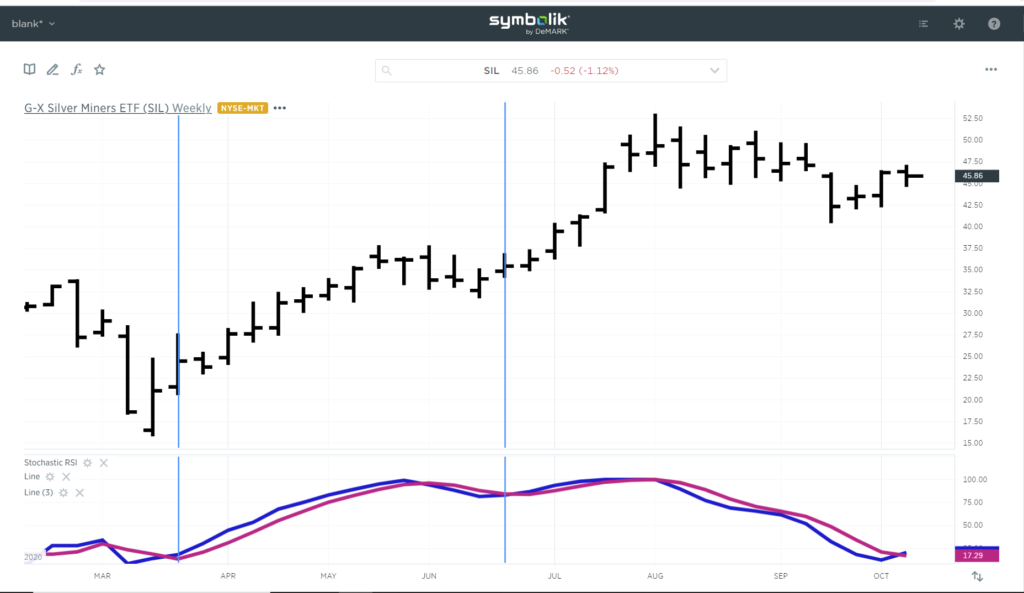

The chart below shows it might be time to invest in the sector.

It’s a chart of Global X Silver Miners ETF (NYSE: SIL) with a momentum indicator at the bottom.

Silver Miners ETF Has Positive Momentum

Source: Symbolik.

The stochastic relative strength index (RSI) completed a bullish crossover. Stochastics RSI is a smoother version of the popular stochastics indicator. Instead of using closing prices in the calculation, it uses the RSI indicator to reduce short-term losing trades.

This indicates SIL could be at the beginning of an uptrend. Two previous signals are highlighted in the chart with vertical lines.

Now could be time to consider silver since miners tend to lead the metal. It could also be a time to buy individual miners since they are a leveraged trade on silver.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.