5G technology is finally here.

After delays because of the COVID-19 pandemic, millions of Americans can download movies and music as fast as they can with a broadband connection at home.

It opens up possibilities beyond faster smartphone downloads (think automation, data collection and AI applications).

The chart above shows how much 5G technology will add to the gross domestic product (GDP) of select countries.

5G will tack on $484 billion to the U.S.’ GDP (final value of goods and services produced).

The tech is a massive benefit to folks who can now download movies in minutes, but it’s valuable to businesses looking to harness the 5G speed for artificial intelligence and more.

Today’s Power Stock develops software to help businesses take full advantage of 5G technology: Amdocs Ltd. (Nasdaq: DOX).

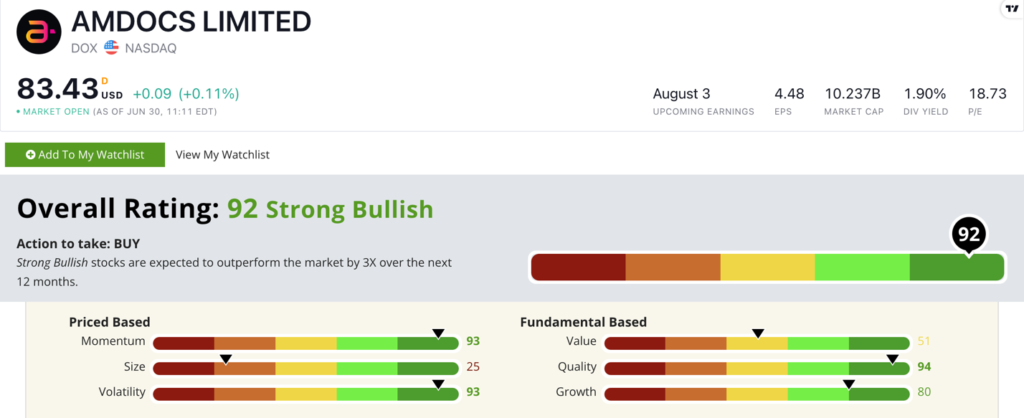

DOX Stock Power Ratings in July 2022.

Amdocs creates AI software to collect data that communications, media and mobile virtual network providers use.

Amdocs stock scores a “Strong Bullish” 92 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

DOX Stock: Quality, Momentum + Low Volatility

DOX’s most recent quarter broke records.

Highlights include:

- Quarterly revenue of $1.2 billion — a 9.2% increase from the same quarter a year ago.

- The third consecutive quarter of 9%-plus revenue growth.

DOX rates in the top 6% of all stocks on our quality metric.

Its return on equity is 15.5% — quashing that of the tech consulting industry, which averages negative 5.6%.

The company’s operating margin is an impressive 14%. Its peers, on the other hand, average negative 13.4%.

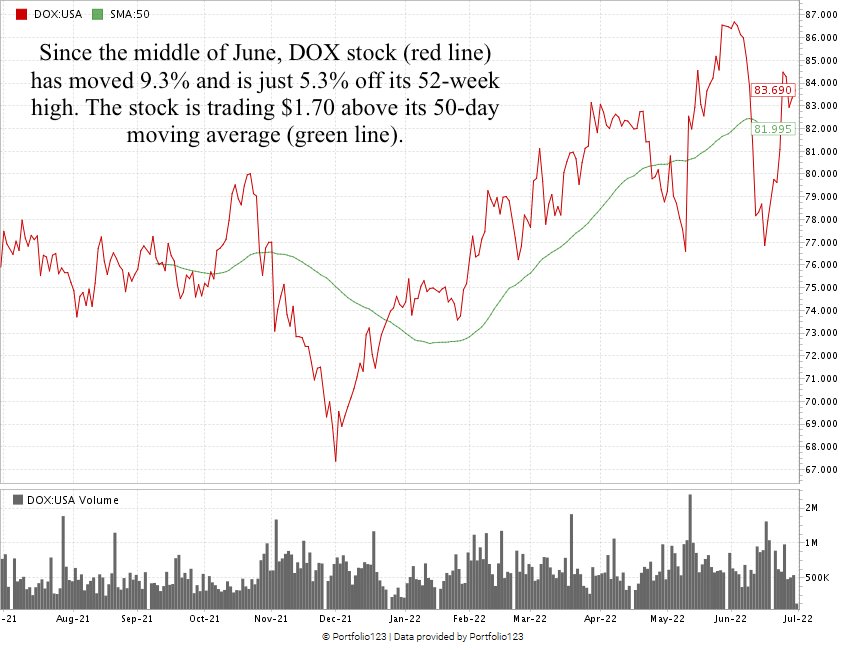

From its low in December 2021 to the end of June, DOX is up 24.7%. In the last half of June 2022, the stock jumped up 9.3%.

It’s 10.7% higher than it was a year ago and is outpacing its industry peers — which are down 6% over the same time.

Amdocs Ltd. stock scores a 92 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

While COVID-19 slowed the rollout of 5G technology, it’s here now … and I expect growth to ramp up.

Companies will leverage its speed and security with software and hardware.

DOX is a strong candidate for your portfolio, folks.

Bonus: Amdocs’ forward dividend yield is 1.9%, so it pays shareholders $1.58 per share, per year to own the stock.

Stay Tuned: Top Gas Station to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a terrific gas station and convenience store to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.