When I lived in Kansas, I considered it a treat to walk to my local convenience store for a drink or a snack … especially on a hot summer day.

Living on my own, I grew to rely on those stores when I needed to pick up snacks, drinks or a gallon of milk after working late hours covering a football game.

Take a look at the revenue of gas stations in the U.S. every year:

In 2020, revenue from gas stations dropped 15% due to the COVID pandemic keeping us all inside.

That number will increase 21% by 2024.

That means gas stations (and gas station stocks) will make massive profits and see a quick return to pre-COVID sales.

Today’s Power Stock operates gas stations in the Southeast, Southwest and Midwest: Murphy USA Inc. (NYSE: MUSA).

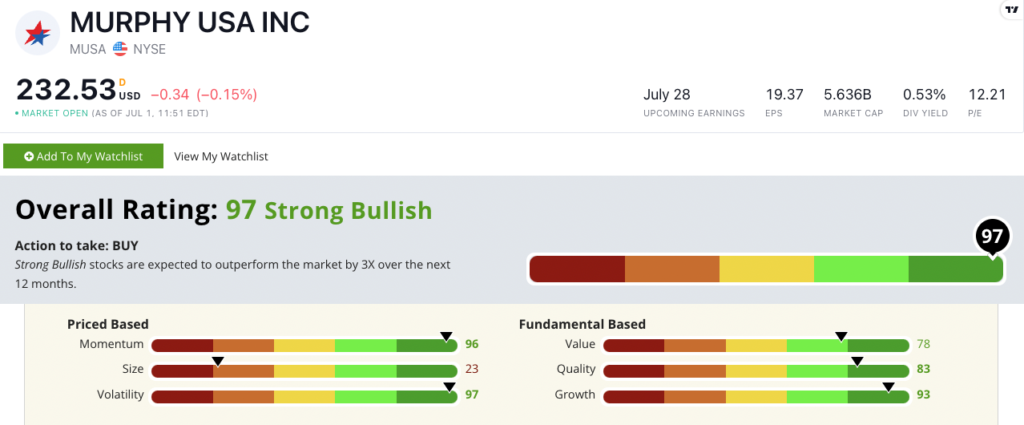

MUSA Stock Power Ratings in July 2022.

Murphy’s brands include Murphy USA, Murphy Express and QuickChek.

It owns 1,679 gas stations from Las Vegas to Miami — and as far north as Michigan.

Murphy USA stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

MUSA Stock: Bear-Beating Momentum + Growth

MUSA posted a strong first quarter of 2022. Here are two highlights:

- Reported net income of $152.4 million — up 175.6% from the same quarter a year ago!

- Sold 1.1 billion gallons of gasoline in the quarter. That’s a 7.8% jump from the same time last year.

I’ll get into MUSA’s awesome momentum. But first, I want to talk about growth.

MUSA’s one-year annual sales growth rate is an impressive 54.1%.

It grew its earnings per share by 202.2% quarter over quarter.

That outstanding growth sets the stage for MUSA’s momentum.

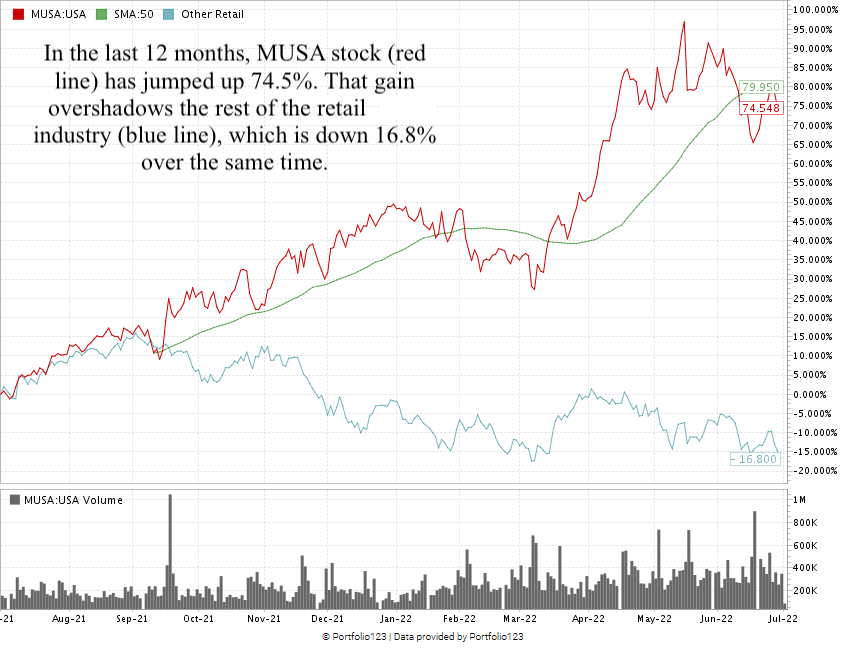

From June 2021 to May 2022, MUSA stock climbed as high as 96%.

Some of those gains pared back during the market sell-off, but MUSA is still up 74.5% over the last 12 months.

It’s now just 12.8% away from that 52-week high. It’s killing its other retail industry peers, which are down 16.8% over the same time.

Murphy USA Inc. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Convenience stores are a terrific way to find a quick snack on the road, fill up with gas or snag that gallon of milk on the way home.

With locations covering two-thirds of the U.S., Murphy is in the perfect position for even more growth, making it a strong candidate for your portfolio.

Bonus: Murphy’s forward dividend yield of 0.5% means it pays shareholders $1.24 per share, per year.

Stay Tuned: Medical Diagnostics Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a solid bioscience stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is separate from the five stocks I write about every week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.