Russia’s invasion of Ukraine changed the global oil and natural gas market.

Sanctions against Russia shut off the tap to one of the world’s largest producers.

Countries have to pivot to other leaders in the market to meet the ever-rising demand for crude oil:

This chart shows the global demand for crude from 2020 to 2026.

In that period, demand will increase 14.4%.

To meet demand, countries are looking outside Russia to other large producers of oil.

Today’s Power Stock is the largest oil and natural gas producer in the world: PetroBras SA (NYSE: PBR).

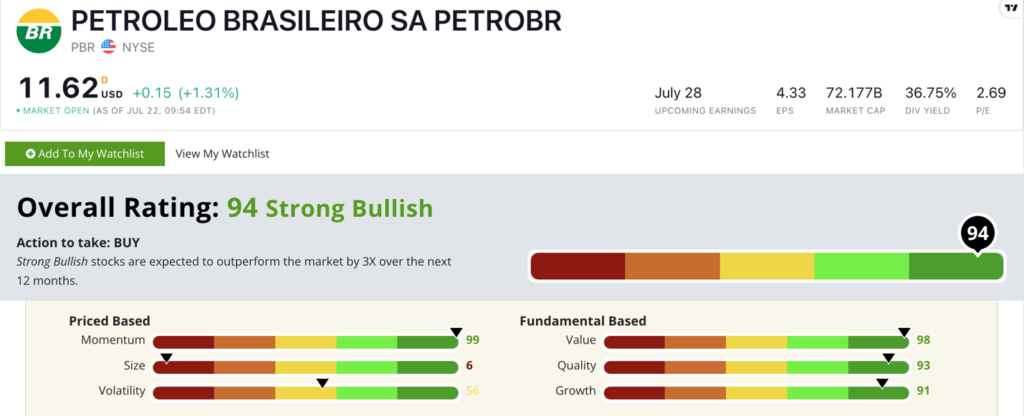

PBR Stock Power Ratings in July 2022.

PetroBras produces 90% of the oil and gas in Brazil. Last year, according to a BP study, Brazil produced 2.99 million barrels of oil per day.

As of June, PetroBras's revenue puts it in the world’s top 15 oil and gas companies.

PBR stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

PBR Stock: Strong Fundamentals + Momentum

PetroBras had an outstanding first quarter of 2022.

Here’s what stood out to me:

- Quarterly revenue came in at $27.1 billion — an increase of 72.6% over the same quarter a year ago … its best quarter since 2018!

- This was its seventh consecutive quarter of sales growth.

PBR stands out as a high-value stock, rating a 98 on the metric.

PetroBras stock trades with a price-to-earnings ratio of 2.7 … more than four times lower than the industry average! This tells us the stock is inexpensive at today’s prices.

At the same time, PBR is a strong quality stock. Its impressive net margin of 29.6% is almost three times higher than the integrated oil and gas industry average!

As you can see in the stock chart above, PBR stock hit a 52-week low in November 2021.

It went on a tear after that, soaring 106.3% to a 52-week high in June 2022.

The broader market sell-off pared its gains, but PBR is still up 66.6% from where it was a year ago.

Takeaway

PetroBras stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

PetroBras has the oil and gas market cornered in Brazil.

As other nations look for new suppliers for fuel, they’ll look to PBR to fill the global shortage. That’s why Petrobras SA is a strong contender for your portfolio.

Bonus: The company’s massive 38.7% forward dividend yield means shareholders earn $4.44 per share, per year in dividends!

My team and I know that demand for oil and gas is rising, but we have high conviction in the decades-long mega trend of alternative energy sources. Click here to find out about the technology Chief Investment Strategist Adam O’Dell calls “Infinite Energy.”

Stay Tuned: Top Global Telecom Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on Europe’s largest telecommunications company.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.