Dividends are my shtick. I love dividend investing. I love it almost to a fault. I’ve missed out on profitable opportunities over the years because I stubbornly refused to buy stocks that didn’t come with a good yield.

But I hate utility stocks as dividend plays.

That sounds strange given utilities’ reputation as income stocks appropriate for the proverbial widows and orphans. But utilities don’t yield enough to warrant buying today. There are other sectors, such as REITs, that offer higher yields and more consistent dividend growth. (As an example, I recommended “Amazon.com’s landlord” a few weeks ago.)

Let’s illustrate this with an example. Duke Energy Corp. (NYSE: DUK) is one of the largest regulated utility companies in the United States. It serves nearly 8 million customers and its service area covers a whopping 91,000 square miles. It has a diverse portfolio of electric generation assets including natural gas, coal, nuclear and renewables like hydroelectric, wind and solar.

At first glance, that sounds promising. But I wouldn’t touch this stock with a 10-foot pole.

To start, your future growth is going to be extremely limited. The U.S. was electrified over a century ago. There is no untapped market. Your only growth comes from new construction or by poaching customers from another provider. That’s difficult given that electric companies have monopoly power in most markets.

But wait a minute … monopoly power is good, right? They can charge whatever they want!

Not exactly. This is a highly regulated industry, and it’s bad optics to raise prices too aggressively lest the proverbial widows and orphans buying the stock also freeze to death in their homes. Green initiatives are also a wild card. Clean energy regulations are evolving. And you have the ongoing trend of homeowners opting to leave the grid and generate their own power via solar panels. That’s not going away.

OK, fine. Even with all of these negatives, the stock could be a buy at the right price, right? After all, tobacco use has been declining for years, yet tobacco stocks have performed well over the decades.

Well, in the abstract, I’d agree. But Duke yields only 3.9% and has raised its dividend only 2.9% annually over the past 10 years. That isn’t a deep value play.

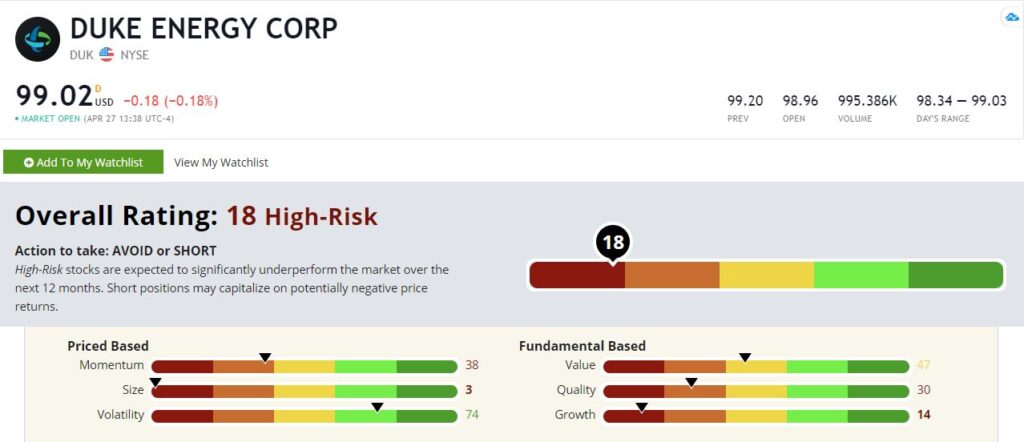

I accept that I’m biased against this stock. But the numbers back me up. Duke rates a pitiful 18 out of 100 on our Green Zone Ratings system.

Duke Energy Corp.’s Green Zone Rating on April 27, 2021.

And the numbers don’t look better as you drill down.

Duke Energy’s Green Zone Rating

Volatility — Duke rates highest on volatility with a rating of 74, meaning it’s less volatile than all but 26% of the stocks in our universe. Big deal. It’s a utility. You expect it to be non-volatile. I want to see an even higher rating for a stodgy utility stock.

Value — After volatility, Duke doesn’t have a single metric that rates in even the top half. It rates a 47 on value. Its price-to-earnings ratio is sitting at just over 57. That’s more than twice the expected P/E for the utilities sector in 2021, according to Fidelity.

Momentum — Duke rates a 38 based on momentum. That rating can fluctuate over time, and during times of market stress, utilities tend to outperform. But if you’re looking for portfolio insurance, you’d be better off in bonds or consumer staples.

Quality — Our quality score favors asset-lite business with high profitability and low debt. That is the literal opposite of a utility company. Duke rates a 30 on quality.

Growth — No surprise here. Duke rates low on growth with a score of 14. As I mentioned before, the U.S. was electrified a century ago. Don’t expect growth to step up any time soon.

Size — We’re also not getting much of a small-cap bounce here. Duke rates a 3 on our size metric thanks to its almost $80 billion market cap.

Bottom line: If I sound like I’m being harsh here, it’s because I want to save you costly mistakes. There are plenty of income opportunities in today’s stock market. But you’re a lot more likely to find them in REITs, business development companies, consumer staples or even in more non-traditional places like commodity producers. Utilities don’t yield enough or offer enough growth potential to make them worth owning as dividend plays.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.