Orders for durable goods are among the most important economic indicators.

Unlike most economic data, orders for durable goods look ahead. They tell us what factories will work on next month. Data like the unemployment rate looks backward. It tells us what happened last month.

Durable goods are things like refrigerators, machines on factory assembly lines or anything expected to last at least three years.

This is one of the few economic series that measures both consumer and industrial activity.

By making large purchases, individuals show optimism. When consumers are confident that they’ll have the income to make monthly payments, they buy durable goods. No confidence means no purchases.

That also applies to business confidence. When business prospects are good, businesses invest. If the outlook is negative, businesses order fewer durable goods.

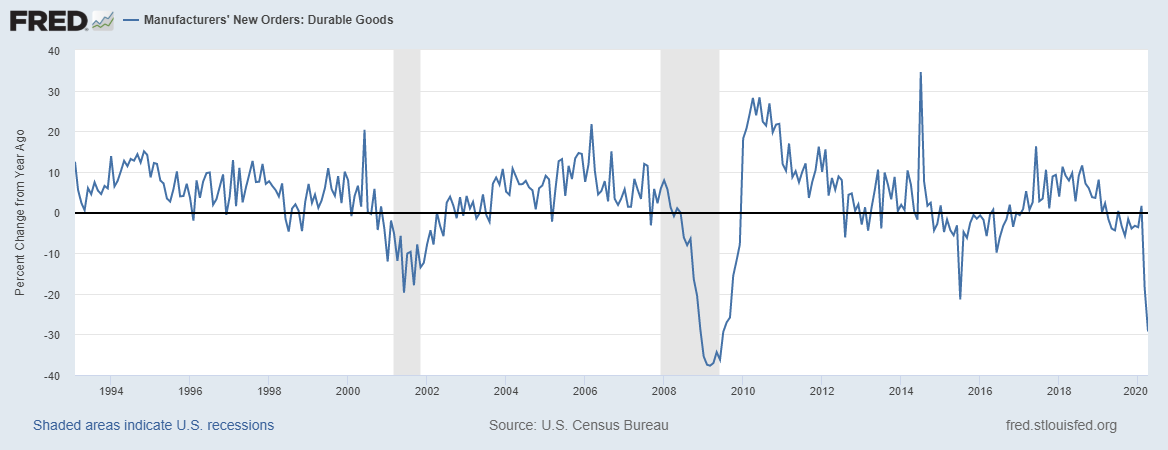

Durable Goods Orders Crater in April

The latest data showed orders for durable goods fell 17.2% in April. Steep drops are generally seen in recessions.

Source: Federal Reserve

The cause of the slowdown in orders is obvious. Census Bureau officials noted “due to recent events surrounding COVID-19, many businesses are operating on a limited capacity or have ceased operations completely.”

While COVID-19 explains the decline, that doesn’t change the facts. With fewer orders, there will be a downturn in manufacturing when the economy reopens.

This report has implications for the stock market.

Their forward-looking nature makes durable goods orders a logical stock market indicator.

Stock prices are also forward looking. In accounting terms, current prices are the net present value of future cash flows. In simple terms, companies grow into their stock price. Rapid earnings growth deserves a high stock price since the company will be worth more soon.

Durable goods do a surprisingly good job predicting stock market returns. The rules are simple:

- Buy stocks when new orders are higher than they were a year ago.

- Sell when new are orders are lower than they were a year ago.

These rules deliver almost twice as much as a buy-and-hold strategy. Sell signals avoided almost every 20% decline in stocks since durable goods data became available in 1994.

No market timing strategy is perfect. But the annualized change in durable goods orders worked well in the past. Since it’s grounded in economic logic, it’s likely to continue providing useful signals in the future.

For now, it adds to the list of long-term sell signals in the stock market.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.