Data is starting to show the magnitude of the current economic collapse. Economists haven’t seen anything like this. And their models are ill-equipped to deal with the sudden shutdown.

“For investors, this means another down leg in stocks is likely. There could be two or more additional down legs in this bear market.”

Sudden changes in the economy have historically been associated with wars.

The United States has been at war continuously for more than 18 years. Yet many Americans may not realize that. The War on Terror doesn’t affect the lives of most people.

In the past, wars usually required entire societies to mobilize. Young men went to battle. Everyone at home produced goods for the war effort.

After the war, soldiers returned as the economy demobilized. This explains why peace historically led to recession.

Economic Collapse

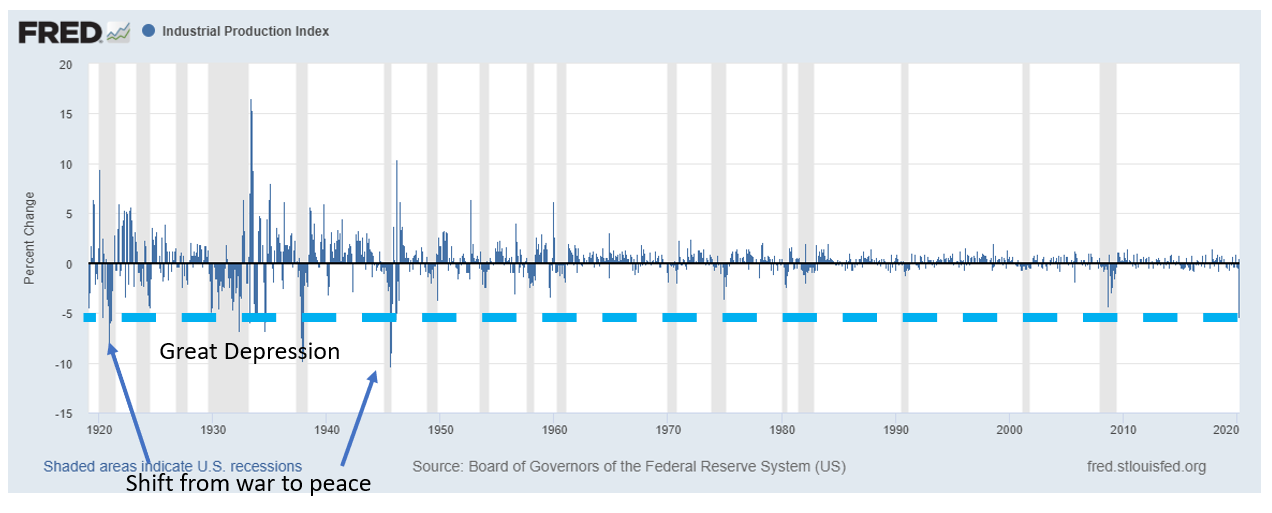

Except for The Great Depression, the steepest slowdowns in the economy came after wars. This is shown in the chart below.

It shows the monthly change in the Industrial Production Index. The current level is marked by a dashed line. We’ve only seen changes like this after the World Wars and during The Great Depression.

Industrial production is putting the current slowdown in perspective. This index dropped 5.4% in March. That the biggest decline since the 10.4% drop in August 1945 when weapons plants closed after World War II.

This is the type of change seen only once in a generation. It’s also the type of change that requires time to recover from.

Economists are starting to note that after the lockdowns end, it will take time for the country to get back to work.

March’s decline in industrial production indicates factories are closed. Turning machinery back on and resuming production will take weeks if not months.

That is obvious to any of the more than 15 million people who lost their jobs in the past four weeks. It’s finally becoming obvious to policy makers. They now realize there is more pain ahead for the economy.

For investors, this means another down leg in stocks is likely. There could be two or more additional down legs in this bear market. Stock prices will rebound with the economy, and both will need time to recover from the sudden reversals.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru