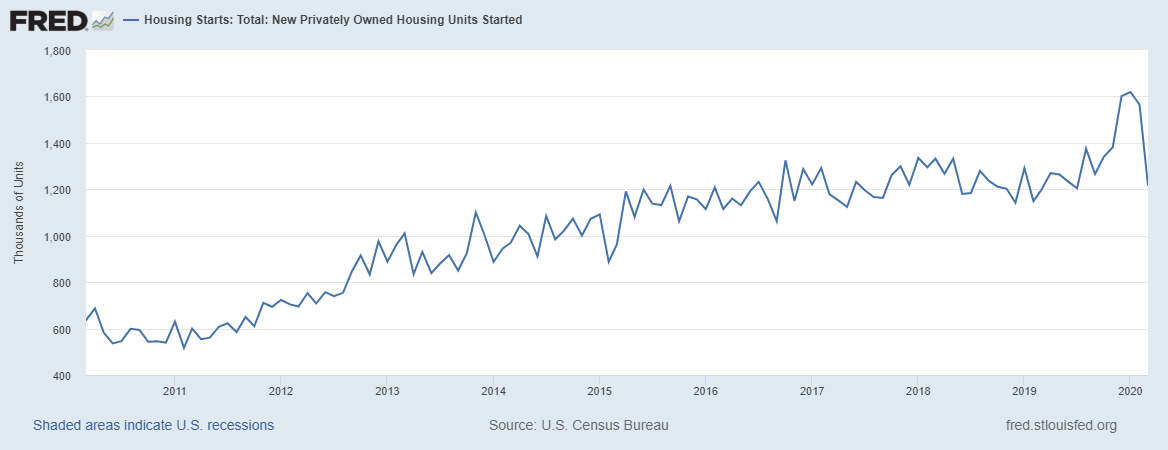

The decade-long growth trend in home construction is broken.

What Happened: In March, many builders kept working. The annualized pace of construction was enough to build 1,216,000 annualized units. This is down 22.3% from February. But we should expect bigger declines in the coming months.

Source: Federal Reserve

Statewide and local stay-at-home orders were mostly issued in March. So, homebuilders were working a normal schedule at the beginning of the month and then scaling back operations. The worst is yet to come for this economic indicator.

That’s confirmed by a 6.8% decline in the number of new permits. In March, 1,353,000 permits for new construction were issued. Again, processing was restricted late in the month. That shows the month was off to a good start and housing would have driven economic growth into the summer.

Now, the sector is weak and will get weaker in the coming months. As shutdowns continue, it will become more difficult for homebuilders to start back up since permits expire, inspection schedules are delayed, and deliveries need to be rescheduled.

Housing Starts and the Job Market

Why it’s important: Home construction creates a large number of jobs. About 778,000 jobs are directly related to building. Each project creates a number of ancillary jobs in a community, for example, related to selling furniture and providing other services new homeowners need. Weak construction markets often indicate a local economy is contracting.

On a national level, the Federal Reserve counts on home buyers to stimulate economic growth. That’s one of the primary ways lower interest rates stimulate economic growth. This report indicates homebuilders will not be providing an inventory of new homes for buyers to choose from. Going forward, the Fed’s policies may not be as effective as they would be in normal recessions.

What this report means: Data continues to point to a steep and enduring economic decline. Builders will need months to get back to levels of activity they were at early this year. In the best case, they would be resuming full operations when the weather changes and brings construction to a halt in many areas.

Housing starts are another indicator that the Federal Reserve and political leaders need to deliver new ideas to restart the economy they shut down.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru