The S&P 500 rallied almost 30% in the past four weeks. It recovered more than half its losses. Stocks turned suddenly after economists said we’ll enjoy a rapid recovery. Those forecasts seem overly optimistic and this stock market rally is built on sand.

Economists expect just one very bad quarter for the economy. Many assume a small contraction in economic activity in the first quarter. They see a catastrophic collapse of 30% or more in the second quarter. Then, they forecast a rapid rebound by the end of the year.

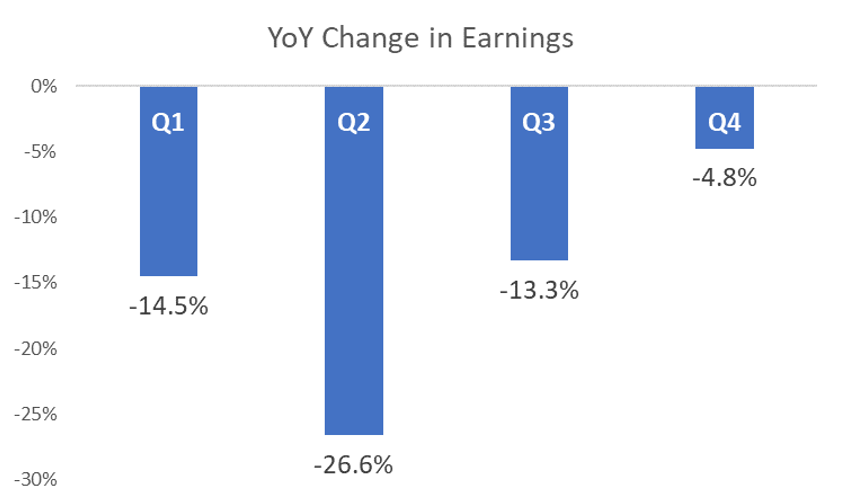

Stock market analysts see a similar trend in earnings. Analysts expect earnings per share (EPS) for companies in the S&P 500 to fall almost 15% in the first quarter. They see a plunge of more than 26% this quarter. They project smaller declines in the second half of the year and a return to growth and another stock market rally in 2021.

Source: Standard & Poor’s

This outcome is only possible if consumer behavior returns to normal within weeks. That’s unlikely.

Unemployment Can Kill the Stock Market Rally

One problem is more people will be unemployed.

Data in a poll from MetLife and the U.S. Chamber of Commerce shows one in four small businesses (24%) say they are two months or less from permanently closing. Using these results, experts forecast 28% of pre-shutdown jobs could be lost.

JPMorgan reports the most vulnerable businesses are restaurants and small personal services business like dry cleaners and hair salons. Failures in these sectors will ripple through many mid-sized businesses that supply them. That will lead to more unemployment and lower EPS.

In addition to unemployment, another concern is consumer behavior. Basically, there are questions about how consumers will respond after businesses reopen.

Will they go inside restaurants and bars? What about crowded bars and restaurants? Will they shop? Will they save because they fear a second shutdown? Will fans attend sporting events and concerts?

It is likely consumer behavior will be different this summer compared to a year ago. The nature of those changes will define the trajectory of the economy’s recovery.

In a few months, we will see analysts are too optimistic. The economy won’t recover suddenly. Stock prices will fall to reflect the reality of an extended recession, and the stock market rally will fizzle.

Now is an ideal time for investors to raise cash instead of increasing exposure to risk.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru