On the first trading day of every month, the Institute for Supply Management releases its survey of supply managers in the manufacturing sector.

It gives us insight into the rest of the economic data for the month.

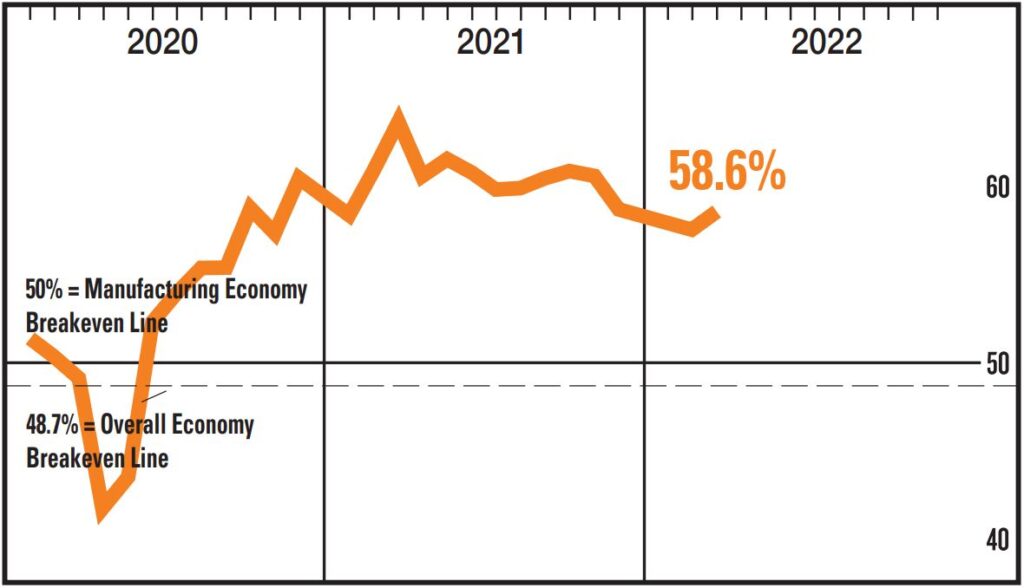

The chart below shows the good news from the nation’s factories:

Economic Recovery: Above 48.7% = Growth

Source: Institute of Supply Management.

In February, the index of U.S. manufacturing activity rose to 58.6% in February from 57.6% a month earlier.

Readings above 48.7% are consistent with economic growth. This is positive for the economy since it indicates a recovery from January’s omicron shutdowns.

The survey includes other data analysts look at to understand employment, inflation and additional economic factors.

One of the most important components of the report is the new orders index. In February, the index reached 61.7%.

Supply Backlog = Bad News

One supply manager in the electrical equipment, appliances and components sector noted: “Strong backlog of orders coming into the new year. Potential to beat target revenue, depending on availability of purchased product.”

The availability of raw materials is a significant problem.

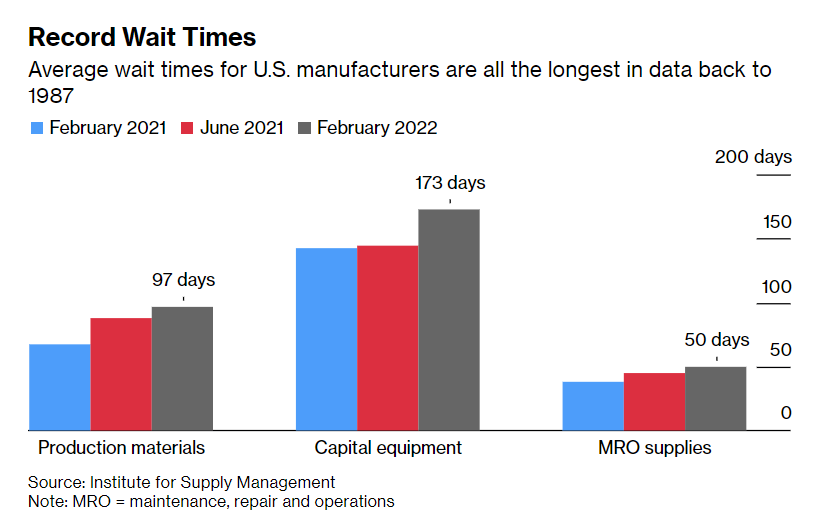

According to Bloomberg, the data showed the average lead times for production materials, capital equipment and supplies all reached the highest records back to 1987:

What took 67 days a year ago, the average wait time for materials used in the manufacturing process is now a whopping 97 days. Wait times for capital equipment are also a month longer than they were in February 2021.

You can see this in the chart below:

Source: Bloomberg.

This is the bad news: Growing wait times indicate the supply chain woes that economists and policymakers blame for inflation are far from over.

The report showed that both demand and supply are pushing inflation higher.

Demand is growing according to the number of new orders. Supply is shrinking given the longer wait times.

Takeaway: This is the simplest way to understand that inflation will continue to be a problem for months.

Click here to join True Options Masters.