The ongoing economic recovery is on everyone’s mind.

While the stock market has surged into a “V-shaped” recovery, the same can’t be said for the U.S. economy.

Some project a “W-shaped” recovery for the economy as a second wave of coronavirus infections washes over the U.S.

Meanwhile, others are far more pessimistic.

San Francisco Federal Reserve Bank President Mary Daly falls into the latter category.

Unemployment hit 13.3% in May, but those numbers were fudged. And Daly doesn’t see unemployment sinking below 10% in 2020.

What’s worse? She thinks it’ll take at least four to five years for unemployment to get back around 3.5%, where it was before the pandemic.

“If we can get the public health issues under control, either through a really robust mitigation strategy or a vaccine, then we can reengage in economic activity really quickly,” Daly told Washington Post Live. “Then it could take just four years or five years.”

Four or five years… that’s her best-case scenario…

“If we end up with a pervasive, long-lasting hit to the economy, then it could take longer,” Daly added.

Keep in mind, monthly unemployment never exceeded 10% during the Great Recession. And we could be looking at six-plus months above that level.

A lot of this depends on how the coronavirus plays out. But things aren’t looking great right now.

Infections are spiking across the country. Some states are reporting their highest numbers yet.

“In the next couple of months,” Daly said, “we are going to really get a lot more information about what the virus has in store for our economy.”

But is she too bearish about the economic recovery?

Nonfarm payrolls for June blew expectations out of the water. The Labor Department reported 4.8 million jobs added. That brings the unemployment rate back down to 11.1%.

“The 4.8 million rise in nonfarm payrolls in June provides further confirmation that the initial economic rebound has been far faster than we and most others anticipated,” Capital Economics senior U.S. economist Michael Pearce said on CNBC.

The keyword there is “initial.” And Pearce made note that unemployment is still well off where it was just five months ago.

“That still leaves employment 9.6% below its February level,” he added. “With the spread of the virus accelerating again, we expect the recovery from here will be a lot bumpier — and job gains far slower — on average.”

How Does High Unemployment Affect an Economic Recovery?

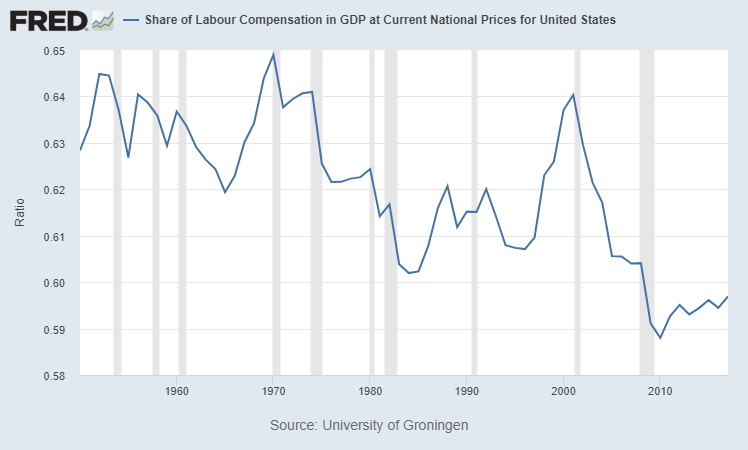

Banyan Hill Publishing Chartered Market Technician Michael Carr said labor currently accounts for around 57% of GDP. The labor share has been in decline for decades.

Labor share is the percentage of GDP that goes to workers in the form of compensation.

A larger supply of unemployed people looking for jobs isn’t going to help wage growth that is already low.

“Rational employers may try to lower hourly wages,” said Carr, Editor of One Trade. “So as unemployment rises, the value of labor as a component of GDP will fall.”

That creates a trickle-down effect.

“It reduces demand for consumer goods and services, and makes economic recovery even more difficult,” Carr said.

The government can step in, as it has through the CARES Act. But it has to act quickly.

“High unemployment creates lower demand, and GDP contracts more and more unless government creates demand,” Carr said. “The private sector cannot create a recovery from high unemployment. Demand is low for products the sector creates. That’s where we are now. The reopening will not create enough good jobs in a timely manner.”

The federal government is working to create some of that demand. The House of Representatives passed a $1.5 trillion infrastructure plan Wednesday. It would create jobs fixing roads and bridges across the U.S.

Infrastructure typically receives bipartisan support. But the bill could face a death sentence in the Republican-controlled Senate because of certain initiatives attached by the House. The Trump administration has already promised to veto the bill in its current form.

And expanded unemployment benefits are set to end July 31. It’s something to keep an eye on because many on unemployment are making more than they would working their actual jobs.

There is still plenty of uncertainty facing the economic recovery. If unemployment continues to stay at elevated levels, it could be a major problem for the economy down the road.