Wall Street’s record bull market rages on, but one economist thinks there is a major disconnect between the stock market and the U.S. economy that is not killing off his fears of another recession.

“A couple of months before the Great Recession, markets hit an all-time high.”

Lakshman Achuthan, co-founder of the Economic Cycle Research Institute, is worried that investors are making an incorrect correlation between the recent surge in stocks and an economic revival, citing certain economic data that’s in decline.

“The actual data itself is just decelerating pretty hard actually. I don’t think we can remove recession risk from the table,” Achuthan said in a Monday interview on CNBC’s “Trading Nation.”

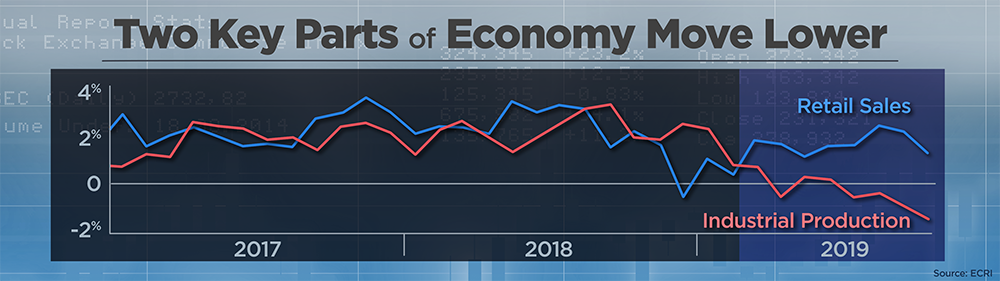

His fears are stemmed from two key sectors of the economy: industrial production and retail sales.

“On the manufacturing side, you have IP (industrial production) at a 3 1/2-year low. It’s deeply negative,” Achuthan said. “On the retail sales front, you’re having deceleration.”

Achuthan has been a self-proclaimed “super bull” in the past, but he noticed a slowdown starting in 2018. He does think consumer spending will bolster retail sales during the holiday season, but the trend will still point down.

“All the hopes are the consumer is somehow going to rev up, and that’s coinciding with the holiday season here,” he said. “But when we look at all of our leading indexes that anticipate turning points in the U.S. economy, it’s not there yet. So we have more slowdown to go.”

One of those turning points could be the U.S. gross domestic product, which the Atlanta Fed’s GDPNow and the New York Fed’s GDP Nowcasting Report are both currently projecting a paltry 0.4% growth in the fourth quarter.

The actual numbers won’t be released until 2020, but the GDP for the third quarter of 2019 will come out Nov. 27, which we’ll have here on Money and Markets.

And Achuthan warns not to be fooled by the current bull market, even as it continues to hit new record highs across the major indexes seemingly every day.

“A couple of months before the Great Recession, markets hit an all-time high,” Achuthan said. “In 1990, right when that recession was starting, markets hit an all-time high. In ’01, they actually hit a high after the recession started. So, the market could be a little off on recession timing.”

He also argues that the warning signs of an impending recession are already happening abroad.

“You could look outside of the U.S. where we do have some real signs of cycle bottoming,” he said. “I would particularly look at the eurozone and maybe a couple of places in Asia.”

To our friends: A former hedge fund manager exposes how Wall Street is failing American investors and shows how to prepare for the end of the bull market.