A few months ago, economists said inflation was transitory. Higher prices were due to the reopening of the economy.

Now, economists say inflation is due to supply chain bottlenecks. This too shall pass, they say, so inflation is still transitory.

Economists who make forecasts about the economy should have seen this coming.

If the economy reopened so fast that prices were rising, that meant demand grew faster than supply. If demand exceeds supply by enough to cause prices to rise, it’s likely that the supply chain won’t be able to keep up.

Based on what economists said they saw, the inflation we see now is the logical outcome. The problem is there is simply no solution in sight.

To relieve supply chain concerns, production should increase. But, given the chip shortage and limited supplies of other commodities, production can’t increase.

The other way to reduce inflation is for demand to fall. With consumer savings near all-time highs and pent-up demand created by the shutdown, there’s no reason to expect demand to fall.

This means inflation should continue. But the same economists who failed to see the current round of inflation say inflation will fall soon.

Economists’ Inflation Expectations Don’t Match Trends

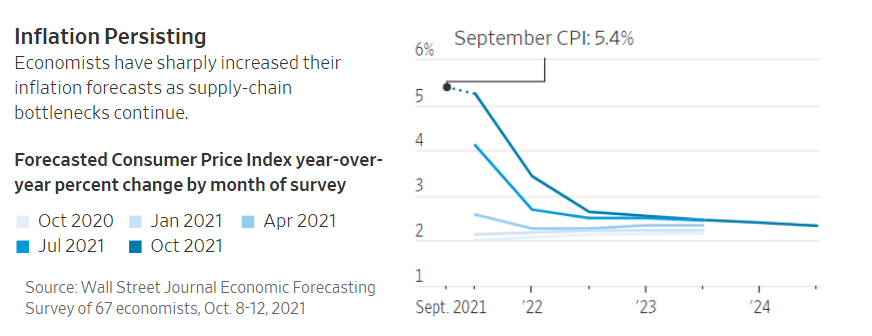

Economists surveyed this month by The Wall Street Journal said they expect inflation to fall to 2.6% by the end of next year.

The chart below shows that inflation expectations are up dramatically from July.

Source: The Wall Street Journal.

Now, economists forecast inflation of 5.25% in December. That would mark the longest stretch of inflation above 5% since 1991.

But economists expect it to drop quickly from there, falling to 3.4% in June 2022 and 2.6% in December.

That ignores the reality that consumer behavior will shift. Social Security benefits will be 5.9% higher in 2022. Government workers should see similar wage hikes, as will many union workers. Others should also see higher wages.

If inflation stays at 5%, there is an increased risk that higher wages will set off more inflation and the economists will be wrong again.

P.S. Live on November 4, my colleague Adam O’Dell will reveal how millions of new investors have accidentally opened a perfect trading window, and the system he designed to exploit this anomaly for massive gains. To sign up for the live event, go here.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.