The average mortgage rate for a new home was 3% in 2020, according to the National Association of Realtors.

Thanks to inflation and the Federal Reserve’s interest rate hikes, that average has doubled to 6% today, the highest we’ve seen since 2008!

Higher interest rates cost millions of Americans the opportunity to buy a new home.

This trend has hit one company hard.

But with our Stock Power Ratings system, you would have known that Opendoor Technologies Inc. (Nasdaq: OPEN) was one to steer clear of even before it announced it sold 42% of its properties at a loss in August.

A quick look at our Stock Power Ratings system helps you see the real picture of a company.

Opendoor started in 2013 as an online platform for buying, selling and trading residential properties.

Homeowners can post their homes, record video walk-throughs and get offers on their homes.

Prospective buyers can use the app to search, make offers and buy their new homes.

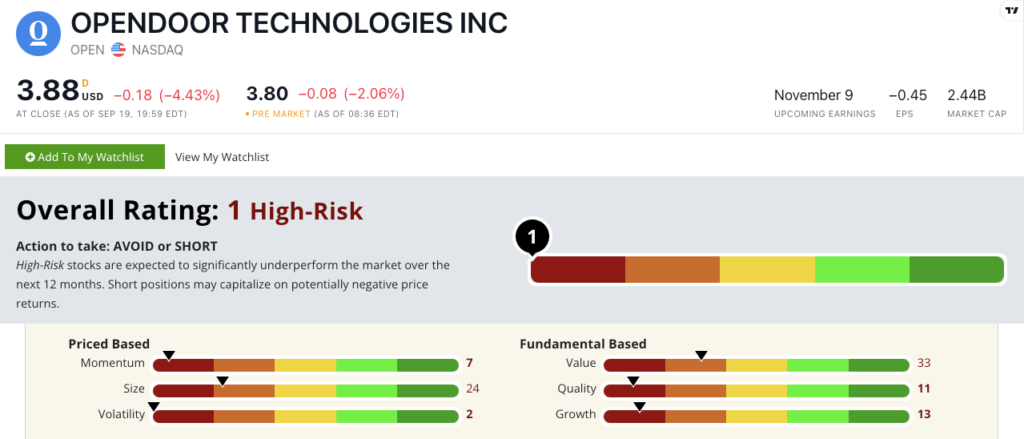

OPEN’s Stock Power Ratings in September 2022.

OPEN stock scores a “High-Risk” 1 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

OPEN Stock: Significant Downside + Low Quality

I like to tell you about impressive company milestones.

Not so much for OPEN:

- In its most recent quarter, the company reported a net loss of $54 million!

- Its total gross margin for the quarter was negative 4.4%.

That’s why OPEN scores a 13 on growth.

It also scores in the red on our other five metrics.

OPEN has a negative price-to-earnings ratio, meaning it’s not making money. It scores a 33 on value.

The company has an awful return on equity of negative 11.5% and a return on assets of negative 3.7%, which translates to an 11 on quality.

Folks are paying too much for the stock, and it has a ways to go before turning a profit.

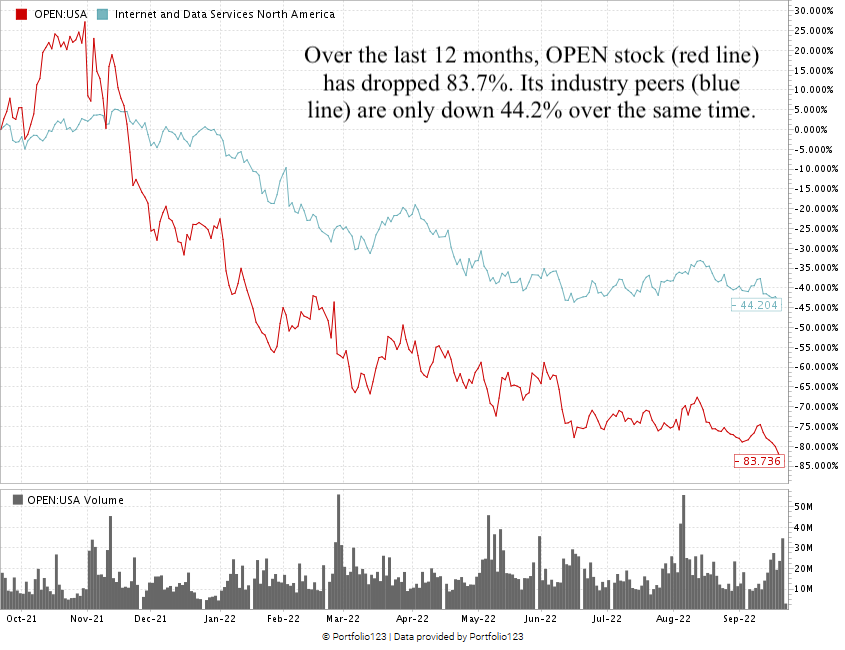

Created in September 2022.

From its 52-week high in November 2021 to its low set this week, the stock has dropped 83.7%.

Opendoor stock scores an atrocious 1 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Bottom line: The housing market has cooled due to higher interest rates, with more Americans priced out of buying a new home.

And that makes OPEN a stock to avoid.

Stay Tuned: Canadian Oil Co. Outperforms Surging Energy Market

On Monday, we return to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on another oil and gas company, this time with “maximum momentum.”

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear your thoughts about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing occasional “High-Risk” stocks so you know what to stay away from?

Would you prefer we only share “Bullish” and “Strong Bullish” stocks?