Last week, I wrote you about how the long-delayed resumption of student loan payments will weigh on the economy.

In September, an estimated $20 billion of wealth could be diverted out of nonessential spending and directly into loan servicing.

That’s bad news for the consumer discretionary stocks that provide us all the wonderful things we don’t need…

But there’s another side to that trade. Stocks that provide essential goods — the stuff we will always need to survive — shouldn’t be affected by this much at all. If anything, consumers will prioritize those purchases as they cut back on the excess to meet their renewed loan obligations.

Companies in these sectors — energy, utilities and staples — are generally in better financial shape than many consumer discretionary stocks. A constant stream of revenue in good times and bad will help with that!

That makes stocks like these an essential element of any balanced portfolio. That’s why today we’re looking at the top consumer stocks across three essential spending sectors.

I’ll share their Green Zone Power Ratings, and let you know if I think they’re a good buy today…

Consumer Stock #1: Don’t Forget the Oil Super Bull

The computer or smartphone you’re reading this on … the air conditioner blowing at your back … the refrigerator storing today’s lunch…

All these things are essential. And all, in one way or another, require energy which fossil fuels such as oil, coal and natural gas are the chief source of.

A lot has been promised about a fast transition to a renewable energy economy, especially by the current presidential administration. That’s a noble goal … but it’s not the kind of thing that happens in a few years, either!

We’re in for a long road of fossil fuel usage. I’m talking decades longer than many expect.

(I’ve been calling this the Oil Super Bull, and there’s a group of stocks I believe will drive both sides of the energy mega trend. One is up more than 57% since I recommended it in December 2022 … and you can get the details here.)

And the top-quality companies in the space will keep churning out profits as fuel costs inch higher. Good times or bad, you won’t stop paying your energy bill.

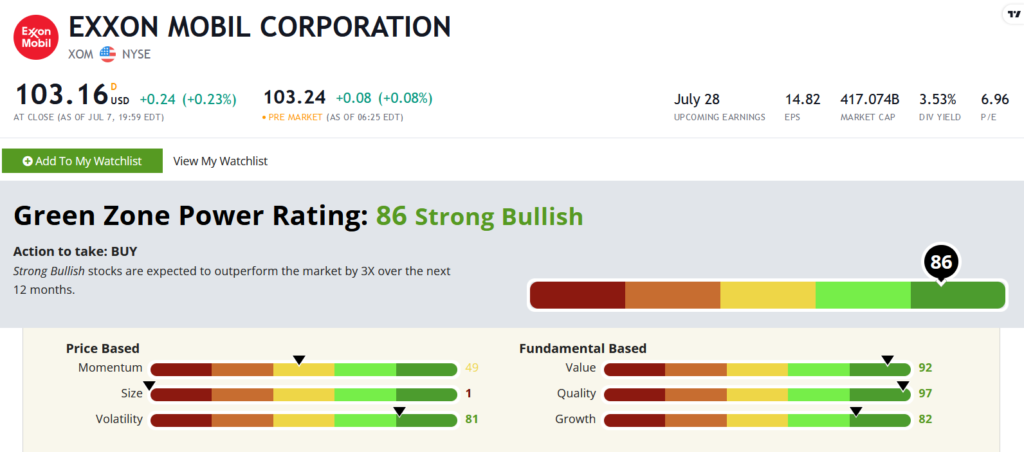

For a rare example of a massive stock you can buy and still expect market-beating gains, let’s look at Exxon Mobil Corp. (NYSE: XOM), the top holding of the SPDR Energy Sector ETF (NYSE: XLE):

Not many large-cap stocks are in the “Strong Bullish” category of my six-factor Green Zone Power Ratings system, where XOM sits comfy with an 86 out of 100.

When you see a $417 billion name with that kind of rating, you can be confident that everything going on under the hood checks out.

XOM rates a 97 on Quality, a 92 on Value and an 82 on Growth — all the fundamental metrics you want to see glowing.

On the technical side, XOM boasts a solid Volatility score of 81. It’s held back by its massive Size, of course, and its Momentum is middle-of-the-road mainly due to the stalled price action of the energy sector this year.

Regardless, XOM is about the biggest no-brainer buy in the energy market. It’s poised to beat the market by 3X over the next 12 months according to our system, and it’s paying you a 3.53% dividend in the meantime. If you don’t already own this stock, consider using this year’s pause in its rapid price growth to add it to your portfolio.

Consumer Stock #2: The Perfect Staple

Going down the list of top holdings in the SPDR Consumer Staples ETF (NYSE: XLP), we have to go through a few consumer stocks before we hit one that rates “Bullish.”

Procter and Gamble Co. (NYSE: PG), the largest holding at more than 14% of total fund assets, rates a “Neutral” 56, and PepsiCo Inc. (Nasdaq: PEP) a 55, with “Value” being a key factor holding each of those stocks back.

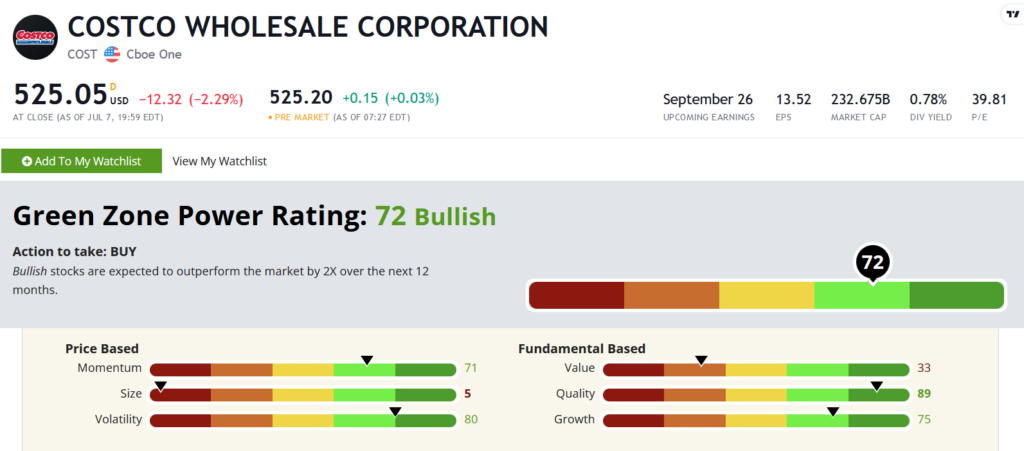

But getting down to the third-largest holding in XLP, we find Costco Wholesale Corp. (Nasdaq: COST)…

Costco stock rates a very respectable 72, with high marks everywhere except on its Size and Value rating.

Its Value rating isn’t terrible, at a 33 — well above the single-digit scores of PG and PEP. And its Quality rating of 89 helps the composite stay in the green.

Costco is, coincidentally, a model consumer staples stock. Its low-maintenance warehouses offer the generic bulk items that a strapped spender needs, all with a relatively low barrier of entry at $60 for an annual membership.

My Green Zone Power Ratings system shows Costco beating the market by 2X or more over the next 12 months, making it a strong play amid a drawdown in discretionary spending.

Consumer Stock #3: A Market-Crushing Utility Co. Is Hard to Find

Similarly to consumer staples, the top holdings in the utilities sector aren’t great buys, according to the Green Zone Power Ratings system.

The top holding, NextEra Energy, rates a “Bearish” 26 (for more on NEE check our recent piece). And the next one down, The Southern Company, just barely scores “Neutral” with a 41.

Duke Energy … a 20. Sempra Energy … a 55.

Where are all the market-beating utilities stocks?!

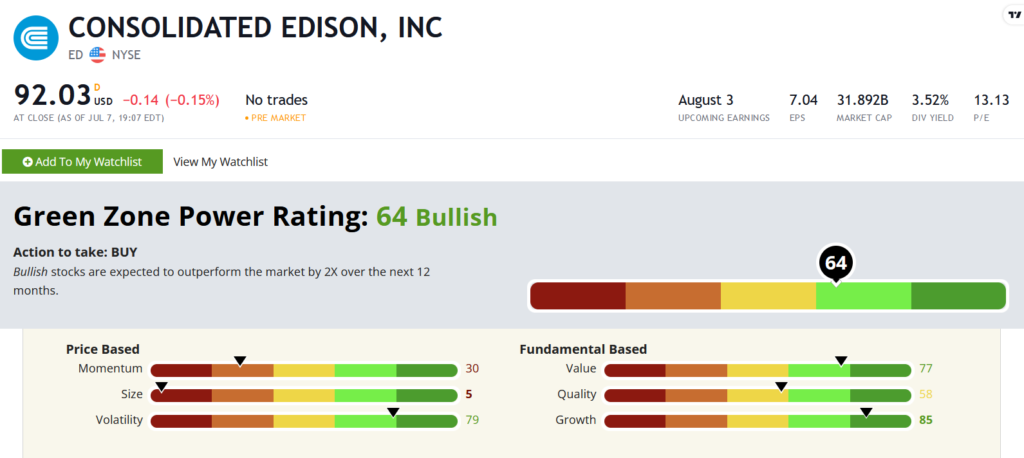

Turns out, we have to go all the way down the list to Consolidated Edison Inc. (NYSE: ED) to get our first Bullish rating…

Consolidated Edison rates a Bullish 64 on the Green Zone Power Ratings system, with the Momentum and Size factors primarily holding it back.

Momentum is an issue for all the top stocks in the Utilities Select Sector SPDR Fund (NYSE: XLU). With this year’s gains being so concentrated in major tech stocks, many other sectors are struggling to catch a bid.

While I can’t say for sure whether that will change in the coming months, I can say that Consolidated Edison is a standout for the sector in terms of quality. And just like Exxon Mobil, it offers investors a 3.5% dividend alongside its solid rating.

But there’s additional value in this exercise. It shows us just how poorly some of the biggest, most widely held sector stocks rate on Green Zone Power Ratings.

An investor who’s intending to diversify responsibly might think that trading sector exchange-traded funds (ETF) like these is a good idea. And, it might be … sometimes.

But it helps to look under the hood and see what landmines potentially await. If you’re buying an ETF like XLU, where more than 52% (!) of the companies can’t crack above a Neutral rating … you’re just begging to trail the market.

Here’s another idea you’ve probably heard me talk about, but maybe haven’t considered: foreign stocks.

Once you look outside the universe of U.S. stock investing, you have no shortage of cheaply valued and growing companies in sectors with macro-level tailwinds at their back.

For example, I recently recommended a South American electric utility company to my Green Zone Fortunes subscribers. It rates a “Strong Bullish” 94 on the Green Zone Power Ratings system, with an especially attractive Value and Momentum rating. The stock trades at just 3X earnings … and is on the move, rising more than 3X from a year ago.

I don’t normally do this … but I’ll share its name with you here. It’s called Enel Chile S.A., ticker ENIC.

I’m comfortable doing this because ENIC is just one of 11 stocks that I recommended to my subscribers in a special report last month (a bonus to our latest monthly recommendation) as part of a new project in finding the highest-rated stock in each market sector. You can go here to learn how you can access the full list.

To good profits,

Editor, Stock Power Daily