I’ve traded through a few bear markets in my career … they never get easier.

Being systematic and following my rules let me keep my emotions in check and stick to the plan.

They also give me the time and energy to consider dominant mega trends that will create the conditions for the next bull market.

What trends?

Inflation: The Not-So-Mega Trend

I’ll start with inflation.

I wouldn’t consider this a mega trend, as I side with the Fed’s notion that inflation is transitory. But I also know that transitory doesn’t mean “ending tomorrow.”

Supply chain issues and chip shortages should run into 2023. (We’re playing the supply chain trend in Green Zone Fortunes, by the way.)

And after the Fed’s extraordinary monetary policy for the COVID era pumped trillions of dollars into the economy, I don’t expect a handful of 0.5% rate hikes to return things to normal.

So expect inflation to linger for a while… And that’s favorable for commodity prices, as they are one of the best-performing asset classes during inflationary times.

We can play the inflation trend with commodities. But I’m a lot more interested in the “change the world” mega trends I see unfolding. At the top of that list is the renewable energy revolution.

I see that the biggest opportunities on this front lie within industrial-scale power generation. Watch my “Infinite Energy” presentation to find out more.

But electric vehicles (EVs) represent another enormous renewables opportunity.

Electric Vehicles (EVs): A Mega Trend With Potential

Electric vehicles currently make up about 9% of global automotive sales, with most of that number coming from China and Europe. But that percentage is only going to go higher, as virtually every major automaker in the world has pledged to go all electric:

- Jaguar Land Rover plans to sell only electric vehicles by 2025.

- Volvo and Mazda aren’t far behind, promising to do the same by 2030.

- Ford plans to be all electric in Europe by 2030.

- General Motors, Nissan, Daimler and Honda all plan to be there before 2040.

This is happening, and it’s happening now.

The mega trend here is obvious. But investing in it is more challenging.

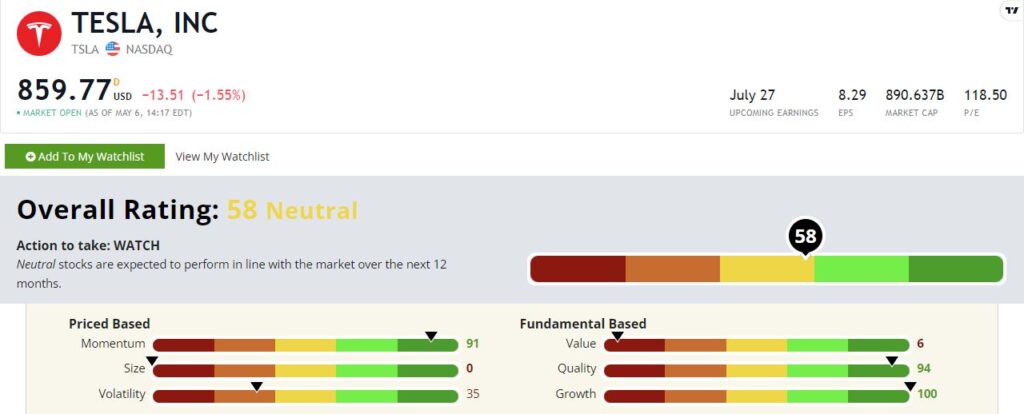

Leading EV maker Tesla Inc. (Nasdaq: TSLA) is getting slaughtered in the tech bear market. It’s down more than 28% year to date!

And it sports a mediocre 58 out of 100 on my Stock Power Ratings system.

EVMT Commodity ETF: A Single Fund for Both Mega Trends

One way to play the inevitable surge in EV sales — along with the current surge in inflation — is the Invesco Electric Vehicle Metals Commodity Strategy No K-1 ETF (Nasdaq: EVMT).

That name’s a mouthful, but it spells out exactly what this exchange-traded fund is all about. EVMT is a new ETF that holds futures contracts of the metals that are most commonly used in EV production:

- Nickel (36.26% of EVMT’s fund allocation).

- Copper (27.52%).

- Aluminum (18.22%).

- Cobalt (9.84%).

- And iron ore (8.14%).

I’m bullish on commodities in general and I expect demand for this particular set of metals to soar as electric vehicles take a bigger share of the market.

Unfortunately, there is one glaring omission. Lithium — a metal that’s critical to battery production — is not included in the portfolio because there are no publicly traded futures for this commodity.

Given the absence of lithium, I can’t call EVMT a perfect play on the renewable energy mega trend. But I think the idea behind it has a lot of potential — both now while inflation is high, and in the future when EVs really take off.

And if you’re looking for more targeted ways to play the renewables mega trend, take a little time to watch my “Infinite Energy” presentation.

To good profits,

Adam O’Dell

Chief Investment Strategist