I had no idea Americans had so much debt.

A Federal Reserve report shows how much we owe … and it’s a pretty lofty total.

Today, I dive into our debt crisis, the FTX/crypto debacle and share some other items that caught my attention this week.

If you have ideas on any analysis you’d like to see, drop me an email at Feedback@MoneyAndMarkets.com.

We Owe How Much???

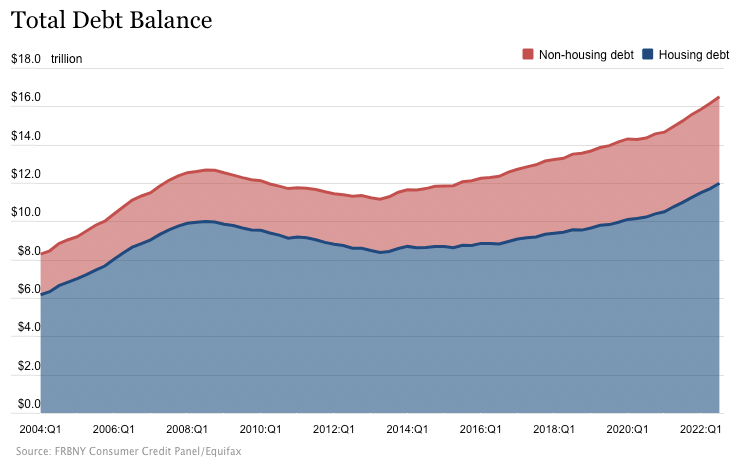

Every quarter, the Federal Reserve Bank of New York looks at just how much Americans are in debt.

After the Q3 release this week, I can tell you … it’s a lot.

The report looks at both housing (mortgages) and nonhousing (credit cards and auto loans) debt:

Total household debt jumped $351 billion, or 2.2%, from July 2022 to September 2022.

- Household debt rose $282 billion.

- Nonhousehold debt climbed $69 billion.

Debt increased 15% across the board — the fastest pace in 15 years. Both mortgage balances and credit card usage exploded.

Total debt hit $16.5 trillion — up 8.3% year over year.

As I said, we owe a lot.

What they said:

“Credit card, mortgage and auto loan balances continue to increase in the third quarter of 2022 reflecting a combination of robust consumer demand and higher prices. However, new mortgage originations have slowed to pre-pandemic levels amid rising interest rates.”

- Donghoon Lee, New York Fed economic research advisor

Yes, but … while credit card usage is on the rise, so are delinquencies.

Researchers noted that, despite a higher number of Americans not paying their bills, the number is still low by historical standards.

Inside the numbers:

- The good … student loan debt was lower at $1.57 trillion (thanks to a long forbearance period).

- The bad … auto loan balances were up to $1.52 trillion. (Cars are more expensive.)

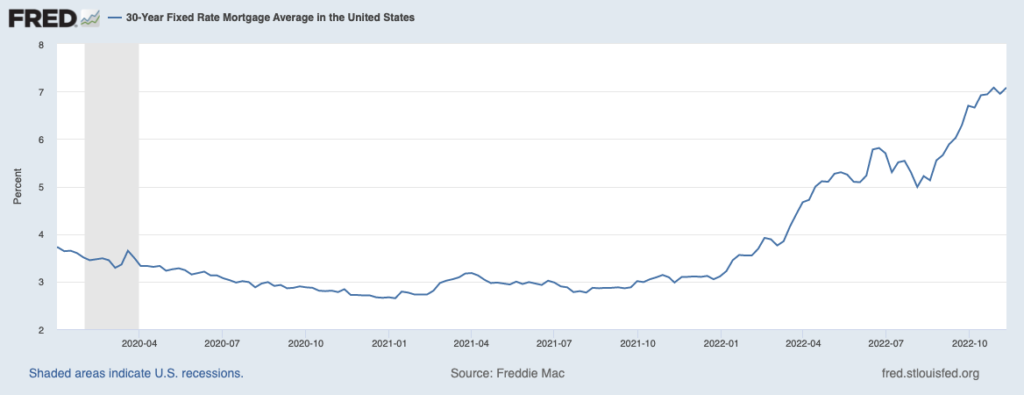

- The ugly … interest rates on 30-year fixed mortgages are above 7%. (Last year, rates were just above 3%.)

Mortgage Rates Rocket Higher

It’s not that Americans are spending frivolously … inflation and subsequent interest rate hikes are making things more expensive.

Because I can’t not mention it:

- Credit card powerhouse Visa Inc. (NYSE: V) scores a “Neutral” 52 on our Stock Power Ratings system.

- Mastercard Inc. (NYSE: MA) is in a similar boat, earning a 48.

When You Think FTX … Think Fyre Festival

I recently watched a documentary about the Fyre Festival.

The 2017 event charged between $500 and $12,000 for a two-weekend series of concerts in the Bahamas.

It turned out to be a disaster. The organizers failed to deliver on everything from performers to accommodations.

The simple explanation was that organizers shot for the moon but couldn’t get the money to cover what they promised.

They used attendance revenue to cover other expenses (like paying social media influencers to promote the event) … leaving little for the festival itself.

Fast-forward to today.

Cryptocurrency exchange FTX made headlines after it declared bankruptcy last week.

It started with a report that crypto hedge fund Alameda Research — the operating arm of FTX — was not worth what it claimed.

Then, a second report claimed both FTX and Alameda were insolvent.

I covered a lot of this earlier this week. You can read more here.

Why FTX failed…

Basically, interest rate hikes pushed investors to sell down their crypto positions, causing coin prices to drop.

Because FTX loaned Alameda billions of dollars, the exchange didn’t have enough to cover the outflows of investors pulling their crypto investments.

Much like Fyre Festival organizers, FTX used money from investors to pay for other, more speculative things … like leveraged trading … using borrowed money to increase your position in an equity.

In this case, the equity (crypto) went down, which forced Alameda to borrow even more.

The cautionary tale here is that if you are in crypto, don’t borrow money to buy more … it could end badly.

Because I can’t not mention it:

Bitcoin wallet provider Coinbase Global Inc. (Nasdaq: COIN) earns a “High-Risk” 1 on our Stock Power Ratings system.

My Tidbits

Here are some things to consider heading into a new week of trading:

- Producer prices rose less than expected. This is further evidence the Fed may slow its pace on interest rate hikes.

- SpaceX could be valued at more than $150 billion. On a related note, fellow space pioneer Virgin Galactic Holdings Inc. (NYSE: SPCE) rates a “High-Risk” 1 on our Stock Power Ratings system.

That’s all from me for now.

Until next time … safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Before joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.