Exxon Mobil Corp. (NYSE: XOM) is one of the world’s largest publicly traded international oil and gas companies. But how does Exxon stock rate?

Exxon Mobil uses cutting-edge technology to find, develop and deliver energy to people and economies around the world.

It’s an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York).

Exxon and the Global Energy Market

Exxon operates in more than 70 countries and has a diverse portfolio of upstream, downstream and chemical businesses.

It relies on the global oil market for its revenue and profit. The company’s upstream segment is responsible for exploring, developing and producing crude oil and natural gas. Exxon Mobil’s downstream segment refines crude oil into gasoline, diesel, jet fuel and other products.

The company’s chemical business manufactures petrochemicals used in plastics, detergents and other products. Global oil market declines hurt Exxon stock. A fall in oil prices leads to lower revenue and profit for the company.

Exxon Mobil is also affected by geopolitical events that can disrupt production and transportation of crude oil. For example, its operations in Libya were shut down due to the country’s civil war. Its business, and Exxon stock, is affected by the global oil market.

Exxon’s Business and Outlook

It is involved in all aspects of the oil and gas industry, from exploration and production to refining and marketing.

Exxon Mobil is also a leading research and technology company, with a strong focus on developing new energy sources.

While Exxon Mobil is a large and diversified company, it has its critics.

Some have accused Exxon Mobil of being too slow to adapt to the changing energy landscape, and of being unwilling to invest in renewable energy. Others have criticized the company for its environmental record, accusing it of contributing to climate change.

However, Exxon Mobil has defended its record, arguing that it is committed to reducing its environmental impact.

And Exxon remains one of the largest and most influential energy companies in the world.

The company has a strong outlook for the future, with plans to invest $50 billion in energy projects over the next 10 years.

Exxon is committed to reducing greenhouse gas emissions, and its research and development team is working on new technologies to improve environmental performance.

Exxon’s Stock Power Ratings

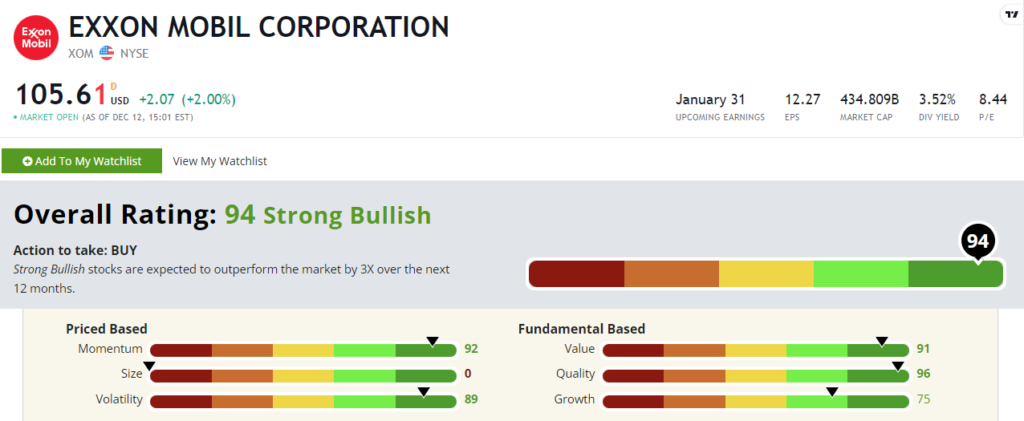

In December 2022, Exxon stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system. The system projects it to beat the broader market by 3X in the next 12 months.

(Click here to see how Exxon’s stock rating has changed.)

XOM earns a “Bullish” 75 on our growth factor.

It scores a 91 on value thanks to its price-to ratios (earnings, sales and cash flow) being in line or below industry averages.

XOM stock best shines on our quality factor — scoring 96.

Its returns on assets, equity and investment are all higher than the integrated oil and gas industry averages.

This all tells us that XOM is a better value, quality and growth stock than its peers.

P.S. Adam O’Dell is watching the oil market closely. He sees a “Super Bull” forming in the coming months.

And when it hits, he expects this No. 1 stock to soar 100% higher in just 100 days. Click here to sign up for his upcoming presentation.