Getting crude oil from the ground and into gas for our fuel tanks is more complex than we realize:

- Oil has to be stored.

- Refined oil (i.e., gasoline) runs through pipelines to terminals.

- Then it’s loaded onto trucks and taken to local gas stations.

And transporting oil is a lucrative business.

The U.S. Census Bureau estimates that revenue from the pipeline transportation of crude oil will increase by 21.3% from 2020 to 2024.

Today’s Power Stock is a key player in the production and transportation of crude oil in the U.S.: PBF Logistics LP (NYSE: PBFX).

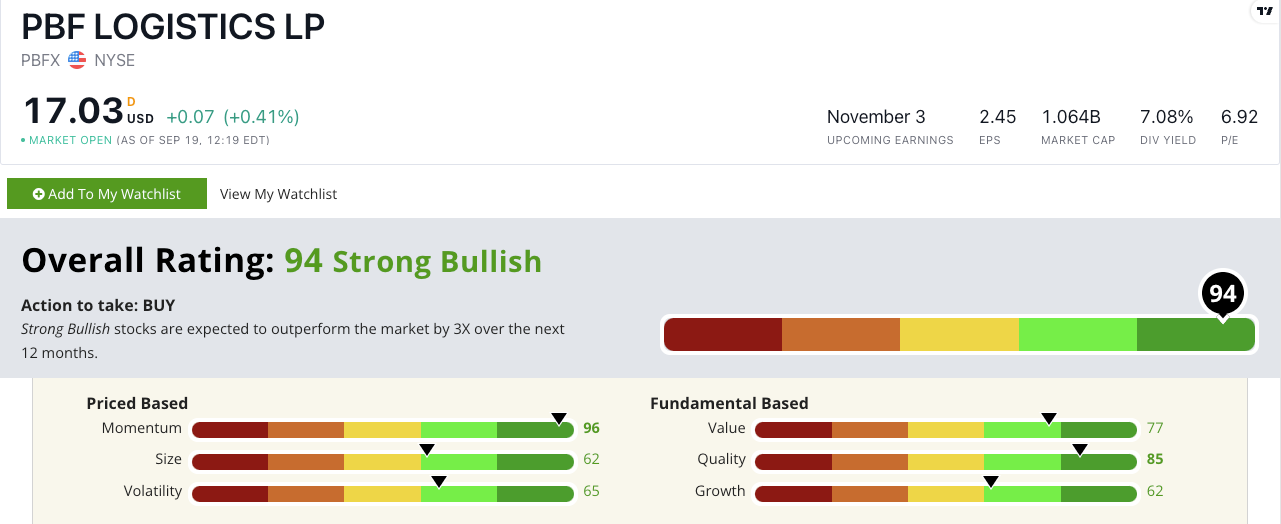

PBFX Stock Power Ratings in September 2022.

Some companies sell crude oil, but without PBFX, there’s no way to store or transport it.

The company owns storage tanks, pipelines and terminals across the U.S.

New Jersey-based PBF Logistics LP stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

PBFX Stock: Excellent Momentum + Strong Quality

PBF Logistics had a solid second quarter:

- It recorded quarterly revenue of $94.4 million — its fourth straight quarter of gains!

- It also reduced its debt by $70 million through its revolving credit line.

It’s not explosive growth, but it’s steady.

The company shows strength on our quality metric, where it scores an 85.

PBF Logistics’ return on equity is an excellent 62.4% — more than double its industry peers’ average of 25.1%.

Its margins (gross, net and operating) are also stronger than its peers’.

Created in September 2022.

These numbers tell us PBFX is a terrific growth and quality stock compared to the rest of the energy industry.

After hitting a low in June 2022, PBFX rocketed more than 50% into August.

The gains pared back due to a broader market sell-off, but the stock is still up 62% over the last 12 months.

PBF Logistics LP stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Bottom line: We still rely on oil, which means we’ll continue to explore and pump more for our vehicles.

But it’s even more important to have dedicated and efficient ways of storing and transporting oil before it hits our gas tanks.

PBFX is a top candidate for your portfolio as a leader in oil logistics.

Stay Tuned: Avoid This Real Estate Stock Despite Ballooned Home Prices

I’m switching it up in tomorrow’s Stock Power Daily. Instead of a top-rated company, I’ll analyze a stock to avoid right now.

Stay tuned for the next issue, where I’ll share all the sordid details on a homebuyer that, despite sky-high real estate prices, you shouldn’t touch with a 10-foot pole.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.