It’s been an epic year for technology and social media stocks.

Not only were most of them unaffected by the virus disruptions; many benefited from them.

With most of the real economy locked down, people spent more time in their homes, playing with their smartphones, tablets and computers. And with normal social interaction still somewhat limited, social media has been instrumental in keeping people connected.

That’s the upside. But there’s the nasty underbelly as well.

Stuck at home and with tensions high in an election year, social media has arguably torn people apart more than it’s brought them together.

And that hasn’t gone unnoticed. Prominent politicians are itching to regulate the industry or bring antitrust action.

So, while the industry is riding high today, threat of regulatory disruption looms.

And social media darling Facebook Inc. (Nasdaq: FB) is at the forefront of that debate as it controls many popular platforms, including Facebook and Instagram.

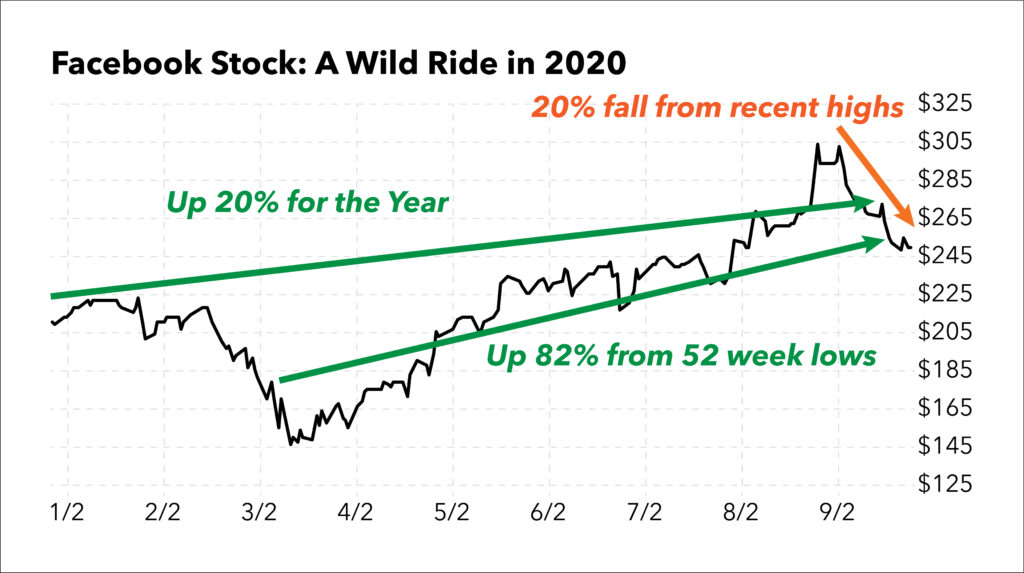

But Facebook’s stock has enjoyed the tech run-up. Shares are up about 20% this year and about 82% from its 52-week lows. But the stock hasn’t been immune to the recent sell-off in the tech-heavy Nasdaq. FB is down almost 20% from its recent highs.

Is this a buyable dip? Or the start of deeper declines?

To get a better idea, let’s look at Facebook’s stock rating using Adam O’Dell’s Green Zone Ratings system.

Facebook’s Stock Rating

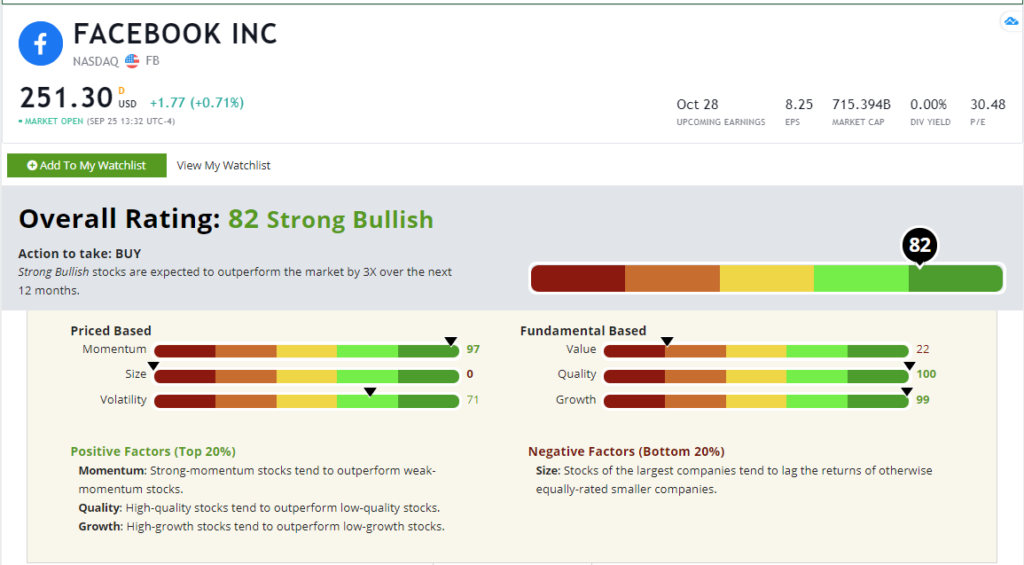

Overall, Facebook scores an 82 out of 100. It’s a “strong bullish” stock using Adam’s model. And stocks rated 81-100 have historically outperformed the market by three times on average.

Let’s drill down to see what drives this high rating.

Quality — With high profit margins and low debt, software and technology service companies tend to rate high on Quality. And Facebook is the champion here as it rates a 100 on Quality. It gets no better.

Growth — Facebook isn’t far behind on Growth, where it rates a 99. Our growth composite combines various measures of earnings and sales growth over various time frames up to 10 years. Facebook’s growth metrics look fantastic across the board. It reaped the benefits during the rise of smartphones and mobile internet.

Momentum — As you might expect, Facebook rates highly in Momentum as well at 97. It’s been a year for tech stocks, and Facebook is no exception. Momentum has sagged this month, but the metrics over longer time frames are fantastic.

Volatility — Low-volatility stocks tend to outperform over time. And despite its rapid growth and high momentum, Facebook is remarkable staid. It rates a 71 on Volatility, meaning that it is less volatile than all but 29% of stocks in our universe.

Value — Facebook rates low on Value, at 22. High-quality growth stocks aren’t cheap, and Facebook is more expensive than three-quarters of stocks we track.

Size — Facebook rates a big fat zero here because, frankly, it’s a huge company with a market cap of over $700 billion. This is clearly not some small, undiscovered gem.

Takeaway: Our system is strong bullish on Facebook, which means the current dip is likely worth buying. But remember, this is a quantitative model that looks at historical data for guidance. And historical data is only useful if the future looks similar to the past.

While Facebook’s stock rating reflects an obvious buy here, we’ll want to keep an eye on any developments that could upset the applecart, such as a major antitrust action.

As I covered last month, tech stocks could be at risk of a “blue wave” in the November elections.

That’s something we need to monitor. But until something fundamentally changes, Facebook remains a strong bullish stock likely to deliver market-beating gains.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.