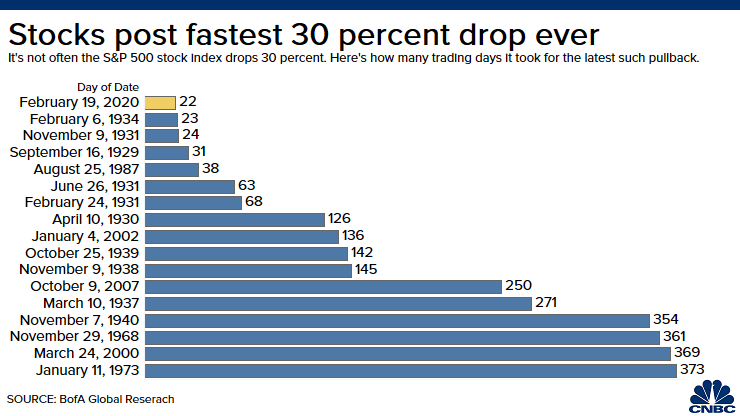

The S&P 500 had rocketed to yet another all-time record close Feb. 19 and the market was humming — now just 22 days later we’ve seen the fastest S&P 500 crash ever of at least 30%.

“It will be years before the stock market is back to all-time highs.”

Sure, it was only a day shorter than the second-fastest S&P 500 crash, two days shorter than the third-fastest and nine days shorter than the fourth-fastest 30% decline. But you have to go all the way back to the 1929 catastrophe and the ensuing Great Depression to find anything close to what we’re currently witnessing, which is now officially unprecedented.

The Fastest S&P 500 Crash in History

As of Monday’s market close after another 2.9% dip, the S&P 500 is at 2,237, or 34.1% below Feb. 19’s record-high close — and falling fast, clearly.

Per CNBC:

The index also is on pace for its worst month since 1940, but does that mean we’ll soon enter another Great Depression-like recession?

The answer to that from most experts is a resounding “no” as the circumstances this time are far different. The COVID-19 pandemic is a true black swan event, and experts think things will return to normal once infections begin to subside and people return to work.

“I don’t think we are headed into another Great Depression, but we are in for more volatility. Many are expecting this to be a V-shaped recovery for the economy. While it may be to some extent, the reality is that the recovery process probably won’t get us back to normal right away. A shutdown of this size, and for a duration of a month or longer, is going to have a lasting impact,” Banyan Hill Publishing Chartered Market Technician Chad Shoop explained. “Companies that survive will be managed differently. Especially the ones getting bailouts by the government.

“Our economy will bottom and a recovery will follow, but we are not escaping a recession. It will be years before the stock market is back to all-time highs. Just not decades like what we experienced during the Great Depression.”

What Comes Next

Of course, the biggest toll could be businesses lost, particularly small ones like mom and pop retail shops, bars and restaurants, which are struggling to cope with no income and laid-off employees amid forced closures in many places.

A few weeks ago, before we knew we were in the midst of the fastest S&P 500 crash ever, Shoop warned we could see a pullback of 50%, all the way down to 1,600.

“At this moment, we are still awaiting a stimulus package. That’s not going to mark the bottom, but could give stocks a much-needed boost before another round of selling continues. Look, businesses are being completely shut down. A few are up and running, but the majority of the U.S. economy is in a coma. The only thing that would cause stocks to turn around sooner is America going back to work sooner, and I just don’t see that happening,” Shoop explained. “The number of infected in the U.S. is going to keep growing, even after social distancing and lock downs.

“It will take weeks for the number of sick people to slow, and even then it’s only a sign that it is working — not an OK to go back to work. So at this point, I’m sticking to a pullback for the S&P 500 to 1,600. It’s not going to be straight down, but that could be the ultimate bottom for this bear market.”

Even though he thought we could see a 50% pullback, which is a drastic decline, Shoop said he is “absolutely” surprised at how quickly the sell-off has occurred.

“I think anyone who says they are not surprised hasn’t been paying attention. Yes, the virus wrecked China’s economy, but their stock market held up during this tumultuous time. The U.S. economy is different, but we went from not being worried at all about the virus to a full blown panic,” he said. “When the stock market was just 5% off its all-time highs, President (Donald) Trump took to Twitter to ease concerns about the virus and said ‘Stock Market starting to look very good.’

“Now stocks have plunged 30% at the fastest pace ever. So, yes, I was completely surprised.”