Inflation has put pressure on businesses to become more efficient.

Companies don’t try to do this alone.

Many turn to professional consultants to find efficiencies and improve operations:

The chart above shows annual revenue from management consulting services in the U.S.

The industry fell during the pandemic as businesses shut down to avoid spreading COVID.

In 2022, however, consulting services roared back, surpassing pre-pandemic levels of revenue.

The forecast gets better: By 2024, revenue from consulting will increase 14.8% from 2020 levels!

Today’s Power Stock is an international business consulting company: Resources Connection Inc. (Nasdaq: RGP).

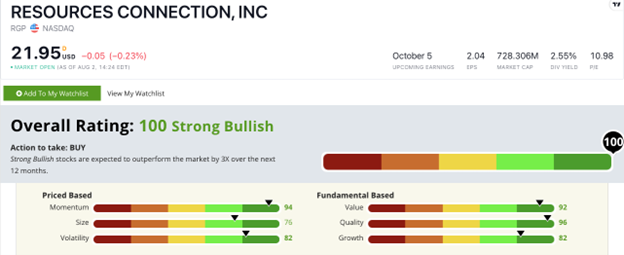

RPG Stock Power Ratings in August 2022.

Resources Connection helps businesses transform their operations.

From managing a supply chain to data analytics to improving workflows (and even finding the right people for those jobs), RGP does it all.

RGP stock scores a perfect 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

RGP Stock: Strong Quality, Value + Momentum

Resources Connection just wrapped up a huge fiscal year.

Highlights include:

- Annual revenue of $805 million: a record 30% increase over the previous year!

- Gross profits jumped 31.2% from last year to $316.6 million.

As you can see, the company’s strong growth numbers back up its 82 rating on the metric.

In addition to growth, RGP’s quality shines.

The company’s return on assets is 12.2% … seven times better than its industry peers.

RGP’s operating margin is 10.4%, while the professional services industry average is a paltry 0.9%.

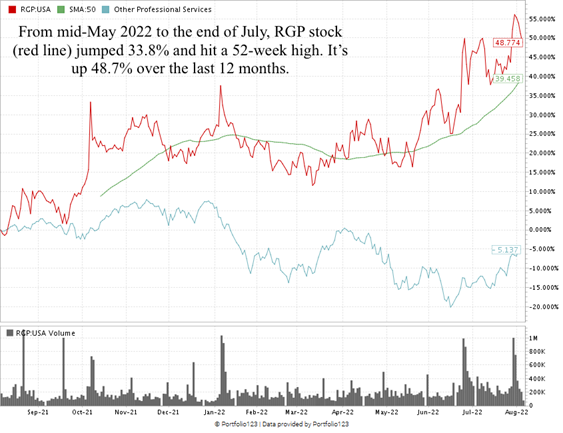

RGP stock has had a fantastic summer.

From mid-May to the end of July, the stock climbed 33.8% and reached a new 52-week high.

The stock is up 48.7% over the last 12 months, blowing the doors off the professional services industry, which is down 5.1% over the last year.

Resources Connection consulting stock scores a 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

High inflation is putting pressure on businesses to be agile.

Resources Connection is in a perfect position to help these businesses adapt to current market conditions — and to help smart investors profit!

Stay Tuned: No. 1-Ranked Regional Bank

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a bank Newsweek ranked the No. 1 best small bank in Louisiana for the past two years.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.