Update, March 19, 2020: About a month and a half ago — before the coronavirus rocked the U.S. economy — we pondered whether Ford would suspend its stock dividend yield, and today the American automaker made it official — the dividend is suspended.

Additionally, Ford Motor Company (NYSE: F) withdrew its guidance and offered payment relief to new car buyers in an effort to help combat the coronavirus pandemic that has put a lot of Americans out of work, at least temporarily until the virus is contained.

Ford also made moves to bolster its cash position, drawing down $13.4 billion from its corporate credit facility and another $2 billion in supplemental credit “offset the temporary working-capital impacts of the coronavirus-related production shut downs and to preserve Ford’s financial flexibility,” the company said in a statement.

Ford also said Wednesday it will soon close all of its North American plants, and factories in Europe and elsewhere have already closed temporarily. The news sent the automaker’s share prices reeling initially, down 8% in premarket trading to $4.14, before rebounding this morning along with markets in general.

“Like we did in the Great Recession, Ford is managing through the coronavirus crisis in a way that safeguards our business, our workforce, our customers and our dealers,” CEO Jim Hackett said in a prepared statement.

Ultimately, it seems COVID-19 is a convenient excuse to cut the dividend it seemed destined to slash before the outbreak even began.

— Shaun Cox, Money & Markets

The Original Story: Ford Profits Evaporated in 2019. Is Its Stock Dividend Next?

It was a rough fourth quarter for Ford.

The American automaker suffered from lower sales, weaker results from its crediting division and more money spent in research and development of new vehicles.

As a result, Ford Motor Co. (NYSE: F) reported a $1.7 billion loss in the fourth quarter. That resulted in just $84 million in profit for the entire year.

Compare that to the $3.7 billion in profit the company reported in 2018, and then it’s even worse when you consider Ford had $7.8 billion in net income in 2017.

Shares of Ford dipped nearly 9% as soon as the opening bell rang on Wall Street on Wednesday morning.

The Bigger Story: Ford’s Dividend Yield

Yes, Ford had a terrible Q4 rife with issues ranging from sluggish vehicle sales to increased expenses related to accounting for pension and other retiree benefits.

But there’s something deeper that investors should be concerned about.

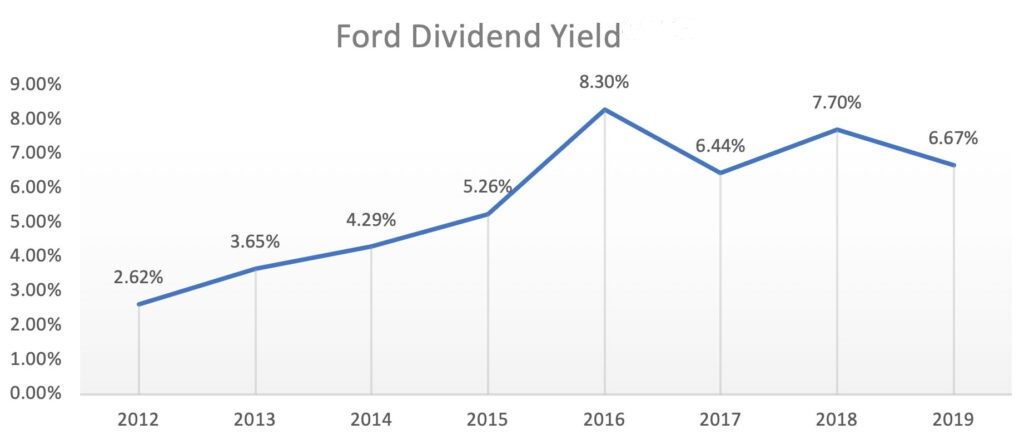

Ford pays a dividend, and it is a healthy one — about 6.54% on average. In the last five years, the growth rate of those dividends has averaged 6.57%.

The last dividend rate for Ford shares was $0.60 per share.

Not a bad chunk.

But here comes the bad news.

Ford has a trend when it comes to its dividend yield. In fact, each time Ford’s dividend yield reaches 7% or above, they cut the yield.

In the first quarter of 2017, Ford trimmed its yield back to around 6.4% after it jumped to 8.3% the year before.

In the first quarter of 2017, Ford trimmed its yield back to around 6.4% after it jumped to 8.3% the year before.

Again in 2019, Ford trimmed back its yield from an average of 7.7% in 2018 to 6.6% in 2019.

Shareholders Should Be Worried

Here’s where Ford’s bad Q4 comes into play.

Because of the horrendous Q4 and its impact on 2019, investors are starting to be more bearish on Ford shares.

That has driven the price down below $9 per share.

Ford pays $0.60 per share annually as a dividend — or $0.15 per quarter. It costs about $600 million each quarter to pay the $0.15 dividend.

The share price dropped to around $8.30 Wednesday morning, meaning the dividend yield is at 7.17% — right at that 7% threshold used to cut in the next quarter.

Ford’s Dividend Yield Compared to Competitors

One of Ford’s biggest competitors in the automotive space is General Motors Co. (NYSE: GM).

Its current dividend yield is about 4.4% — considerably lower than Ford’s. Shares of GM were down slightly Wednesday after the company reported a Q4 loss of $194 million and lower 2020 guidance.

You can expect their share price to follow suit and fall, meaning there could be a dividend yield cut in the offing.

The only other major automotive company that pays a dividend yield is Ferrari NV (NYSE: RACE). The Italian company currently pays 0.51% — again, way lower than Ford.

The Immediate Future of Ford’s Dividend Yield

Do its recent losses mean Ford will cut its dividend for the next quarter?

Cutting its dividend payment will allow the company to reinvest those funds in things like electric vehicles and other research and development products.

And after a very weak 2019, Ford is likely to need those funds if it hopes to have any growth in 2020.

Nothing is guaranteed but if history repeats itself, you can bet it’s going to happen.