Investment managers are nervous.

The data shows they are running to cash. According to MarketWatch:

Fund managers dashed for cash in anticipation of more aggressive Federal Reserve policy, according to the latest survey conducted by Bank of America.

The allocation to cash rose to 5.1% in December from 4.4% in November, the survey of 371 panelists running $1.1 trillion in assets under management found. The survey was conducted between Dec. 3 and 9.

It’s an interesting story. But the editors buried the lede.

The lede opens an article and should hook the reader. In this case, editors thought high levels of cash were important.

Buried near the bottom of the article is what investors should care about the most: “…holdings in real estate investment trusts reached a seven-year high, and the allocation to stocks was the lowest since 2020.”

Big Money Flees Into Real Estate

Professional investment managers aren’t hiding from the market action. They are allocating cash to the real estate sector because they believe it has additional upside potential. It could also indicate these managers believe income from real estate will continue to grow even as interest rates rise.

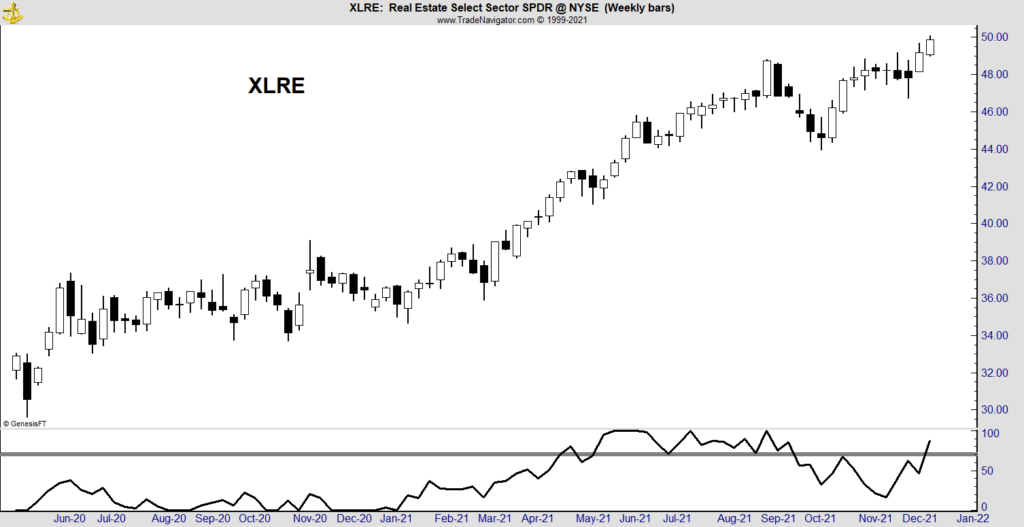

Individuals should also consider real estate. A simple strategy just gave a buy signal and confirmed a developing uptrend. The chart of the Real Estate Select Sector SPDR (NYSE: XLRE) is shown below.

XLRE Is Trending Higher

The ETF’s relative strength is shown at the bottom. RS just moved above 70, a buy signal that indicates XLRE is outperforming 70% of stocks in the market.

The previous signal last spring was followed by a 10% rally. That was more than double the gain of the S&P 500 Index over that same time.

Now, as the S&P 500 appears vulnerable to a sell-off, XLRE may be even more attractive with a 3% dividend yield that can cushion downside risks.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.