Federal Reserve economists watch the Job Openings and Labor Turnover Survey (JOLTS) closely. This report provides information on how many job openings there are, how many people were hired and how many left their jobs.

Economists use this type of information in supply and demand models. When there aren’t many job openings, and few people are leaving their jobs, we’d expect employers to hold down wages. Under the opposite conditions, with a high number of openings and a large number of departures, we’d expect employers to increase wages to find and retain the best workers.

Job Openings Outstrip the Number of Unemployed

Trends in wages lead to trends in inflation. That makes the most recent JOLTS data troubling to economists.

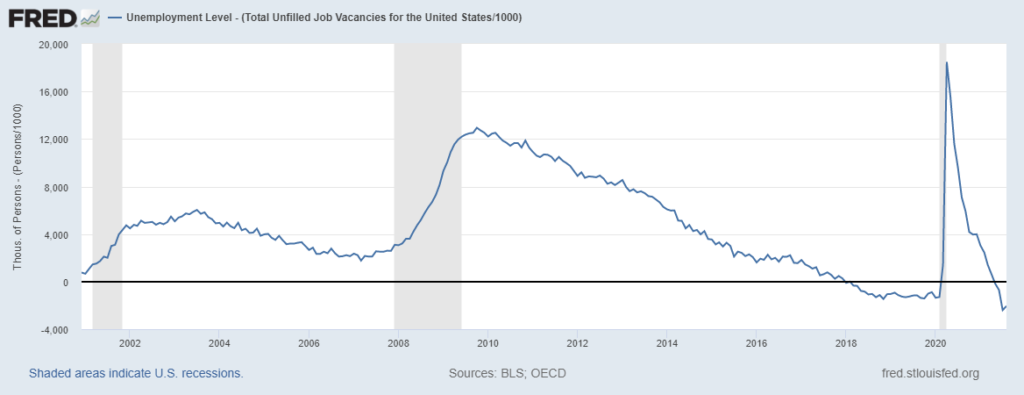

At the end of October, there were over 11 million unfilled job openings in the country, far exceeding the number of unemployed, which stood at 6.9 million in the most recent report. There are 4.1 million more job openings than unemployed, a near-record reading of that measure as the chart below shows.

Job Openings vs. Unemployed

Source: Federal Reserve.

This is a chart of the difference between the number of unemployed and the number of job openings. The large number of unemployed relative to openings coincided with a period of unusually low inflation. When the difference turned negative in 2018, the consumer price index remained consistently above 2%.

This is the latest piece of data indicating the Fed is failing to act as inflationary pressure builds.

The economy is at risk of falling into a wage-price spiral where prices increase as a result of higher wages. In theory, when workers are paid more, they will buy more goods and services, and the increased demand could cause prices to rise even more.

As employers compete for the diminishing pool of potential workers, the Fed will have to act. They should begin to explain their plan when Chairman Jerome Powell holds a press conference on Thursday.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.