You may know that before I dove headfirst into financial markets, I was studying to become a doctor.

I was a biology and chemistry major on the pre-med track at Elon University in Burlington, North Carolina. It was just west of what’s known as the “Research Triangle,” an area of North Carolina that houses some of the country’s most prestigious science and technology firms.

Life comes full circle because now that small geographic area in North Carolina is becoming a biotech hotspot. A recent study from Newmark shows the Triangle is the fourth-largest life-science cluster in the U.S. It’s only behind the huge metropolitan areas of Boston, San Francisco and San Diego.

And that presents us with an interesting investing idea: Become a genomics landlord.

Genomics Will Be Huge

Genomics — or DNA-based science — is the single biggest investment opportunity of our lifetimes.

I don’t say that in hyperbole or exaggeration. You know me. I’m a straight shooter, and I believe in following the data wherever it might lead. And as I’ve said before, I believe this opportunity will ultimately be bigger than the internet in terms of its overall investment potential.

Stop and think about that. It’s hard to remember what life was like before the internet. Finding information was time-consuming and often expensive. Everyday chores like paying bills or reviewing account statements took far longer. And shopping! Remember what it was like before Amazon.com? What takes five minutes today might have taken hours of trudging the malls or your local Walmart.

The internet changed all of that forever. And I am serious when I say that the genomics revolution will be even bigger.

Genomics Investing Comes in Many Forms

I’m always looking for promising genomics investments, and my readers in Green Zone Fortunes are up over 180% on half the position in one of my favorite genomics recommendations.

To find out more about my No. 1 genomics stock, click here to watch my “Imperium” presentation now.

But investing in this sector can cause indigestion… As I wrote recently, it can be like throwing a big plate of spaghetti on the wall and seeing what sticks. Many promising new applications never make it past the testing stage. And as we saw back in the internet revolution of the 1990s, not every startup makes it. Many fail to make room for the winners.

I expect to pick many of those winners, of course, and I already have. But there are more conservative ways to play this trend.

One way to play the genomics revolution without having to pick the exact winners?

Be a landlord.

Biotech REITs

The pandemic sent large swaths of America’s workforce to work from home.

But you can’t run a lab out of your living room. Apart from the health risks, it would be cost-prohibitive. So, while demand remains slack for office, retail and many other traditional real estate sectors, demand for life sciences properties has never been stronger.

Venture capital funding for life sciences is set to reach an all-time high in 2021 after reaching $26.7 billion in the first half of 2021, according to Newmark.

And that’s created a red-hot real estate market for new lab space across the U.S. The top 10 life science owners control 100 million square feet of wet laboratory space across the country.

Labs tend to cluster where the talent is, which is to say around major research universities and hospitals. And today, the biggest clusters are concentrated in Boston, the San Francisco Bay Area, San Diego and the Triangle of North Carolina, which encompasses North Carolina State University, Duke University and the University of North Carolina at Chapel Hill.

The investment play here goes far beyond the labs, of course. A major influx of knowledge workers creates demand for high-end housing and retail and other supporting industries such as logistics and telecom.

But if you want to focus your landlord duties within the life sciences space, there are several public real estate investment trusts (REITs) with exposure to the sector. To give an example, Alexandria Real Estate Equities Inc. (NYSE: ARE) specializes in the sector and has a major presence in every major life sciences cluster. The REIT owns over 40 million square feet in life science properties.

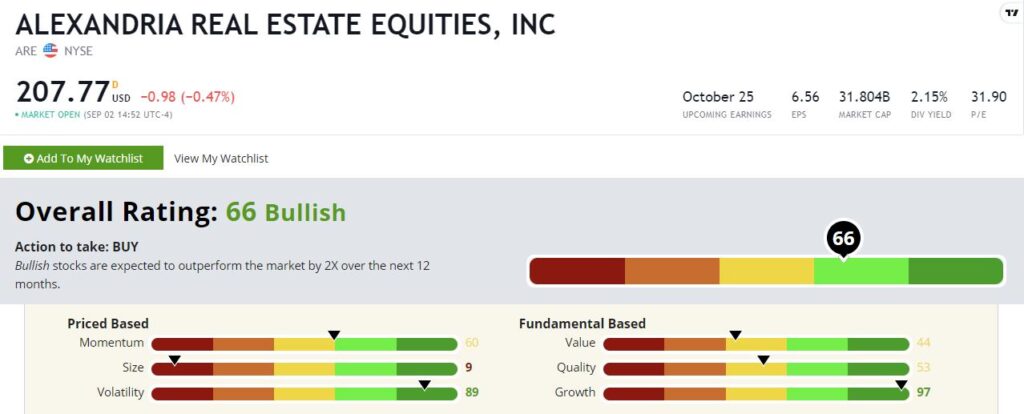

It’s not the highest-yielding REIT at 2.2%. But it rates a “Bullish” 66 out of 100 on my Green Zone Ratings system, including an impressive 97 on the system’s growth factor.

Alexandria Real Estate Equities’ Green Zone Rating on September 2, 2021.

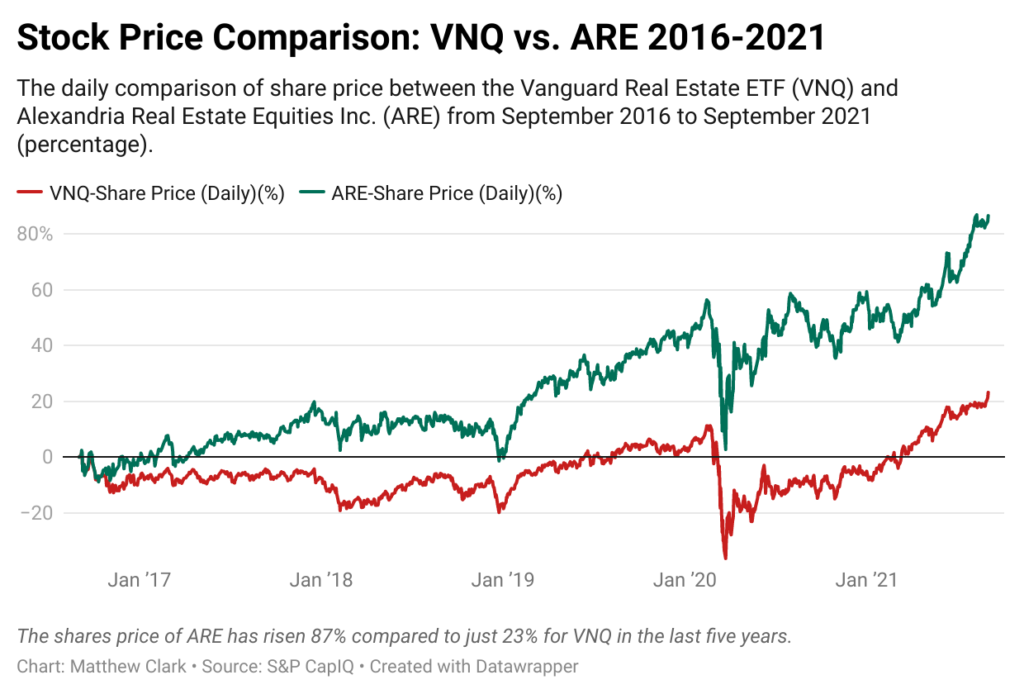

Over the past five years, Alexandria has crushed its competition, rising 87% versus just 23% for the Vanguard Real Estate Index Fund (NYSE: VNQ).

And importantly, while many real estate sectors may be dealing with long-term oversupply issues for years to come due to the rise of internet commerce and changing work preferences, Alexandria’s portfolio is virtually future-proof.

If you’re looking to benefit from the general trend of capital flowing into this trend, being a genomics landlord is a good way to play it.

To good profits,

Adam O’Dell

Chief investment strategist, Money & Markets