In an effort to bolster its balance sheet, GM has suspended its quarterly cash dividend.

General Motors Co. (NYSE: GM) also completed the extension of its original $2 billion revolving credit agreement to $3.6 billion and halted its share buy-back program.

“We continue to enhance our liquidity to help navigate the uncertainties in the global market created by this pandemic,” GM Chief Financial Officer, Dhivya Suryadevara said in a statement. “Fortifying our cash position and strengthening our balance sheet will position the company to create value for all our stakeholders through this cycle.”

The move comes as automakers face slumping sales and a slowdown in production due to the coronavirus lockdown.

IHS Markit projected auto sales to drop more than 15% year over year in the U.S., and at least 12% globally. It would be the biggest decline in sales since an 8% drop during the Great Recession more than a decade ago.

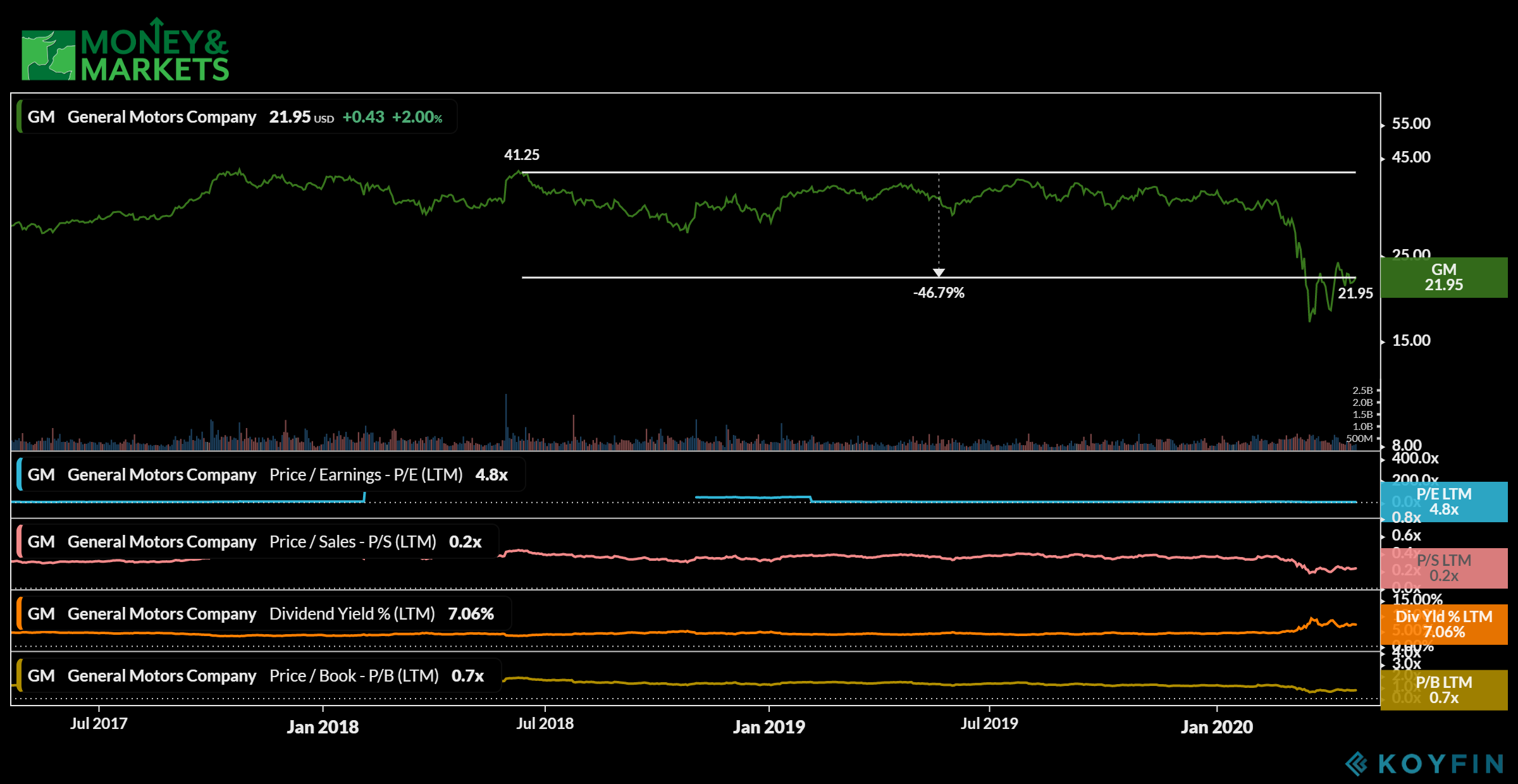

GM Sagging Stock Price

The company’s share price has also been hammered by the coronavirus.

Since reaching a high of $41 per share in June 2018, GM has tumbled nearly 47% to trade at around $22 per share.

Since the middle of February, those shares have fallen by nearly 38%.

The company has paid a $0.38-per-share dividend in each of the last eight quarters, with the last payment coming in March 2020.

While GM suspending its dividend will provide much-needed capital for the auto giant, it hammers shareholders who were already facing losses due to the drop in its stock price.

GM Suspends Dividend — It’s Not the First and Won’t Be the Last

The COVID-19 crisis has hit businesses of all sizes and in all sectors as shutdowns have forced companies to strengthen their bottom lines.

Some of the bigger companies which have already suspended their dividend payments include Carnival Corp. (NYSE: CCL) and Ford Motor Co. (NYSE: F).

Carnival cut its dividend and share buyback programs on March 31 as the cruise industry faces considerable losses due to a virtual shutdown of the travel industry.

Similar cruise companies like Royal Caribbean Cruises Ltd. (NYSE: RCL) could face a similar situation in order to preserve capital.

Ford cut its dividend at the same time it halted production in North America and Europe.

The company will be helped by the $2.2 trillion coronavirus stimulus program passed by Congress in 2020. However, the company was already facing struggles after analysts cut the company’s debt rating significantly.

Banyan Hill Publishing Chartered Market Technician Michael Carr said that “dividends are no longer a meaningful source of long-term returns for the stock market indexes.”

“GM proved that for any investor clinging to the hope that dividends would offer steady, and growing, income,” Carr, editor of “This is important because those studies showing stocks return an average of 7-10% a year, in the long run, assuming steady dividend yields of 3% or so.”

He said that zero dividends, low inflation and slow growth should lead investors to expect annual returns of around 3% to 5% per year.

“It’s time for a paradigm shift for investors who need to consider the benefits of short-term trading strategies,” he added.

The bottom line is that as consumer confidence continues to fall and sales across different sectors plummet, investors can expect GM, Ford and Carnival to set a trend for companies halting their dividend payments to increase capital.