When I was a kid, I read … a lot.

My grandparents bought me an encyclopedia set before I started elementary school, and I read it over a summer.

When I have the time, I still love to read.

And I’m not alone:

The chart above shows print book sales in the U.S.

Sales jumped 19% from 2019 to 2021 … and I have high conviction the trend will continue!

One of the biggest sectors of the book market is young adult and children’s books, which grew 30.7% in 2021.

Today’s Power Stock is one of the world’s largest publishers of children’s books: Scholastic Corp. (Nasdaq: SCHL).

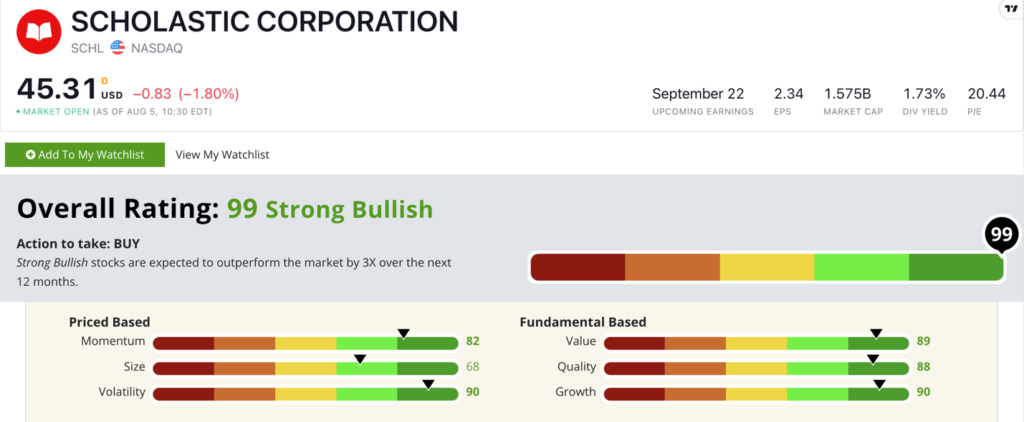

SCHL Stock Power Ratings in August 2022.

SCHL has published children’s books since 1920. It started with book fairs in elementary schools and now includes comic books, e-books and interactive products.

Fun fact: Scholastic published the Harry Potter book series in the U.S. It also owns the license to British animated character Peppa Pig and Japanese franchise Pokémon.

Scholastic Corp. stock scores a “Strong Bullish” 99 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SCHL Stock: Strong Growth + Value

SCHL just released an outstanding quarterly report.

Highlights include:

- Revenue of $514.4 million — a 28% increase over the same quarter a year ago.

- Increased its operating income to $65.5 million for the quarter — a massive year-over-year jump of 575.3%.

SCHL is a strong growth stock, as you can see from those revenue figures.

It’s also a smart value play, with a price-to-sales ratio of 1.

Compared to the industry average of 1.4, we can see SCHL is undervalued compared to its industry peers.

SCHL is a solid quality play too. Its gross margin is high, at 55%, and its return on equity is a respectable 6.7%.

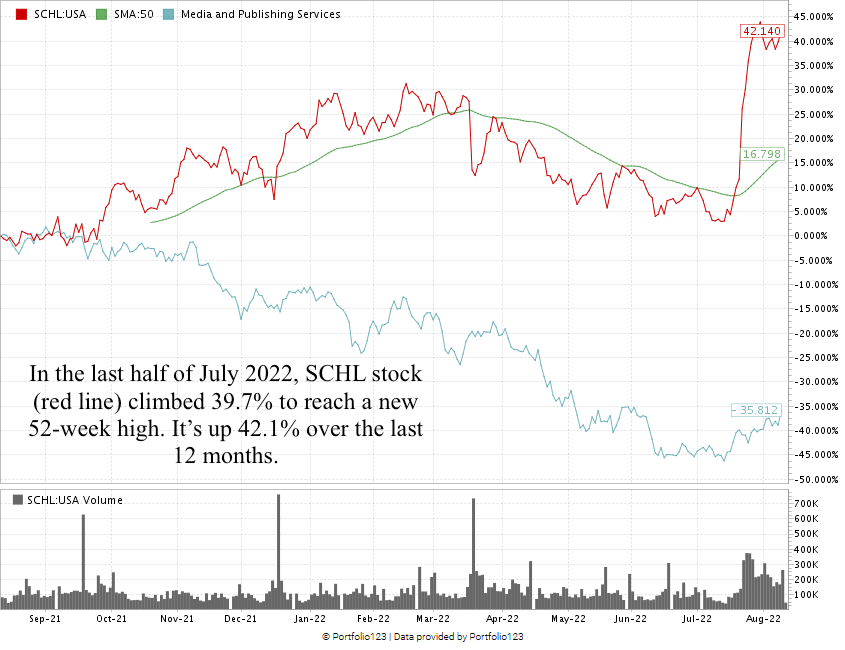

In the last 12 months, SCHL climbed 42.1% — including a 39.7% run in the last half of July 2022. It’s crushing its market peers, which lost 37.9% in the past year.

The stock trades more than $8 above its 50-day simple moving average (green line in the chart above).

Scholastic Corp. stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

From book fairs to worldwide publishing, Scholastic has grown into a global leader in children’s books.

SCHL is a smart addition to your portfolio.

Bonus: Scholastic’s 1.7% forward dividend yield pays shareholders $0.80 per share, per year to own the stock.

Stay Tuned: American Energy Stock With Renewable Focus

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top company that supplies traditional as well as renewable electricity, with a focus on solar.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Chief Investment Strategist Adam O’Dell and I know many of you are worried right now.

But fear not: Adam has created a special system to help you beat back inflation, protect your wealth and even profit from the market’s uncertainty. This is a recession-proof strategy that can help you make money regardless of which direction stocks are heading.

You can forget about all the fearmongering and breathe easy.

Adam will share everything you need to know during a special presentation on August 30.