Traders look at a variety of indicators, but many indicators rely on the same data inputs. They all tend to give buy or sell signals at the same time.

Fundamental indicators often tend to incorporate price. Popular tools such as the price-to-earnings ratio, dividend yields and enterprise value-to-operating earnings are all based on the market price of the stock.

Technical indicators almost always add, subtract, multiply or divide the closing price with formulas of varying complexity, but most simply plug prices into an equation.

There is a different type of indicator that uses time instead of price as its primary input. This factor is called seasonality.

Seasonal tendencies can be useful because the truth is some stocks will do better than others at different times of the year. The same concept applies to commodities where fundamentals are difficult to apply.

Based solely on the calendar, we are at the beginning of an unusually bullish time frame for gold.

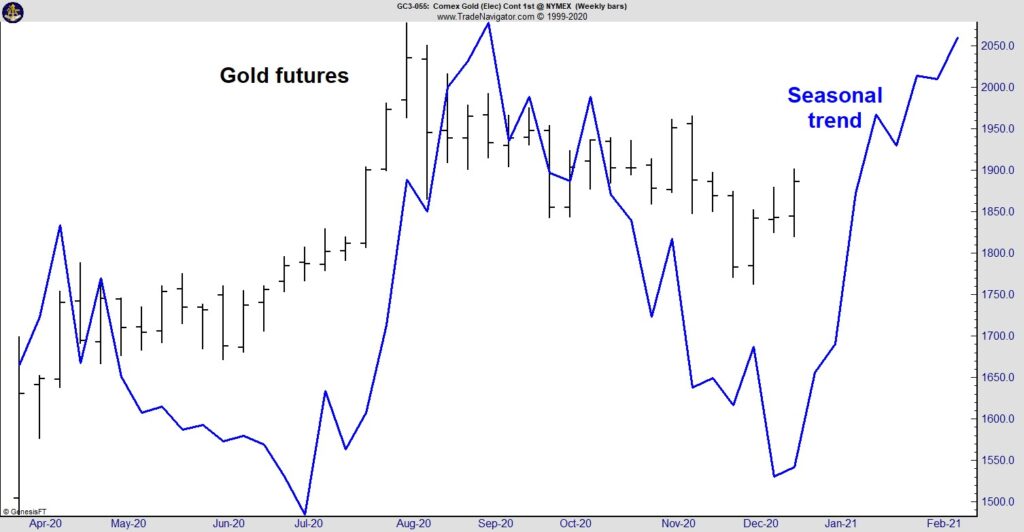

The chart below shows the price of gold futures as the black line and the seasonal trend in prices as the blue line. The seasonal trend is forecast for one year in advance.

Gold Seasonals Are Trending Upward

Source: Trade Navigator.

Investors Could Profit From Gold’s Bullish Future

This chart uses data since 1975. That’s when futures exchanges began offering standardized contracts on gold, showing a long history that includes bull and bear markets, periods of inflation and deflation.

Seasonals only show the direction of the expected trend. They do not forecast price levels. Over the past nine months, gold has moved in line.

From the middle of December to the beginning of February, gold’s seasonal trend is bullish. This is the most bullish eight-week period of the year, with gold rallying in about 80% of all years.

For short-term traders, an SPDR Gold Trust (NYSE: GLD) call option expiring on February 19 provides a trading opportunity.

For long-term investors waiting for the recent pullback to end, seasonals indicate this could be the ideal time to buy.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.