Attention, gold skeptics: The price of the yellow metal is moving higher. That’s at least in part because of inflation.

In economic terms, inflation is a decline in the purchasing power of money.

In simple terms, imagine that a meal at your favorite restaurant costs $10.

If inflation averages 2% a year, it will cost $12.19 in 10 years. A $10 bill won’t buy that meal anymore.

This is why people invest. Investing $10 in a 10-year bond paying 2% interest ensures we can still buy that meal in 10 years.

Earning more than 2% a year increases buying power — if inflation remains low.

Federal Reserve officials assure us that price increases are low, so we don’t need to worry about inflation.

But Fed officials are wrong.

Even if prices fall, money can still lose purchasing power. Economists understand that there are other ways money loses purchasing power.

One of those factors is pushing gold higher.

If an investor buys a 10-year Treasury bond for $1,000, they expect the interest rate to compensate for price increases over 10 years.

But that’s not happening right now.

A Chart for Gold Skeptics

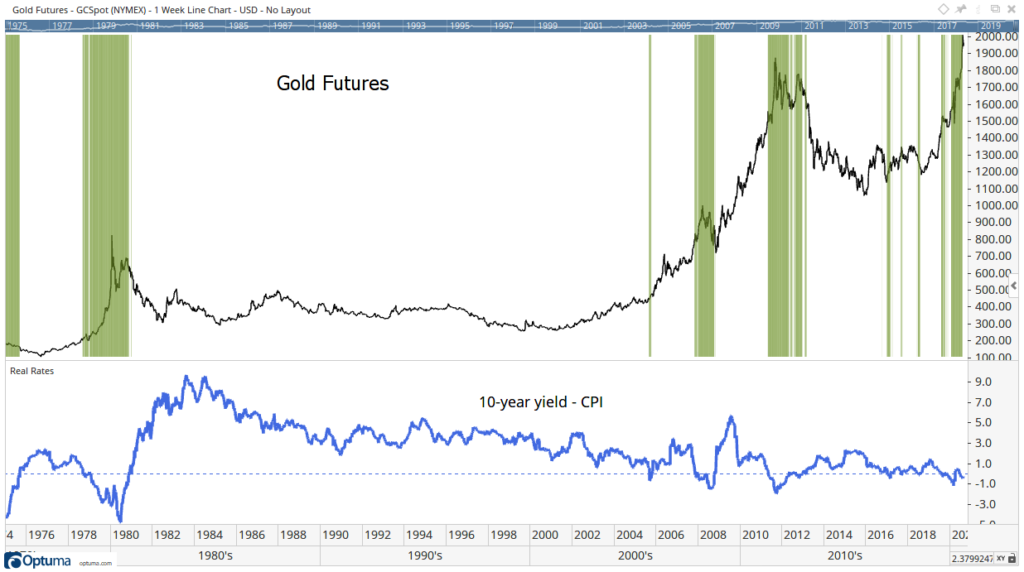

The chart below shows the real yield on 10-year Treasurys at the bottom. That’s the return to investors after inflation is subtracted from the yield.

Green bars highlight periods when that value is less than zero. Gold, the black line in the chart, tends to rally when that happens.

Gold Surges When Yields Bottom Out

Source: Optuma

In technical terms, real interest rates are negative. This means inflation is greater than the return on investment for bond holders.

Gold is an inflation hedge. And this chart shows that it serves that purpose well.

Even if official inflation measures are low, the market reacts when the buying power of the dollar is under pressure as it is now.

Take it from history, gold skeptics: Gold is likely to continue delivering gains until interest rates rise. With the Fed reluctant to raise rates, gold’s rally could last for years.

P.S. Money & Markets Chief Investment Strategist Adam O’Dell sees gold rallying to $10,000 per ounce — and he’s taking advantage. Using what he calls “A9 gold stocks,” Adam is targeting profits up to NINE TIMES more than buying gold coins, ETFs or bullion. Click here to learn more.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.