I can’t count the number of different theories I’ve been presented by market experts about gold. Invariably, no matter how sophisticated the theory is it always boils down to, “dollar up, gold down,” and vice versa. And this usually is said with the kind of frank smugness that is a prelude to someone going broke.

During normally functioning markets they are usually right. But in this day of central bank risk-suppression and price controls can we really define when or how markets are functioning normally?

Because if this week is any indication, all conventional wisdom about gold should be discounted by about the same amount that the market is Lebanese sovereign debt right now.

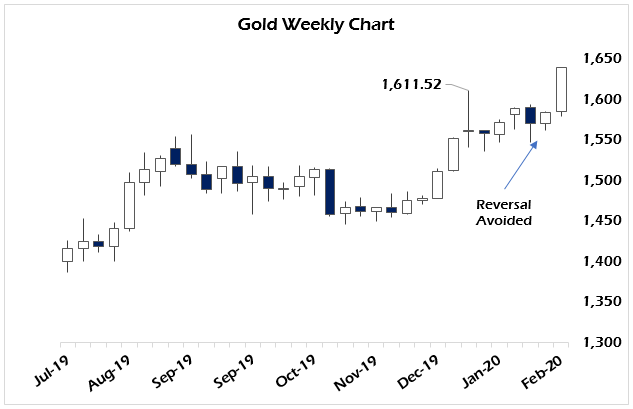

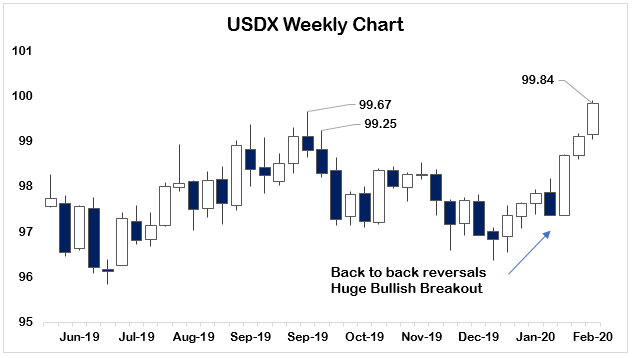

Because if gold is the inverse of the dollar under all circumstances, then how do you explain a week in which gold breaks to a seven-year high near $1,650 with nary a pause at the January high while the USDX simultaneously breaks out into a new trading range to the upside?

Human interpretations are faulty, we see what we want to see in all things. And so many will dismiss this week as an anomaly. But charts don’t lie when you look at them without adornment.

Since the beginning of 2020, gold and the dollar have been in lockstep moving higher together. It would be one thing if, for example, it was a relief rally in gold after an extended or overdone downtrend.

But that’s not what’s going on here.

This is a fear trade, folks. Plain and simple. And it’s a reflection of the uneasiness in global markets as a result of a lot more than just the news coming out of China about the coronavirus. That is just another stressor, the proverbial straw on the camel’s back that finally broke down official price suppression through central bank liquidity injections and interventions into the repo markets.

Gold is already in a bull market in just about every other currency in the world. And as those currencies break down versus the dollar, demand for gold locally rises as people move to protect themselves against falling local currencies.

This is not to say that gold is off to the races to a new bull market versus the dollar here. However, it’s certainly making a credible case that it is part of the conversation of where those fearful of the near future are putting their trust.

For this to be the new bull market in gold we’d have to be looking at challenging the all-time high in dollar terms. So until that happens, curb your enthusiasm and keep watch on the technicals because as global trade falls, high-priced gold will look tasty for raising dollars. But that said, what the past few years of rising gold prices are telling us is that any kind of dissention in global monetary policy will reveal the flaws in the foundations of the monetary system.

The Fed tried a tightening cycle against the wishes of the entire world and that marked the bottom in gold, and it’s been trending higher ever since. Tighter dollar liquidity fans the flames of political problems the world over thanks to zero-bound interest rates pushing so much debt into the dollar space, crowding out local currency borrowing.

Once that trend reversed, upward pressure on gold alongside the dollar was inevitable in a broad sense as our faith in our governments erodes. Gold is the flipside of our confidence in our government. It is not a hedge against the inflation-discounted rate on a 3-year Treasury bond, as one person haughtily told me a few years ago. It’s not the difference between the 90-day LIBOR and OIS rate.

I’ve chased all of these down over the years and they all fail. Gold isn’t hard to understand. Gold is governed by fear and doubt.

Nothing more or less.

As fear rises so does gold. As fear subsides gold falls. The question each day is: What, if anything, do investors fear?

At the same time when the world is fantabulously short dollars, fear means they have to rush in there as well, regardless of the latest theory of the latest fad trader or market guru.

Today the thing to watch is the response to the coronavirus. It will be another major test for governments around the world to maintain the trust of the people whose interests they are supposed to represent. If they are impotent to control the spread of this virus, think of it as a dry run for what happens when financial contagion grips the markets later this year.

Because this is the precrisis tremor to what’s coming next.

Failure to contain this virus adequately will further undermine confidence in our leadership and institutions. It will force people who don’t normally care about any of this stuff to wonder just what in the holy hell have these people been doing with all of our money all these years?

And that’s the moment that keeps people like Federal Reserve Chief Jerome Powell awake at night.

In Europe, it almost feels like Christine Lagarde, Emmanuel Macron and the rest have been waiting for this moment for years; to use the crisis as an excuse to ram through political and fiscal integration across the continent that few, if any, want or ever signed up for.

Either way, this upward momentum in both gold and the U.S. dollar is here for very good reasons. It’s a rocky relationship that wants to go its separate ways but, right now, as the world economy begins to burn they are both on fire.