Editor’s Note: Chief Research Analyst Matt Clark dives into crypto mining stocks and how they rate in Green Zone Power Ratings below. But if you’re looking to invest in actual cryptocurrencies as 2024’s bull market gains steam, you need to check out what Ian King has to say.

Ian is our go-to for this innovative market segment, and he’s identifying the cryptos you want to be holding before bitcoin’s fourth halving next month. To see why Ian is our guy, click here to watch his brand-new “4th Halving” presentation now.

At last month’s Total Wealth Symposium, I shared the stage with our chief investment strategist, Adam O’Dell.

Our topic of discussion? His proprietary Green Zone Power Ratings system.

I mentioned to the crowd that when Adam first shared the system, I was skeptical. (I can thank my journalism background and my grandfather for questioning everything.)

It was my mission to find something wrong with it … but I had to admit defeat. I couldn’t find a flaw with the methodology or the ratings themselves.

And the system has proven to be rock-solid, no matter the market conditions — with the highest-rated stocks beating the market 3-to-1 for years. Stocks like:

- Modine Manufacturing Co. (NYSE: MOD) — In December 2022, the stock rated a 96. As I write, it’s up 374%.

- Powell Industries Inc. (Nasdaq: POWL) — This stock rated a 97 in December 2022. Since then, the stock has gained 318%.

While those are just two of the breakout stocks Adam’s system has found, I’d be remiss if I didn’t give this disclaimer: No system is “perfect.”

The Green Zone Power Ratings system does take a data-driven approach to evaluate stocks. It’s meant to save you the time of doing hours of technical and fundamental research. In that regard, the system is flawless.

But sometimes, data doesn’t tell us the whole story, especially about one particular opportunity.

2024 Has Been the Year of Bitcoin

Last year, the most popular cryptocurrency on the market — bitcoin — finally broke above $30,000 per coin after years of sideways and bearish trading.

What has happened this year, however, puts last year’s bitcoin gains to shame:

Bitcoin Up More Than 47% in 2024

The approval of 11 spot bitcoin exchange-traded funds (ETFs) helped push bitcoin past the $70,000 mark earlier this month.

Even with a slight correction, it seems like we’re in a new bull market in bitcoin.

Using the “rising tides lift all boats,” it stands to reason that bitcoin miners would make a great investment now as a kind of “picks and shovels” play in the crypto market. And their Green Zone Power Ratings should point to that fact.

But as ESPN college football guru (and former football coach) Lee Corso would say: “Not so fast, my friend.”

I ran an analysis of the holdings in the Valkyrie Bitcoin Miners ETF (Nasdaq: WGMI) through the Green Zone Power Ratings system. This is the same process Adam went through back in November.

Bitcoin Miners’ ETF Rates “Bearish”

The ETF rates 37 out of 100 overall based on the average rating of each holding. That rating would be even lower if not for the bullish ratings of two large semiconductor stocks, NVDA and TSM, which are rated 71 and 75, respectively.

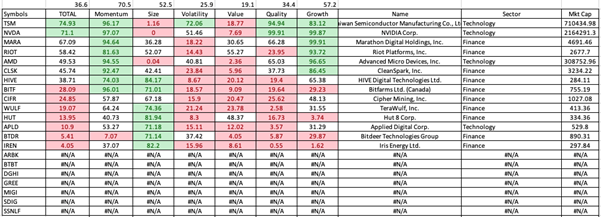

Here’s a breakdown of the ratings of each of the holdings in the ETF. Seven of the stocks are too small by market cap to have a rating, as denoted by the “#N/A” fields):

WGMI: Weak Green Zone Power Ratings

Here’s where the “whole story” part comes into play.

There’s a lot of red in that graphic above, but that doesn’t mean any of these stocks are necessarily bad investments.

Most of these companies are still very young, meaning they don’t have a long operating history or haven’t been growing for decades, like Taiwan Semiconductor or Nvidia. Adam’s rating model looks at data as far back as 10 years. Because of that, new companies are “penalized” simply for being young.

Something else to consider is that these miners are aggressively reinvesting revenues and profits into more infrastructure. The more infrastructure, the greater the production capacity and the potential for future growth.

This means their cash flows — tracked by the Quality factor in our system — are taking a hit today on the bet of greater profits in the future.

Crypto Mining Stocks: What to Do Amid Conflicting Signals

First and foremost, each of the ratings above is accurate.

It doesn’t matter the size, industry or age of a company; the Green Zone Power Ratings system uses the same standards and scoring metrics for every company.

It takes bias (even if unintentional) out of the equation. It’s the perfect tool to filter out noise and headlines and see what the numbers say about a potential investment.

The crypto market is different. It’s a new industry in the grand scheme of things, and the numbers aren’t going to tell you the whole story.

In this instance, if you are waiting for these miners to become an obvious and solid investment, you’ll end up joining the herd when most of the significant gains are already gone.

It’s likely that by the time many of these miners rate 80 or higher on Adam’s model, the biggest profits in the sector will have already been taken by early investors.

Bottom line: If you want to take advantage of some of the market’s biggest opportunities, you may have to go beyond our “green zone.”

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets