Research analyst Matt Clark is running your requested cannabis stocks through Adam O’Dell’s Green Zone Rating system. And he’s back with a brand-new Marijuana Market Update video!

This week, Matt analyzes GrowGeneration Corp. (Nasdaq: GRWG). This company designs, implements and consults on building cannabis cultivation facilities.

But it’s been in the news for a different reason.

About GrowGeneration Stock

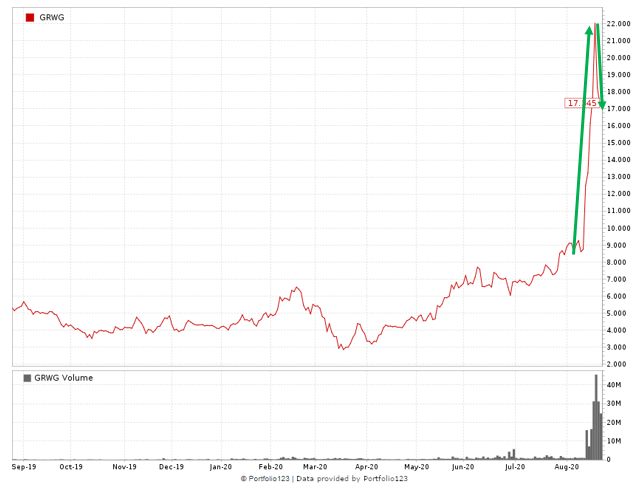

Take a look at GrowGeneration’s stock chart:

GRWG Stock’s Whiplash in August

The stock shot up over 100% in August after it announced second-quarter earnings.

However, a scathing report about GrowGeneration caused the stock to fall more than 30%.

Watch the video above to find out:

- Who released the report.

- The question Matt learned to ask in his decades working as an investigative journalist.

- Why he questions the timing of the report.

- How GrowGeneration stock ranks according to Adam O’Dell’s Green Zone Ratings system.

- What Matt expects for the future of GRWG stock.

In addition, Matt addresses a question from viewer Stephen S. about Curaleaf stock based on comments Matt made in a recent video.

Fantastic question, Stephen!

If you have any questions for Matt, or if there’s a stock you’d like him to run through Adam’s Green Zone Rating system, be sure to send an email to feedback@moneyandmarkets.com — or leave a comment on the video!

Cannabis Stocks: Question of the Week

And if you’re here because you want to learn more about pot stocks, we have a simple question for you: Why?

Why are you interested in cannabis stocks?

We’d love to hear from you so that our team can make sure you’re getting the most relevant information about the cannabis industry! Send us an email to let us know.

And to make sure you catch Matt’s Marijuana Market Updates as soon as he posts them, subscribe to our Money & Markets YouTube channel!

Check Out Our Other Videos

Don’t forget to stay tuned to our YouTube channel to catch our other videos:

- 3 Stocks to Watch as Tech Continues to Roar: 33-minute video — Technology stocks are all the rage on Wall Street recently. Tech has powered the Nasdaq to all-time highs, even with the coronavirus crash back in March. But the big question is whether the surge in technology stocks is sustainable. Valuations continue to skyrocket as the economy falters. An exchange-traded fund tracking some of the biggest technology stocks jumped more than 64% since reaching a low in March 2020. In this episode of The Bull & The Bear, host Matthew Clark talks with Adam O’Dell and contributor Charles Sizemore about three technology sector stocks. Check out our video now for insight on what you should do with these three companies — if you are thinking about buying or already have them in your portfolio.

- What Dow’s New Look Means for You: 14-minute video — Traditionally, the Dow Jones Industrial Average makes headlines when the index rises or falls dramatically. However, this week the index, which tracks 30 large, publicly-traded companies, decided it was time to change things up: S&P Global announced a big shift in the Dow spurred by one company announcing it would undergo a stock split. Matt takes a look at what this big change could mean for investors. He also tells you what you should do about it.