There is some good news for homeowners hidden in the latest report on home sales.

It showed that the number of existing home sales fell 0.4% in August.

That was better than the 2.9% drop economists expected.

Stronger sales numbers might be related to the small August dip in mortgage rates.

High Mortgage Rates Cooled a Bit

Rates dropped to 5.2%, down from 5.5% in July.

Buyers may have rushed to lock in low rates.

With mortgages now near 6%, that decision proved to be good.

Price gains slowed in August, with the median sale price at $389,500.

That’s a 7.7% jump from the same month a year ago but 5.9% below the all-time high reached in June.

Slow sales and falling prices are the bad news. The good news is that prices are unlikely to fall much further because supply is limited.

The number of homes for sale is now at the same level it was a year ago.

In 2021, supply was limited because sellers had a problem.

If they sold, they needed to buy new homes.

But homes were so expensive that they might not have been able to afford homes of the same size or quality they were selling.

This limited inventory and kept prices high.

Now mortgages are expensive.

High Mortgages Halt Home Sales

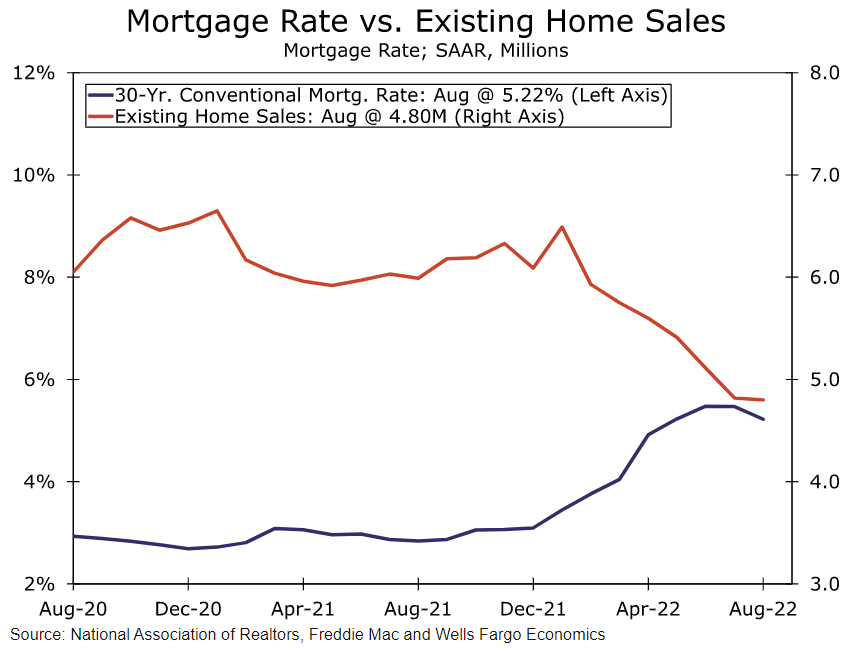

The chart below shows the relationship between mortgage rates and sales activity.

Source: Wells Fargo.

As mortgage rates rise, home sales drop. Higher rates price out potential buyers by making payments unaffordable.

Potential sellers are also affected by high mortgage rates.

As they rise, many potential sellers decide to stay in their current homes.

Most homeowners have mortgages with rates below 5%.

Selling now would mean taking on a more expensive mortgage.

As with all buyers, higher rates reduce the number of homes they can afford.

Selling might not be appealing to many current owners.

Bottom line: With sellers, supply is limited.

That means there is support for prices.

Although there might be declines, the price drops might not amount to much.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.