Sometimes, news doesn’t seem like it’s related to financial markets.

But smart investors realize that almost everything ties into the markets.

An example is a recent story about the U.S. military:

Acting Pentagon chief Christopher Miller said Tuesday that the United States will reduce its military presence in Afghanistan to 2,500 troops and 2,500 troops in Iraq by Jan. 15.

The United States has approximately 4,500 troops currently in Afghanistan and more than 3,000 in Iraq.

This means that about 2,500 military personnel are leaving that theater of operations in the next two months. This is an unexpected change in troop levels. It means oil prices are likely to move up.

All military movements use a lot of fuel. The units leaving Afghanistan, for example, will need to move equipment from their operating locations to the airfield. The Air Force will move planes from their home bases to the airfield and then fly the troops back to their bases.

From there, trucks will move the troops and equipment to wherever they need to be while the planes return to their home base.

This operation will involve hundreds of aircraft and thousands of trucks. It will require hundreds of thousands of gallons of fuel.

This surprise order will increase demand for fuel, and that will push up the oil price.

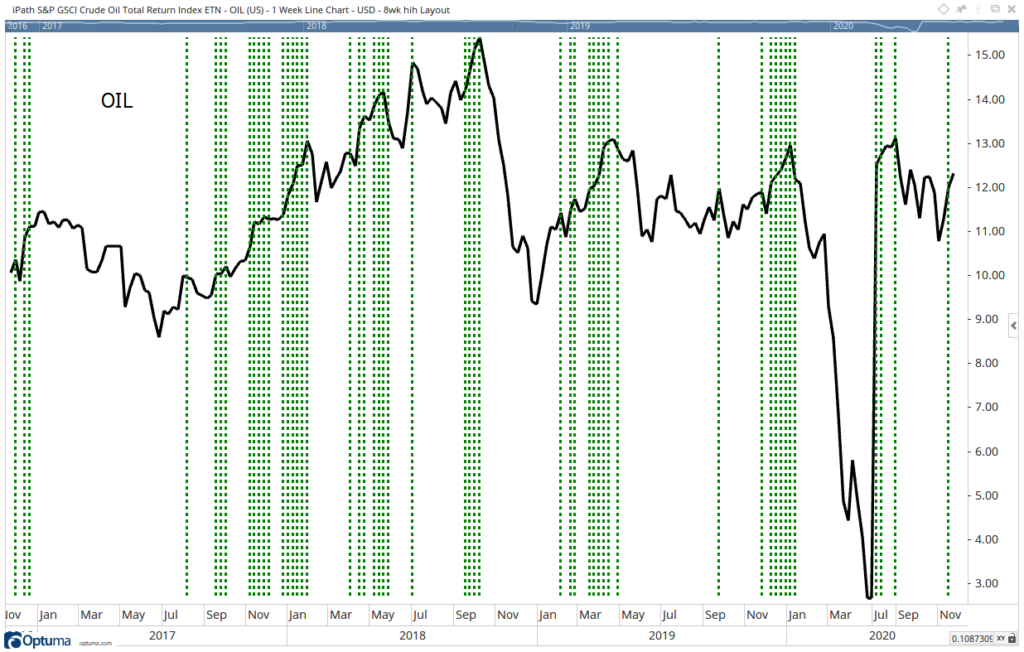

The news comes as oil is already on a buy signal, which you can see in the chart below. This is a chart of iPath Series B S&P GSCI Crude Oil Total Return Index ETN (NYSE: OIL).

OIL ETN: A Play on Oil Prices

Takeaway: Easy Trade on Higher Oil Prices

Individual traders can gain exposure to the oil futures market with OIL. There are also options available to trade on this ETN.

In the chart, green lines indicate that OIL reached an 8-week high in price. Because futures markets tend to move in trends, buying when OIL reaches an 8-week high has been a profitable strategy.

You can also use call options to trade OIL.

OIL was already moving higher when the Defense Department announced the large troop movement.

Getting all those troops back home before the deadline will require the Department to buy fuel, and that should boost OIL even more.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.