When my family was deciding on a cellphone carrier, all the options overwhelmed us.

From the major players to low-cost providers, we had more than 50 companies to choose from.

Overseas, however, those options can be much more limited.

That led me to today’s Power Stock — a major telecom company in Greece and Romania:

This chart shows revenue from the communication services sector in Greece.

From 2019 to 2027, the market’s value will jump 23.9%!

Today’s Power Stock is Hellenic Telecommunications Organization (OTC: HLTOY).

HLTOY Stock Power Ratings in July 2022.

Along with telecommunications, Hellenic offers internet access, landline telephone, satellite and e-commerce services in Greece and Romania.

The stock scores a “Strong Bullish” 96 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

HLTOY Stock: Low Volatility, Terrific Value

I looked closer at Hellenic Telecom stock.

Here’s what I found interesting:

- Its $3.9 billion in total annual revenue in 2021 was a 7.2% increase from the previous year.

- Its subsidiary Cosmote is one of the largest mobile phone providers in Greece.

HLTOY stock rates in the green on five of the six factors in our Stock Power Ratings system, as you can see above. It scores best on volatility, value and momentum.

It earns an 84 on value thanks to price-to ratios (earnings, sales and cash flow) that are all lower than the U.S. telecom industry’s.

The company’s price-to-earnings ratio is 11.4 — a better bargain than the industry average of 17.3.

HLTOY’s price-to-cash flow is 4.4. The industry’s much higher average of almost 8 tells us Hellenic is a much better value than its peers.

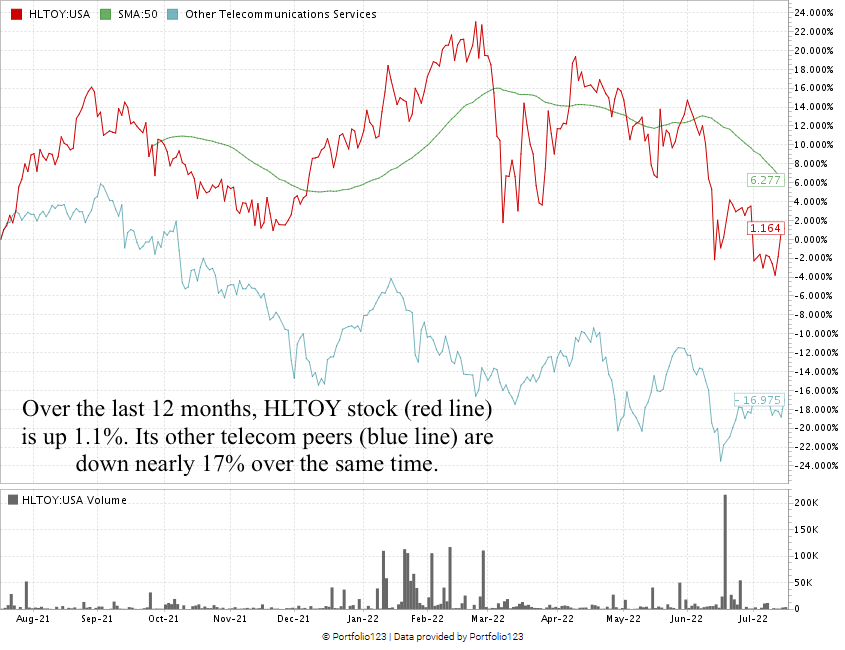

HLTOY’s gains are far better than its peers, as the chart above shows.

The stock is up 5.2% off the 52-week low it hit in the middle of July.

HLTOY stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

In the U.S., we have tons of providers for cellphones.

But folks in other countries, Greece included, have fewer options.

As one of the largest companies in the region providing mobile tech, Hellenic Telecom stock is worthy of a spot in your portfolio.

Stay Tuned: Florida Ag Stock to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent agribusiness known for innovation in citrus and conservation.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.