Housing prices are soaring in many parts of the country.

Based on the S&P CoreLogic Case-Shiller U.S. National Home Price Index, prices in Phoenix are up more than 33% in the past year. In Tampa, the increase was 27.7%, and Miami reported price gains of 25.2%. Nationally, the 20-city composite posted a 19.1% year-over-year gain.

While some believe this is a bubble, many expect additional gains. One analyst told Barron’s, “This market is primarily driven by a lack of supply, not excess demand. The supply shortage built up over 10 years, and it won’t go away quickly.”

Barron’s added:

The numbers support [this] assertion. Inventories of existing homes remain near historically low levels. Construction starts on new single-family housing, meanwhile, will finally top one million this year after averaging fewer than 750,000 in the previous 10 years. That would still be below the 1.6 million annual starts from 2004 to 2006, the peak years of the housing bubble.

Millennials Face a Housing Market Crisis

To meet the needs of millennials who are at that stage of life when they buy homes, some experts believe builders need to start two million homes a year for the next decade.

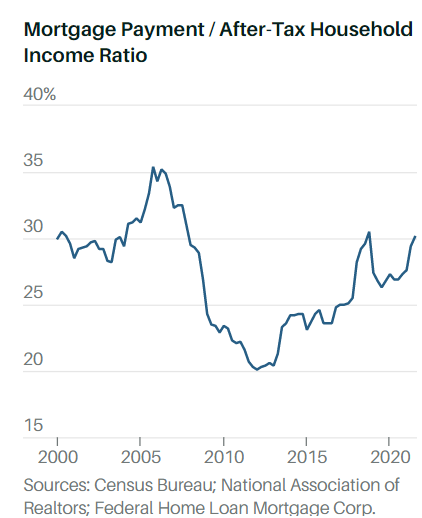

This is a long-term bullish scenario for homebuilders and homeowners who plan to sell in the next few years. But affordability is an issue. The chart below shows that buyers are reaching to afford homes in the current market. An average of 30.1% of after-tax income is devoted to mortgage payments now.

Source: Barron’s.

When the Federal Reserve raises interest rates, mortgages should become more expensive. With little room to take on larger mortgages, many potential buyers will look at less expensive homes, which could lead to a slowdown in the appreciation of home prices.

But long-term demographics are still bullish. The lack of supply is also bullish and will take years to overcome. These factors point to additional gains in housing, and any dips, should they occur, are buying opportunities.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.