What happens when you witness the three largest bank failures since Washington Mutual tapped out in 2008?

You start thinking about who’s next…

I think more pain is coming for certain financial institutions. There are more than 4,000 small banks in the U.S., according to NPR. Odds are high that some of these firms are feeling the same pressures that took down Silicon Valley Bank, Signature Bank and First Republic.

But now I’m wondering about the other side of the coin … the bigger banks that step in with the safety nets as their smaller competition flounders.

We already saw it when JPMorgan Chase bought First Republic earlier this month.

First Citizens Bank almost doubled its assets on hand and became one of the 20 largest U.S. banks when it acquired $110 billion of SVB’s assets back when this whole mess started in March.

Would it shock the world if another big dog like Bank of America or Wells Fargo were the next saviors as this situation develops?

I can’t tell you who will step in when another bank fails … we’ll have to wait and see.

But I can use Adam O’Dell’s proprietary Green Zone Power Ratings system to see how these larger entities look as investment prospects.

Let’s see if any are well-positioned to crush the market from here…

The Current Situation

The Federal Reserve’s benchmark interest rate is hovering around 4.75% now. That’s a full 4% higher than even a year ago. Ten consecutive — and aggressive — hikes over one year will do that.

That means banks that can lend more right now are raking in profits on interest payments.

Of course, this is a double-edged sword. Businesses and individuals are wary of borrowing when rates are the highest they’ve been in 15 years. My wife and I have been building up a car fund while we wait for rates to ease a bit — and I’m sure we aren’t the only ones.

I don’t think we’ve reached a point of no return, where no one locks in new loans due to exorbitant rates. But we’re firmly out of the near-zero interest rate environment of just two years ago.

With that in mind, let’s see if any of these big banks are set to thrive as interest rates remain high.

Big Bank Stock No. 1: Bank of America

One of my favorite things about Green Zone Power Ratings is how it can keep you out of stocks that seem like a safe bet, but are anything but when you look under the hood.

And that’s true with Bank of America Corp. (NYSE: BAC).

Bank of America stock scores a “Bearish” 23 out of 100, which means it’s slated to underperform the broader market over the next 12 months.

You can see its fundamental ratings on value (68) and growth (78) are both pretty strong. BAC managed to increase revenues more than 9% year over year due to higher interest rates.

But then, its price-based ratings are all in the tank. Volatility is high as investors mull the broader financial situation. And BAC has lost 25% of its share price in the last six months, which is why it scores a 20 on our momentum factor.

I don’t think Bank of America is at risk of failing anytime soon. And it’s in a good position to step in and acquire any smaller banks that do fail in the coming months or years. Having $2.4 trillion in total assets helps.

But Green Zone Power Ratings says this “Bearish” stock is one to avoid for now.

Now, let’s see the other side…

Big Bank Stock No. 2: JPMorgan Chase & Co.

JPMorgan Chase & Co. (NYSE: JPM) made waves earlier this month when it stepped in and acquired most of First Republic’s assets following its failure.

And things are looking great for America’s largest and most profitable bank.

Unlike a lot of its smaller competition, JPMorgan executives said the bank was raising its forecast for net interest income in 2023 to $84 billion. The First Republic acquisition added $3 billion to that total!

When interest rates are high, net interest income is critical because it’s what the bank takes in after deducting what it pays for deposits from what it earns on loans.

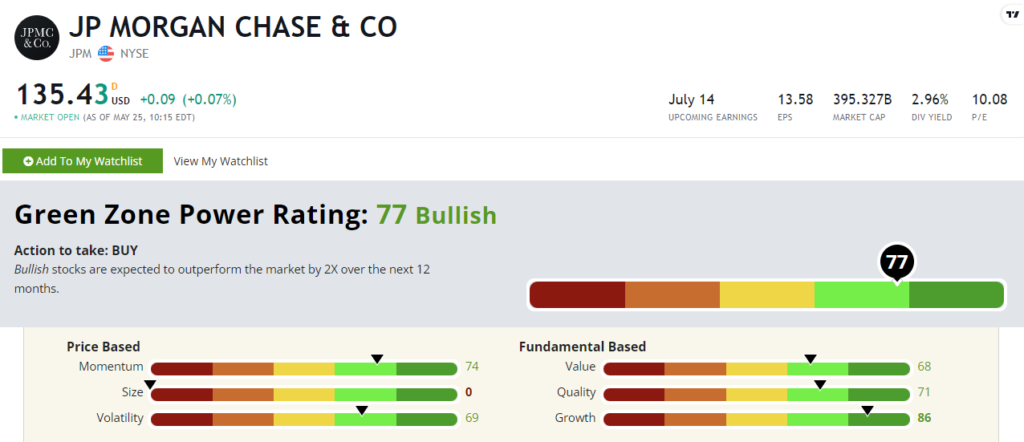

This positive outlook is reflected in JPM’s Green Zone Power Rating.

With a “Bullish” 77 out of 100, JPM is expected to outperform the broader market by 2X over the next 12 months.

Strong net income and revenue have helped JPMorgan stock to an 86 growth rating.

And its momentum (74) and volatility (69) scores are almost the complete opposite of Bank of America’s above. It’s traded flat year to date, but when you consider the broader financial sector has lost almost 8% over the same time, that’s not so bad.

If you’re looking for a potential big bank to invest in as this new banking crisis develops, Green Zone Power Ratings says JPMorgan stock is a strong candidate.

Next Week: How You Can Profit on the Next Banking Blowup

I’ve said throughout this piece that I don’t believe we’re out of the woods yet.

Matt walked us through some of the troubling banking data yesterday. And every day that interest rates remain elevated is another day in the pressure cooker for some of these smaller entities.

Big banks like Washington Mutual and Lehman Brothers grabbed the headlines during 2008’s financial crisis. But did you know that 465 other institutions failed in the five years that followed?

Adam has actually been compiling a list of more than 280 financial institutions that are at high risk of failure this time around.

Why is he doing this? Because he knows elite investors are making a fortune following these failures and he wants to show you how you can do the same.

If that sounds like something you want to know more about, click here to put your name on the guest list for Adam’s upcoming presentation.

He’ll reveal all next Wednesday.

Until next time,

Chad Stone

Managing Editor, Money & Markets