Electric automaker Tesla has been known for pushing the boundaries when it comes to sustained electric and autonomous driving.

But there’s one other area where the California-based car company is creating investment opportunities for investors.

Banyan Hill Publishing Senior Editorial Manager Nick Tate said this new breakthrough will help other auto manufacturers adopt what he called “this America 2.0 megatrend.”

“It will boost production, cut costs and produce better and more affordable vehicles,” said Tate, the Editorial Manager for Bold Profits Daily.

And it has the potential to prop up an auto industry that has struggled of late thanks to the coronavirus pandemic.

More importantly, it opens the door for investors to see a 300% gain in just five years.

This Breakthrough Means Big Profits

Earlier in May, Tesla Inc. (Nasdaq: TSLA) implemented 3D printing to create the underbody of its Model Y electric vehicle.

The process makes the underbody one single part as opposed to the 70 parts it was before.

Before, each of the 70 parts were all manually designed, built and assembled by hand.

“I don’t have to tell you — this is going to be a game-changer and put 3D printing on the map,” Tate said.

It’s all part of a larger trend in 3D printing.

Factory floors are changing as manually operated machines and dated technology is replaced by larger, more advanced 3D printers.

The 3D printing market is expected to grow from a projected $16 billion in 2020 to nearly $41 billion in 2024, according to data from Wohlers Associates.

“That’s a huge increase from just seven years ago when 3D printing was a $4.4 billion industry,” Tate said. “So, the current projections put 3D printing on track to shoot up a whopping 900% since 2013.”

That makes now a time for investors to get in on this trend.

How You Can Profit From the 3D Printing Boom

The advent of 3D printing in auto manufacturing will be as revolutionary as Henry Ford’s assembly line innovation, Tate said.

And while Tesla continues to be a somewhat volatile stock, there are ways to play this surge in 3D printing.

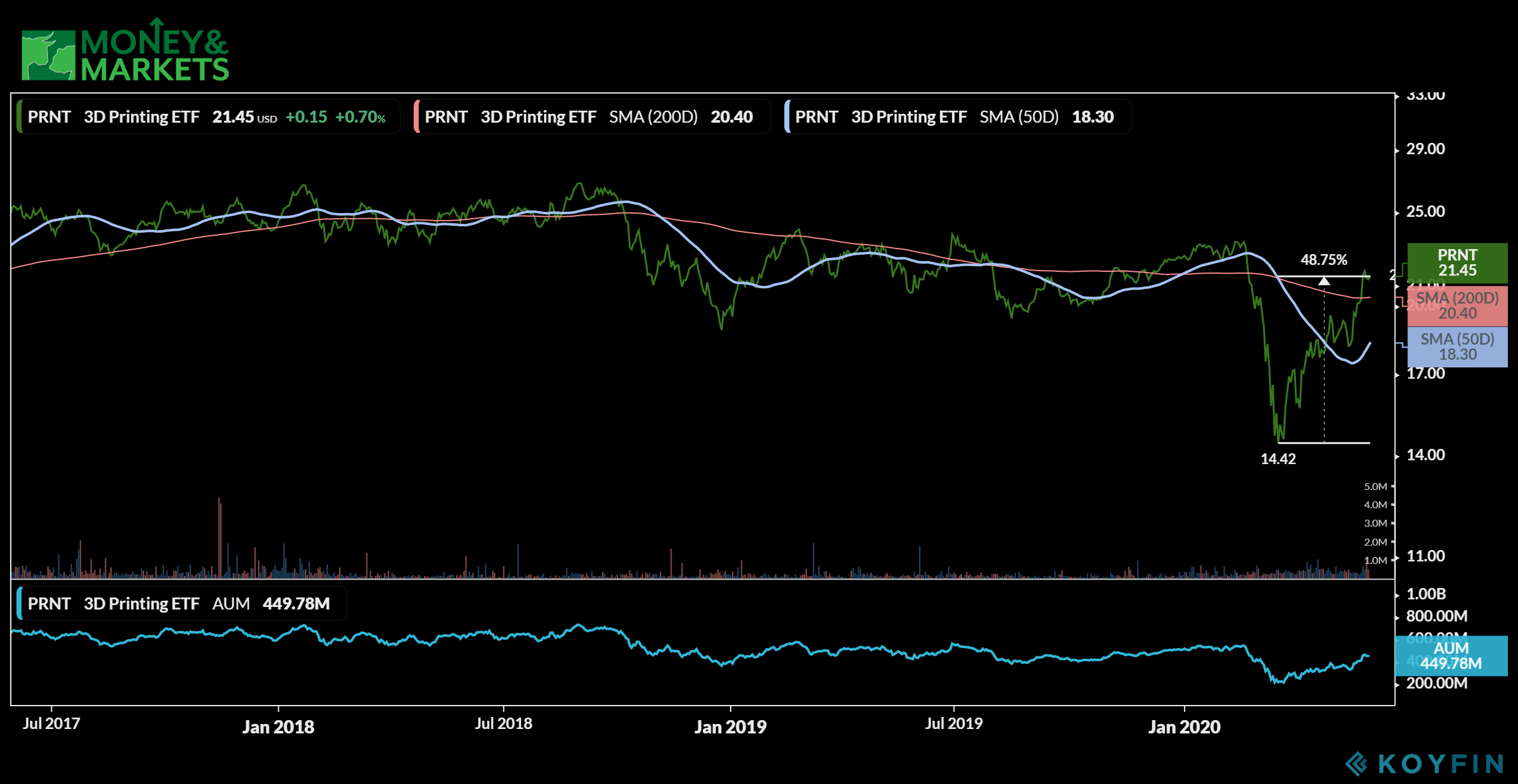

The 3D Printing ETF (NYSEARCA: PRNT) is an exchange-traded fund that tracks the price movements of stocks of companies involved in the 3D printing industry.

It currently has more than $449 million in assets under management — including Autodesk Inc. (Nasdaq: ADSK), Proto Labs Inc. (NYSE: PRLB) and Altair Engineering Inc. (Nasdaq: ALTR).

After a big price drop in March 2020, PRNT has jumped more than 48% and remains incredibly affordable — trading around $21 per share.

It recently moved above its 200-day moving average, signaling now is a good time to buy into this ETF.

“This exchange-traded fund lets you profit from 56 companies who are leading this megatrend,” Tate said. “It’s up 21% in just the past two weeks. But with the market’s booming growth, you could be looking at triple-digit gains in the next five years.”

This relatively new ETF — started trading in July 2016 — has a management expense ratio of 0.66% and an annual dividend yield of 0.07%.

That may seem a little low — its yearly dividend was $0.01 per share, paid out in December — but with the growth in the 3D printing industry, it will grow even higher.

Tesla has started this revolutionary way to change the manual design, casting and assembly of auto parts. I look for the rest of the industry to start adopting this in the near future.

Once that happens, 3D printing is going to take off.

As an investor, you want to make sure you are along for the ride.